- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- TikTok and PayPal 1099, but ones in the wrong name

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TikTok and PayPal 1099, but ones in the wrong name

Hello, I made $43,000 on tiktok this year, Tiktoks only form of withdrawing the money is PayPal. The PayPal is in my husbands name. So I have now received a 1099 from tiktok in my name, and then a 1099k from PayPal showing the same income in my husbands name. I have now created a new PayPal to avoid this next year, but I have no idea how I’m supposed to file this? Do I add the 1099k from PayPal and then deduct the full amount to zero out and add a note that it’s an error or the same income from tiktok? I’m so nervous of doing something wrong.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TikTok and PayPal 1099, but ones in the wrong name

You received a 1099 and an IRS form 1099-K, each reporting the same $43,000 gross income from TikTok.

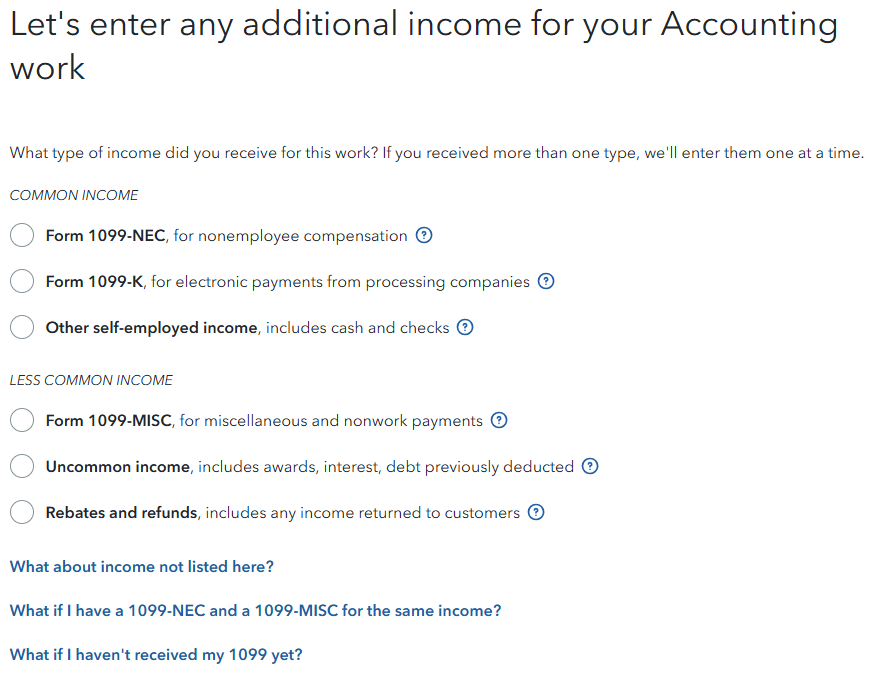

I presume that you are reporting this income on Schedule C as a self-employment activity. If that is correct, report both of the gross income sources within the self-employment activity. Report the 1099 income under the appropriate Form 1099. Report the IRS form 1099-K under Form 1099-K.

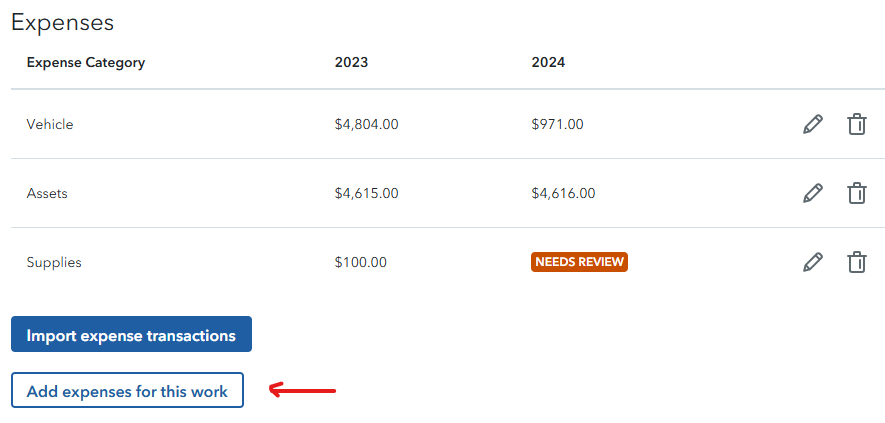

Then under Expenses, select Add expenses for this work. Select or create an expense to 'back out' the $43,000.

Within your tax records, maintain a clear record of how the transaction was handled should a tax authority have a question about this transaction at a later time.

If you are not reporting a self-employment activity, post again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shansmw

Level 2

Tmlong

New Member

Vickiez1121

New Member

Vickiez1121

New Member

Vickiez1121

New Member