- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You received a 1099 and an IRS form 1099-K, each reporting the same $43,000 gross income from TikTok.

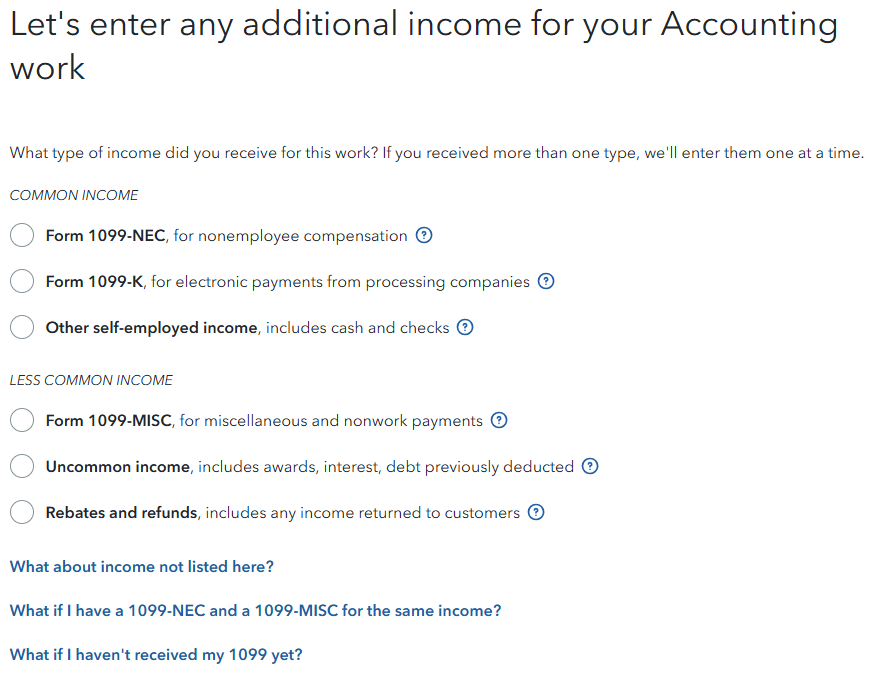

I presume that you are reporting this income on Schedule C as a self-employment activity. If that is correct, report both of the gross income sources within the self-employment activity. Report the 1099 income under the appropriate Form 1099. Report the IRS form 1099-K under Form 1099-K.

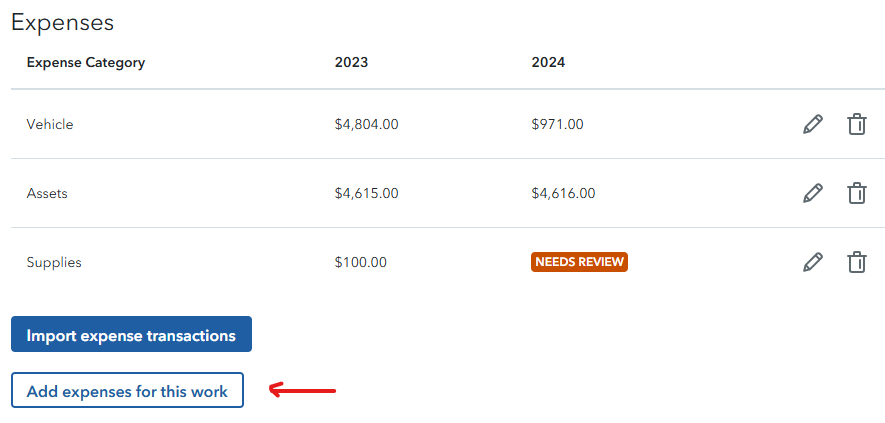

Then under Expenses, select Add expenses for this work. Select or create an expense to 'back out' the $43,000.

Within your tax records, maintain a clear record of how the transaction was handled should a tax authority have a question about this transaction at a later time.

If you are not reporting a self-employment activity, post again.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 3, 2025

8:32 AM