- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Tax rate on capital gains after 5yrs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax rate on capital gains after 5yrs

I understand there is a $250k/500k (single/married) exclusion and the tax rate is 15% on the profit if the second home is sold within 3yrs of moving out.

If home is sold after 3yrs of moving out, whats the tax rate on the capital gains from sale of second home 3yrs after moving out? Is it 20% on the profit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax rate on capital gains after 5yrs

Not sure we completely understand your question. You are correct there is a capital gain exclusion on the sale of a home provided certain requirements are met. Generally, you're not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home. What this means is that you can defer capital gains on the sale of a primary residence only once every two years.

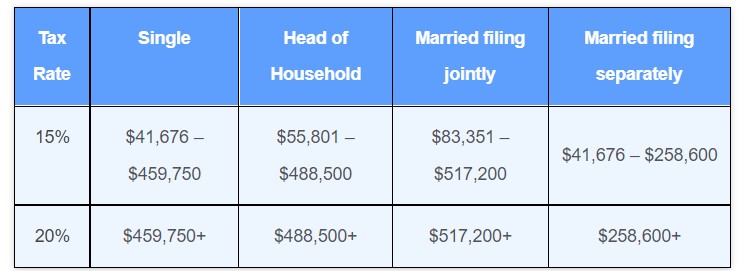

Let's assume you sold your home for a capital gain, and you don't qualify for the capital gain exclusion. The capital gain tax on that sale could be 15% or 20% depending on your filing status and taxable income. Below is the 2022 long-term capital gain rate tax table which will help you decide which capital gain tax rate applies to your sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

oreillyjames1

New Member

Cindy10

Level 1

user17538342114

Returning Member

abcxyz13

New Member

cm-jagow

New Member