- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Not sure we completely understand your question. You are correct there is a capital gain exclusion on the sale of a home provided certain requirements are met. Generally, you're not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home. What this means is that you can defer capital gains on the sale of a primary residence only once every two years.

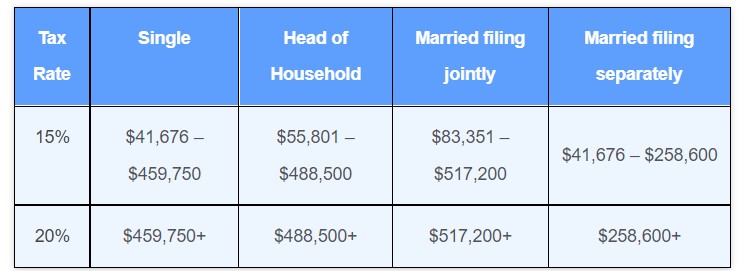

Let's assume you sold your home for a capital gain, and you don't qualify for the capital gain exclusion. The capital gain tax on that sale could be 15% or 20% depending on your filing status and taxable income. Below is the 2022 long-term capital gain rate tax table which will help you decide which capital gain tax rate applies to your sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"