in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Sold Main home originally from a 1031 exchange, where to enter the deferred capital gains from the inital 1031 exchange into Turbo Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Main home originally from a 1031 exchange, where to enter the deferred capital gains from the inital 1031 exchange into Turbo Tax

I sold my rental property A and complete a 1031 exchange with property B in 2018 thus, I was able to deferred my capital gains from property A. I rented property B for 24 months and then converted it into a primary residence for a little more than 3.5 years before selling it. I have entered this as a main home sale in Turbo Tax Premier but I am not able to figure out where to add in the deferred capital gains from property A. Can someone post me step by step instructions for Turbo Tax as to how to enter that in?

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Main home originally from a 1031 exchange, where to enter the deferred capital gains from the inital 1031 exchange into Turbo Tax

Yes, the accumulated depreciation you used throughout property A and Property B will be entered into the sale of home. Find this information in your prior year returns

When you enter the home sale in TurboTax it will ask for a couple of items that are needed to report the sale correctly.

- The total depreciation expense that was allowed during the period it was available for rent (in your case both Property A & B). Check your prior tax returns for this figure.

- The number of days the property was available for rent during the ownership period.

Results:

- The amount of depreciation that was allowed will be completely taxable up to the amount of gain received on the sale.

- The remaining gain if any, will be split between taxable and and amount eligible for exclusion by using the following formula.

- The total days available for rent will be divided by the total days owned to determine the portion of the remaining amount of gain that is taxable for the rental period

- The balance will be eligible for the home sale exclusion

- TurboTax will do all the calculations based on your entry

Let's go step by step to enter your sale.

- Scroll to Less Common Income > Select Sale of Home (revisit or update)

- Continue to indicate you sold your home > Edit or add your home address and ownership > Continue

- Enter the Sales date, Selling Price and Sales Expenses > Continue

- Enter the Date Acquired and the Cost of the Home (includes any capital improvements for the period of ownership (do not reduce for depreciation expense) > Continue

- Continue past the 'Less than two years' screen > Yes the home was used for anything else > Enter number of days used for rental purposes

- Continue > Select No another home was sold after _____ date > Select ownership if married > Continue

- Select Yes for Depreciation After May 6, 1997 for both of you if married > Continue > Enter the depreciation claimed after May 6, 1997 (same amount for AMT)

- Continue to answer the remaining questions and you will see your 'Tax Free' gain.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Main home originally from a 1031 exchange, where to enter the deferred capital gains from the inital 1031 exchange into Turbo Tax

Thank you for your reply.

Just to clarify, did you mean in the box where it asks Enter the depreciation claimed after May 6, 1997

The total depreciation value = deferred capital gain from property A + depreciation of property B?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Main home originally from a 1031 exchange, where to enter the deferred capital gains from the inital 1031 exchange into Turbo Tax

it depends. All the depreciation from Property A carries over to Property B, which is why there is any deferred gain in the 1031 exchange. The property for your tax return only changes in name and then possibly an additional asset is added for the increase in additional funds paid or loan transferred to you.

If you have a deferred gain figure, it could be the depreciation you used on Property A. Property A was not required to be entered or treated as a sale because under the tax law it was allowed to receive Section 1031 like kind exchange treatment. This reduces the cost basis in the property given up, which transfers to the property received. Plus a possible additional asset for any 'but up'. Not it sells and there is no trade, the sale is treated like the firs property was never given up and all gain is captured as a taxable event.

I hope this provides a clearer picture. Please add any additional questions here for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Main home originally from a 1031 exchange, where to enter the deferred capital gains from the inital 1031 exchange into Turbo Tax

Form 8824 shows my given up property A with a deferred gain of $X.

I calculated its depreciation $D on my own.

I am still a little lost on where the enter this deferred gain of $X into Turbo Tax.

As you advised, I will enter the depreciation $D into the field for "Enter the depreciation claimed after May 6, 1997"

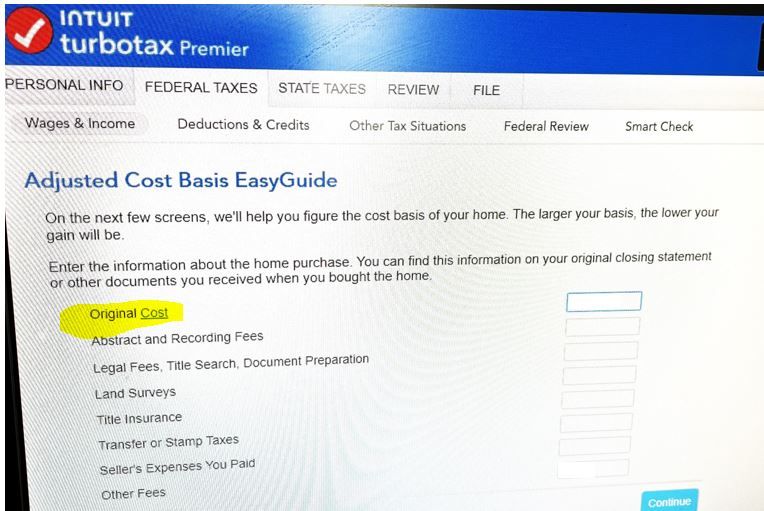

On the screen where it asks me about property B, in the Adjusted Cost Basis Screen.

Should I just subtract $X from the Original cost $Y of my replacement property B and enter that into the Original Cost field (see screenshot below)?

If not, where else can I enter the deferred gain $X into Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Main home originally from a 1031 exchange, where to enter the deferred capital gains from the inital 1031 exchange into Turbo Tax

The original cost would be the cost of Property A plus any up charge for Property B at the time of the trade. Add to that amount any capital improvements that were added to Property A after purchase and before you traded it, and any capital improvements to Property B after the trade year and before you sold it. You are also allowed to add any purchase expenses as shown below.

- The calculated result is the original cost.

Government Recording and Transfer Charges

- Recording fees

- Title Charges

- Lenders Title Policy

- Settlement or Closing Fee

- MLC - Assuming it means Municipal Lean Certificate

- Title Exam

- Owners title Insurance

You can include these closing costs and add them to the cost basis of the property as noted above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Main home originally from a 1031 exchange, where to enter the deferred capital gains from the inital 1031 exchange into Turbo Tax

As to “2 The number of days property was available for rent during the ownership period”, does the number of days include both Property A & B, or just Property B?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524159637

Level 1

atn888

Level 2

lsrippetoe

New Member

Jimmytax

Level 1

semjeito

Level 2