- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Form 8824 shows my given up property A with a deferred gain of $X.

I calculated its depreciation $D on my own.

I am still a little lost on where the enter this deferred gain of $X into Turbo Tax.

As you advised, I will enter the depreciation $D into the field for "Enter the depreciation claimed after May 6, 1997"

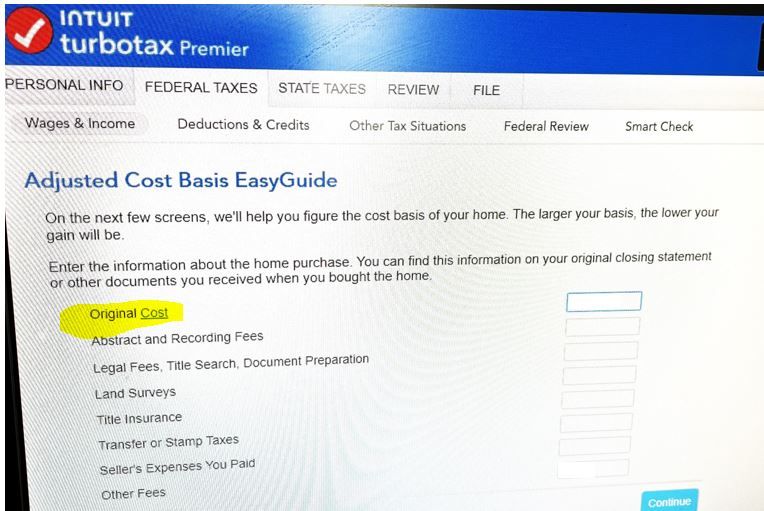

On the screen where it asks me about property B, in the Adjusted Cost Basis Screen.

Should I just subtract $X from the Original cost $Y of my replacement property B and enter that into the Original Cost field (see screenshot below)?

If not, where else can I enter the deferred gain $X into Turbo Tax?

April 4, 2024

11:45 AM