- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- reporting capital gains

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

reporting capital gains

1099b shows date of sale of stocks and proceeds. but does not show date acquired and cost basis. Also, box 5 states non-covered and X (unknown holding period). Problem is I bought company A years ago and 3 years(2019) ago they were acquired by another company. This company gave me x amount of stock in the new company. Last year(2022) I sold stocks of the new company three different times. Question is what date to use for when the stock was acquired and the cost of the stock.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

reporting capital gains

If I understand this correctly.

- You bought stock in Company A.

- It was acquired by another company (Company B).

- Company A no longer exists, but you got stock for Company B.

To calculate cost basis.

- The total cost of the Company B stock is what you paid for Company A.

- To get the Company B cost per share divide the total purchase price of Company A by the shares in Company B.

The sale of shares of Company B will have the per share value calculated above compared to the proceeds on your 1099-B.

The date acquired will be the purchase date of Company A

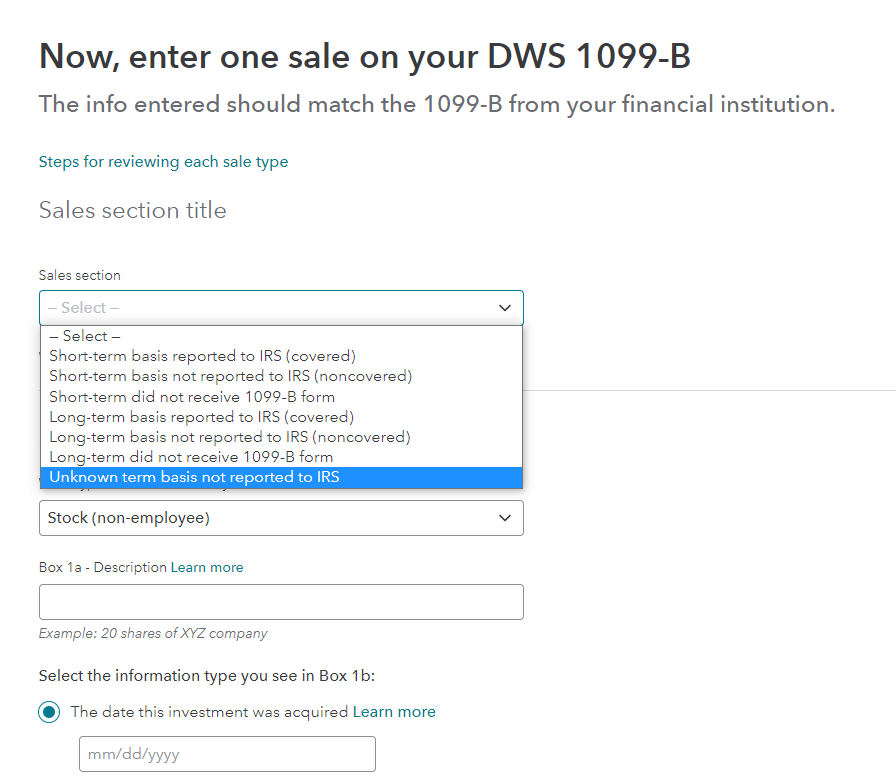

In the Sales Section of the entry screen select Unknown term basis not reported to the IRS

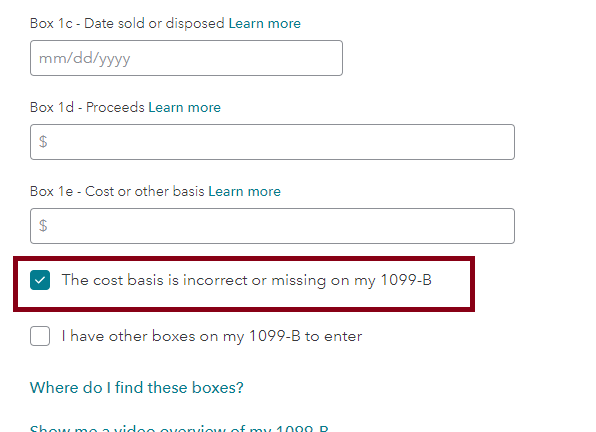

Leave the cost basis blank, but select. The cost basis is incorrect or missing on the 1099-B.

Then enter your new cost basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

zyppy

Returning Member

jillwoodcpa

New Member

gir0106

New Member

BrianLKearney

Level 1

taxdean

Level 4