- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

If I understand this correctly.

- You bought stock in Company A.

- It was acquired by another company (Company B).

- Company A no longer exists, but you got stock for Company B.

To calculate cost basis.

- The total cost of the Company B stock is what you paid for Company A.

- To get the Company B cost per share divide the total purchase price of Company A by the shares in Company B.

The sale of shares of Company B will have the per share value calculated above compared to the proceeds on your 1099-B.

The date acquired will be the purchase date of Company A

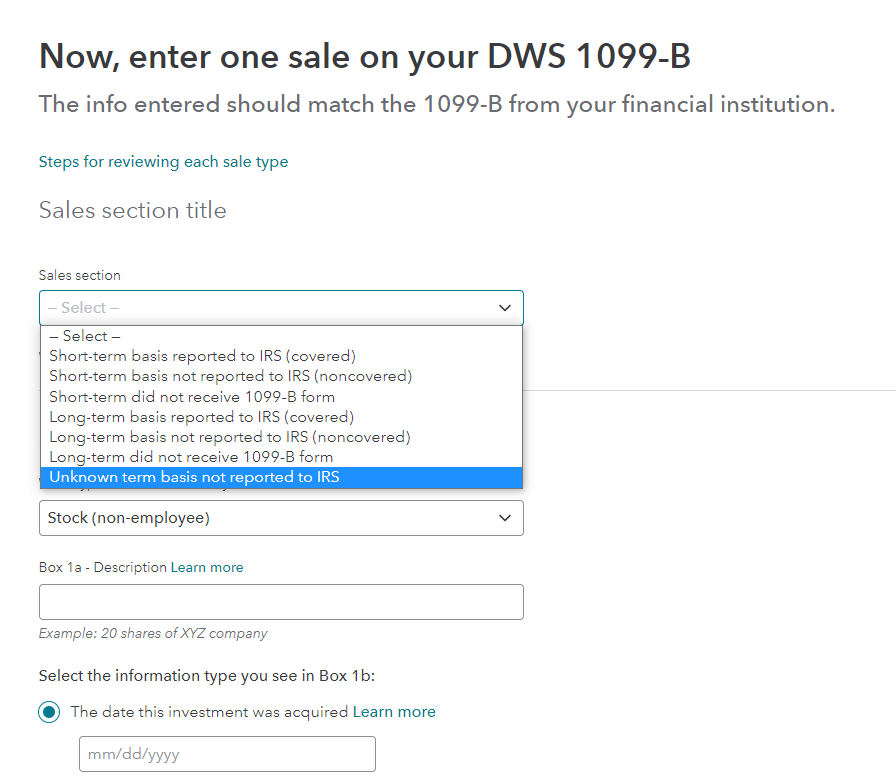

In the Sales Section of the entry screen select Unknown term basis not reported to the IRS

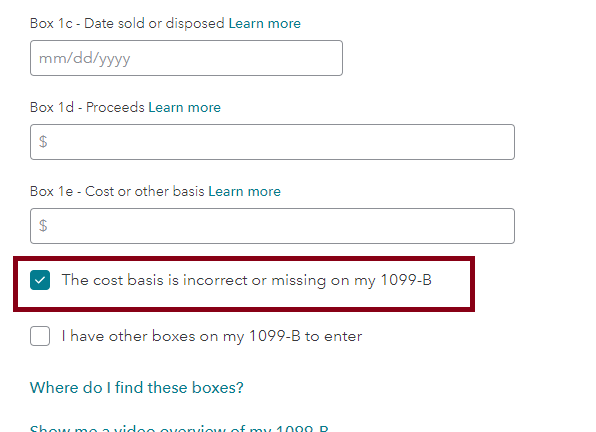

Leave the cost basis blank, but select. The cost basis is incorrect or missing on the 1099-B.

Then enter your new cost basis.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 19, 2023

11:55 AM