- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- rental property passive carryover loss doesn’t offset my rental income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property passive carryover loss doesn’t offset my rental income

first time using turbotax. trying to populate passive loss carryover figures from previous years to offset rental property income.

turbotax gives me 3 options.

1. regular tax : if i put the amount here, it offsets my non passive gains which is not what i want.

2. amt tax : i don’t have any previous year forms stating any amt info about my rental loss. if i try to put the amount here, it does not offset the income i have from my rental.

3. QBI : not relevant to me.

so bottom line , it seems that there is no way to use the unallowed carry over losses from previous years in order to offset any income i have from my rental property.

What am i missing here?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property passive carryover loss doesn’t offset my rental income

Did you materially participate in the rental activity in 2022? Also, if your income is to high, once your rental expenses gets your rental deductions to zero, that's it. You are not allowed the additional $25K of passive losses against other "ordinary" income. It just gets carried over again.

There's a fairly descent writeup on this at https://www.thebalancemoney.com/passive-activity-loss-rules-5197833

The part that sticks out to me is:

You might also be eligible for a special $25,000 allowance if your losses were the result of a rental real estate activity. The IRS indicates you can effectively subtract up to $25,000 of any associated loss from your active income if you actively participated in this type of activity. You actively participate if your interest in the endeavor was at least 10% by value. This is different from the rules for material participation in other types of business enterprises.

The special allowance drops to $12,500, however, if you’re married but lived separately from your spouse for the entire year and filed a separate tax return. And there’s no special allowance if you lived with your spouse at any time during the tax year but filed a separate return. This allowance also phases out if your modified adjusted gross income (MAGI) is more than $100,000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property passive carryover loss doesn’t offset my rental income

The situation is simple:

The rental income is higher than the expenses. i want the previous year’s losses to cover for the gap so i owe $0 in taxes.

i definitely don’t look for ways to offset any ordinary or non passive in come with passive carryover losses.

My point is that is that turbotax doesn’t lets me do that. i think the software is buggy and not serving its purpose.

i was able to do that in the past using other tax preparation software (non of them asked gave me 3 strange options of “regular tax” , “amt tax” and “qbi tax”)

turbo tax is over complicating it and not providing the desired effect using any of these 3 options.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property passive carryover loss doesn’t offset my rental income

That is strange to me. I know you already selected the chick box to indicate you have carry overs. Otherwise, you wouldn't be presented the screen asking you to enter them.

Take a look at the screen where you enter your PAL carry over losses. On that screen is a check box for "I have passive activity losses reported on SCH D or form 4797 to enter". I don't know if this is your situation or not. But we're checking it just in case. If this is your case, then select that checkbox and go from there. (really shouldn't matter though.)

I'm sure you already know this, but as a reminder keep in mind if you have more than one rental property, you enter the PAL carryovers for each property separately.

You can go ahead and complete the section. Then take a look at the form 8582 and see if that helps find the issue or explain what's going on. I don't know how to view a specific form with the online version of the program, as I only use the CD version. Meanwhile, if it's a program issue a TTX rep should be jumping into this thread in the morning, since it will be Monday by the time they see this thread.

I would test it on my end. But my PAL carry overs are already auto-imported from the 2021 tax file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property passive carryover loss doesn’t offset my rental income

I am searching for an answer to the same question. I have a passive loss from a partnership that I would like to apply to offset income from rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property passive carryover loss doesn’t offset my rental income

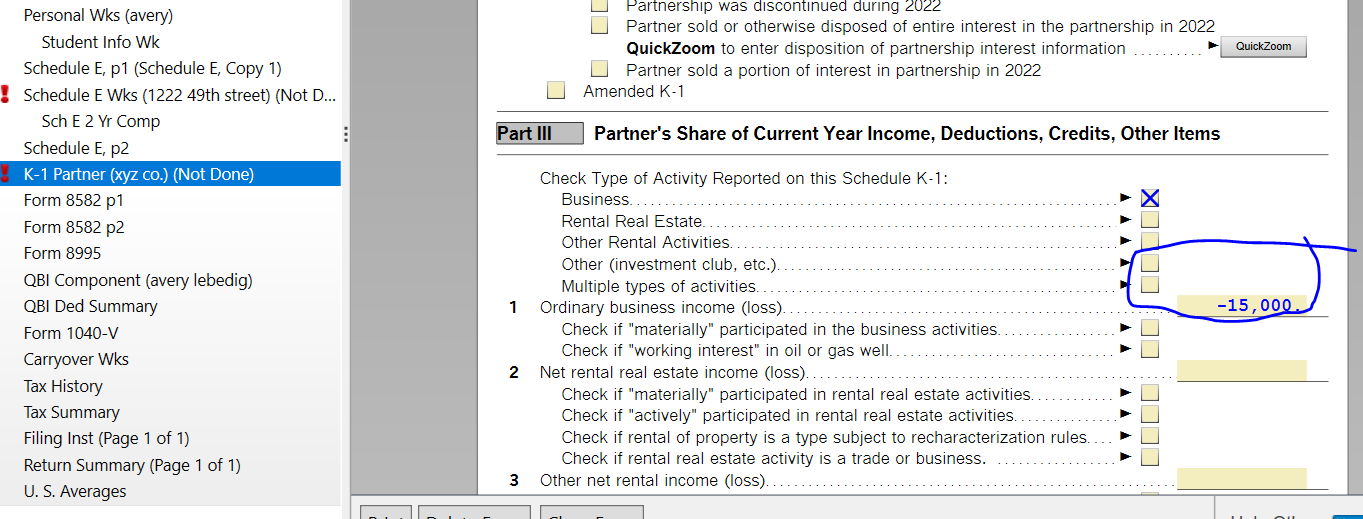

Just to clarify, is it a passive loss from a k-1 which you would like to offset against the rental income. Here's how you would do it.

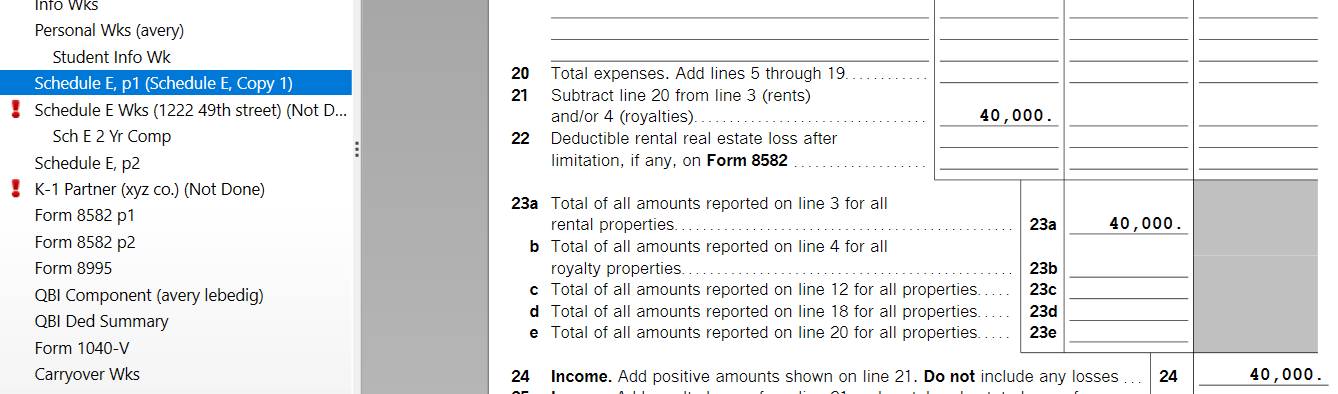

Now the 40,000 of income from your rental comes from here

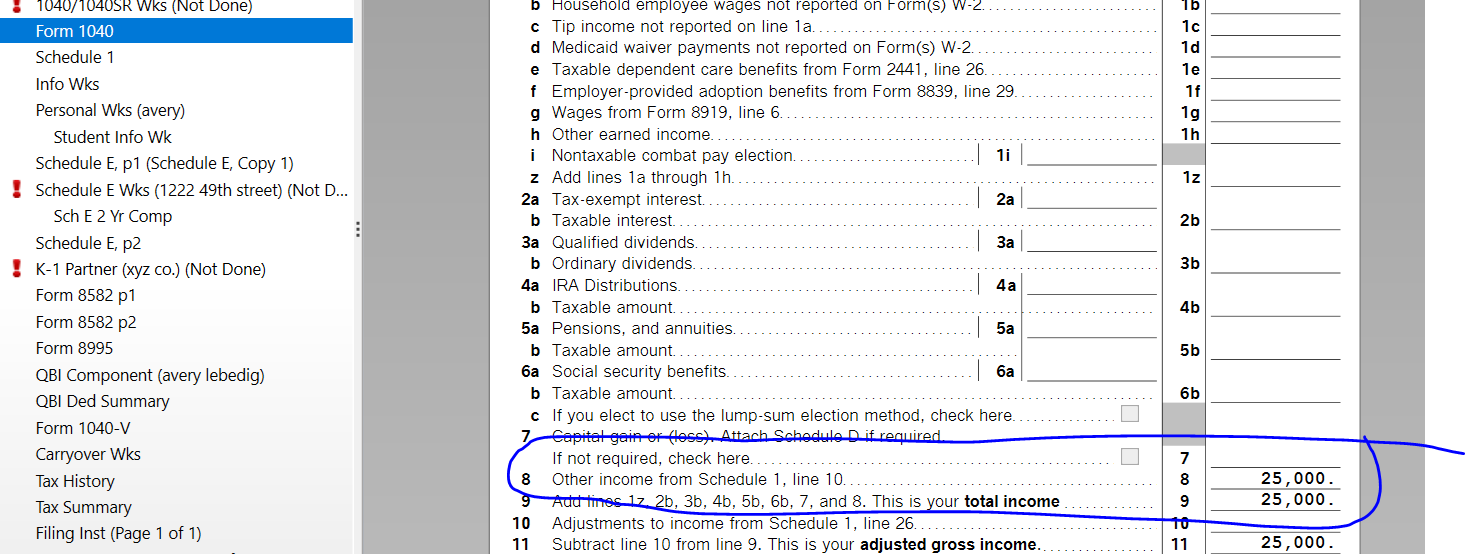

And shows up as a net figure on the 1040, line 8 over here

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kramyou1

New Member

MCSmith1974

Level 2

andrew1graves

New Member

asdfg1234

Level 3

Jim_dzg5zg

Returning Member