- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Received free stock from Webull? Should I mention I received it as gift or as a stock I purchased. For gift option what shall I mention for owner cost basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received free stock from Webull? Should I mention I received it as gift or as a stock I purchased. For gift option what shall I mention for owner cost basis?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received free stock from Webull? Should I mention I received it as gift or as a stock I purchased. For gift option what shall I mention for owner cost basis?

In order to determine what basis to use in the stock, you must know the donor's original cost, the value of the stock at the time it was gifted to you and the price you sold it for.

If you sell the stock for more that the donor's cost, you would use the donor's cost as the basis.

If the FMV of the stock was less than cost, you would use the FMV as the basis if you sold the stock for less than cost, otherwise, you would use the cost as the basis.

If you sell the stock for a price between your original cost basis and its market value at the time of the gift, there will be no gain or loss to report.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received free stock from Webull? Should I mention I received it as gift or as a stock I purchased. For gift option what shall I mention for owner cost basis?

That's the thing, I don't know donors cost basis as it was a gift and they never reported what the share cost to them. They just reported cost basis which is basically the stock value when I received it as a gift.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received free stock from Webull? Should I mention I received it as gift or as a stock I purchased. For gift option what shall I mention for owner cost basis?

The only other way to determine the cost basis is to select a date range when you think the donor purchased the stock and look at the historical value of the stock during that time.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received free stock from Webull? Should I mention I received it as gift or as a stock I purchased. For gift option what shall I mention for owner cost basis?

I too received "free stock" from WeBull Brokerage via an online promotion.

1 share of SAN appeared in my brokerage account at no cost to me 8th May 2020 at a FMV of $2.04 USD

I sold that 1 share of SAN 14th May 2020 for $2.01 USD

1 share of LEVI appeared in my brokerage account at no cost to me 19th May 2020 at a FMV of $12.43 USD

I sold that 1 share of LEVI 29th May 2020 for $14.11 USD

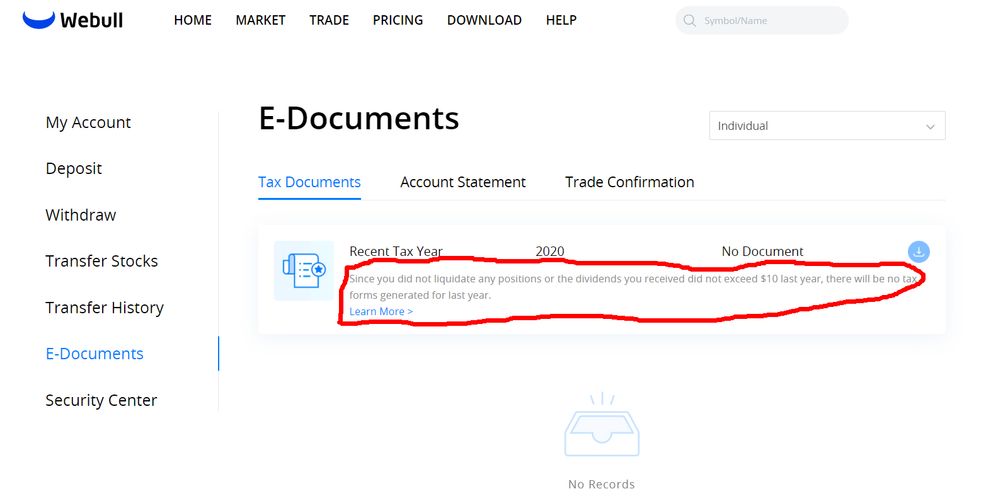

I did not receive any tax forms from WeBull. Their message to me: "Since you did not liquidate any positions or the dividends you received did not exceed $10 last year, there will be no tax forms generated for last year."

How do I file for this income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received free stock from Webull? Should I mention I received it as gift or as a stock I purchased. For gift option what shall I mention for owner cost basis?

According to this Turbo Tax article, if your original cost basis is lower than the Fair Market value, you will use the original cost basis, which is zero.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

psberg0306

Level 2

yenmde8

New Member

griverax

New Member

helenehallowell

New Member

Jbrooksnw

New Member