- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Your property assets (conversion from home to rental)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Your property assets (conversion from home to rental)

Hello,

If property is converted to a rental in the middle of the year, I assume it gets listed only once (as a rental) in the "Your property assets," correct? I mean at

- wages and income > schedule E > review your rental info > update property > update assets and depreciation > "summary":

Thank you!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Your property assets (conversion from home to rental)

Yes ... you only enter items once however since you converted mid year then the interest & RE taxes must be properly prorated between the Sch A and the Sch E ... follow the interview screens carefully or do the proration yourself.

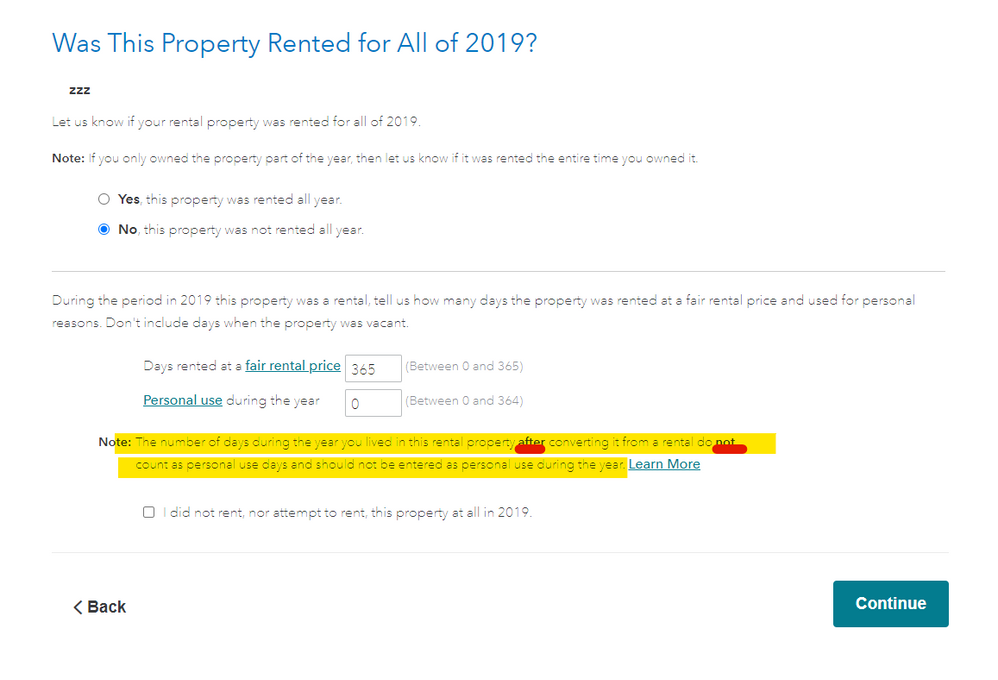

FYI **** once you convert the property your personal use is ZERO ... entering in any personal days will mess you up badly ... again read the screens carefully.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Your property assets (conversion from home to rental)

If property is converted to a rental in the middle of the year, I assume it gets listed only once (as a rental) in the "Your property assets," correct?

yes. Generally, the absolute only thing you see in the Assets/Depreciation section is the property itself, and that's pretty much it. Let me run through a possible scenario for you.

2010 - You purchase the home as your primary residence for $100,000.

2015 - You put a new roof on the house for $15,000

2020 - You move out of the house and convert it to a rental. your cost basis in the property is $115,000. Using your 2020 property tax bill you do the math and figure that 30% of your tax basis (not cost basis) is allocated to the land. So 30% of $115,000 is $34,500. When entering the asset in TurboTax you will enter your total cost basis of $115,000 where it asks for that, and enter $34,500 where it asks for the cost of land. The program (not you) will do the math and assign the difference of $80,500 to the structure and that's the amount that will be depreciated over the next 27.5 years.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

New Member

vithlanisamay

Returning Member

scatkins

Level 2

SB2013

Level 2

William--Riley

New Member