- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Why is a blank date not being accepted filling Form 1099B for a long term basis sale of mutua...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is a blank date not being accepted filling Form 1099B for a long term basis sale of mutual fund. It is blank on the form.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is a blank date not being accepted filling Form 1099B for a long term basis sale of mutual fund. It is blank on the form.

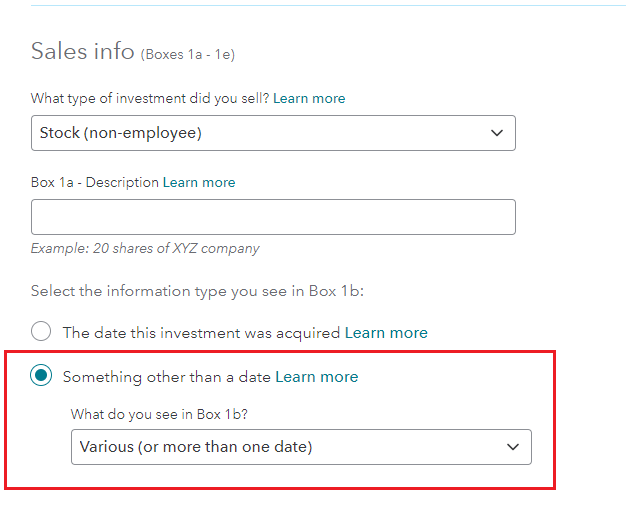

For the IRS required fields a blank is not acceptable. There is a selection that allows you to use 'Various" and it is acceptable.

When you walk through the steps, as you can see from the image below, you must select the check beside 'Something other than a date'.

If you still have difficulty, make sure the date acquired reflects the correct holding period. It's not important other than to have the correct holding period for the results to be calculated accurately for tax on your return.

- Long term is a holding period of more than one year and receives capital gain tax treatment (0%, 10%, 15%, 20% depending on your regular rate of tax)

- Short term is a holding period of one year or less and receives ordinary gain tax treatment (your regular rate)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is a blank date not being accepted filling Form 1099B for a long term basis sale of mutual fund. It is blank on the form.

I have ticked Something other than a date. I clicked on -Blank- but it remains "greyed out".

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Primerrycaregvr

New Member

markperry7878

New Member

NoNumber13

New Member

freddytax

Level 3

joseve

Level 1