- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid ...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

LinaJ2020:. Any info yet since I gave you the token number?

Thanks

niraolso

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

LinaJ2020:. Are you still working on mine since I gave you the token number an hour ago?

Would appreciate a reply from someone

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

3 hours ago I gave LinaJ2020 my token number for her to look at my input.

No one is replying to me for 3 hours - can someone please help me on my issue. I'd like to get this completed

Thanks niraolso

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

I'm still waiting for the help I'm supposed to be getting on this since yesterday.

Who is helping me on this?

Thanks

Niraolso

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

Certificate of Rent Paid (CRP) is at the very end of the state return, after the questions about penalties, extensions ( click Skip Extension).

There are several screens related to the CRP, make sure you continue through the screens and answer all of the questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

MayaD:. I just went in on this and skipped extensions, marked the box for the rent form, nothing came up right after marking the box to complete my info.

My federal and state returns were reviewed and said all is ok and I get to a screen that says: review order (which I have done many times in the last 2 days), your refund info OR sign and file returns. So where are all the questions regarding the rent I have paid form? I don't want to go too far and end up signing before it's even complete. Frustrated for sure by now.

Niraolso

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

MayaD: also please check my input on the token number I gave yesterday and see what all I have done.

Niraolso

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

Whoever can help with this would be appreciated-- I get all the way to the end of the state return where it says ""done with state"", BUT there is NOWHERE before I touch that "done with state" button, to input the info from the certificate of rent paid. This is the 2nd day I'm trying to complete this and paying for help, but I have not gotten where I can input the certificate of rent paid info. Please help !!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

To enter your Certificate of Rent in your Minnesota return, please follow these steps:

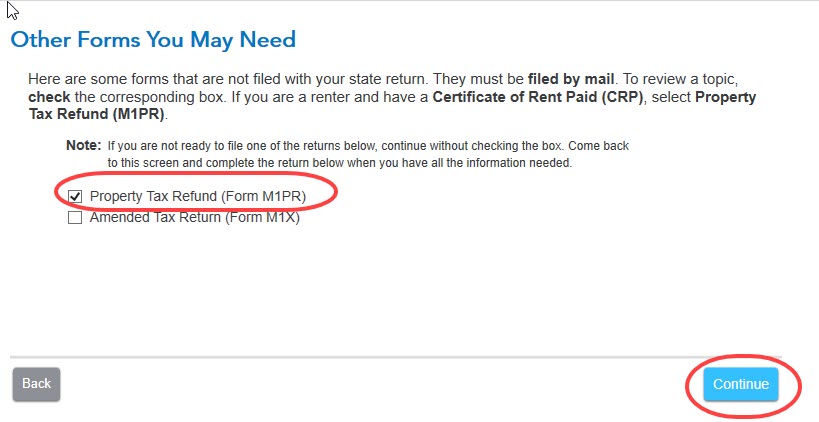

1. In your Minnesota return, continue through the screens until you reach Other Forms You May Need.

2. Mark the box for Property Tax Refund (Form M1P) and click Continue. [See screenshot below.]

3. Continue through the interview, entering the information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

This is so frustrating!!! I have said before that I have marked that box and I have touched ""continue"" and NONE of those screens come up.

I am getting so frustrated as this is day 3 that I'm trying to get help on this .

I tried to clear it and start over also, but it says I can't since I registered . And that's because I had to towards the beginning.

Please have a manager help me or give me a phone number where I can talk to someone in person.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

Any help yet? Check the token number I gave 2 days ago and you will see I have that box marked already.

I need this resolved

Niraolso

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

I am sorry this has taken so long, but I was able to review your return today and the reason this doesn't come up for you is that you are claimed as a dependent on someone else's tax return.

That means you are not eligible to claim this credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

Jilie

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

. So what do I do with the form the landlord gave me? Anything?

My parents are still claiming me becuz I was a student . And this rent form is only for 4 months at the end of 2019.

Please advise what I do with the form .

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I input the amount of rent that I paid? I have a 2019 crp, certificate of rent paid form

You might hold onto the form for future reference, but there’s no reason to retain it as far as the refund is concerned.

Unfortunately, you won’t get any tax benefit from the form, since you don’t qualify for the credit.

For more information, please see Renter's Property Tax Refund.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

swick

Returning Member

yvonnemk123

New Member

sfp1000

Level 1

tjmgator

New Member

ftermine

New Member