- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Turbotax calculating refinance fees depreciation incorrectly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculating refinance fees depreciation incorrectly?

Turbotax tells me that my closing costs of $1500 can be fully deducted over 30 years. In the assets summary, it shows MACRS Convention is NA and no Depreciation Method is listed. Why does it say that I can only depreciate $5 per year? Shouldn't it be $50 per year ($1500/30=$50)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculating refinance fees depreciation incorrectly?

There are different items are included n closing cost, it is why the calculation might be different.

Items below are not tax deductible but may increase the cost basis of your home which may benefit you in the event of sale.

- Attorney fees in connection with obtaining property

- Commissions

- State stamp taxes and transfer taxes

- Tax service fees

- Title policy fees or title insurance

- Miscellaneous abstracts of title, surveys, recording of deed

- Appraisal Fee

Deductible expenses for a new loan or refinance: mortgage interest paid (including origination fee or "points"), real estate taxes, and private mortgage insurance.

Some of the expenses associated with the closing cost cannot either be deducted nor depreciated, they should be amortized within 5 years instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculating refinance fees depreciation incorrectly?

This is a rental property so all costs should be ded (https://turbotax.intuit.com/tax-tips/home-ownership/mortgage-refinance-tax-deductions/L2fzA7hg5). Turbotax also indicates that the Cost/Cost basis is $1500. If there was something that was not depreciable, it seems it would reduce the $1500 amount in the asset summary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculating refinance fees depreciation incorrectly?

You are correct, the deduction is not correct due to the entries. Follow the steps below to add this asset for the appropriate outcome.

- Sign into your TurboTax Account > Search (upper right) > Type rentals > Press enter > Click on the Jump to .... Link

- Edit beside the rental you want to work on > Scroll to Assets > Edit

- Select Yes to go directly to the asset summary >

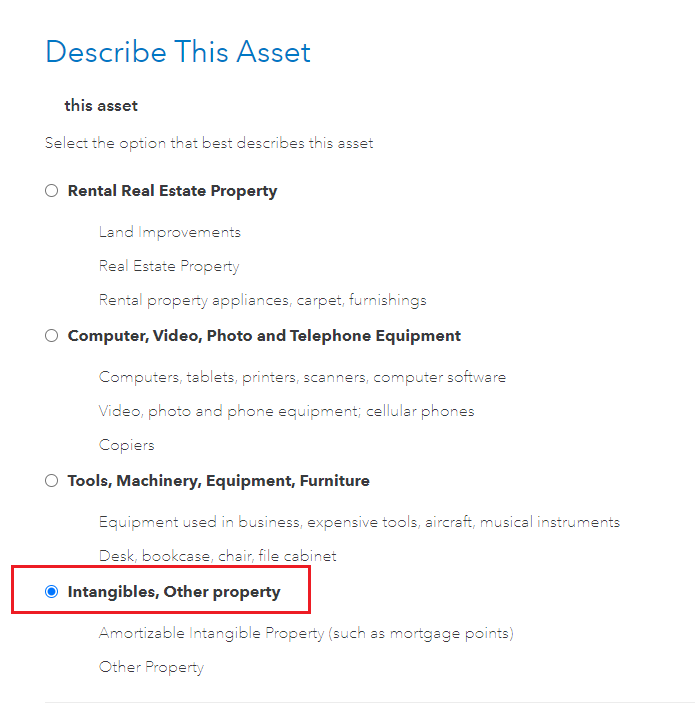

- Add or Edit the asset for the closing costs and or points > Select Intangibles, Other Property > Continue

- Select Amortizable intangibles > Continue > Enter the details about your costs including the refinance date

- Continue > Select the Code Section 163 for loan fees > Enter the useful life (number of months of the loan)

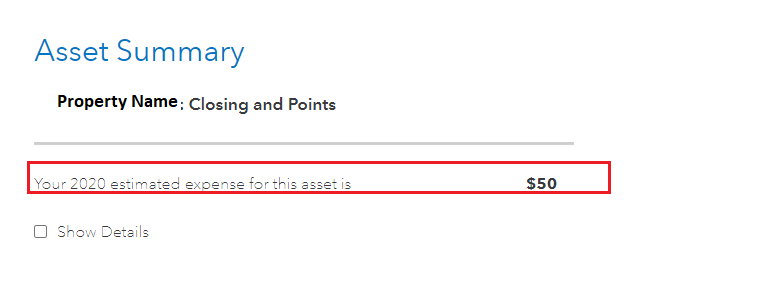

- The final screen will show the deduction.

- See the images below.

Notice the end result is what you want to see, the date the refinance began in this example is 01/05/2020. The date the refinance began will alter the deduction if it was not a full year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

alvin4

New Member

iqayyum68

New Member

WadiSch

Level 1

Benjamine

Level 4