- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Turbo tax is not calculating the depreciation on foreign rental property for 40 years, it is calculating based on 30 years. Can you help me how to change to 40 years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax is not calculating the depreciation on foreign rental property for 40 years, it is calculating based on 30 years. Can you help me how to change to 40 years?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax is not calculating the depreciation on foreign rental property for 40 years, it is calculating based on 30 years. Can you help me how to change to 40 years?

If the property was placed in service after Dec 31, 2017, then 30 years depreciation on foreign residential rental property is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax is not calculating the depreciation on foreign rental property for 40 years, it is calculating based on 30 years. Can you help me how to change to 40 years?

Turbotax is calculating 27.5 years depreciation for my foreign rental property (pre-2018) instead of 40 years. Foreign address has been entered. How can I fix this please?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax is not calculating the depreciation on foreign rental property for 40 years, it is calculating based on 30 years. Can you help me how to change to 40 years?

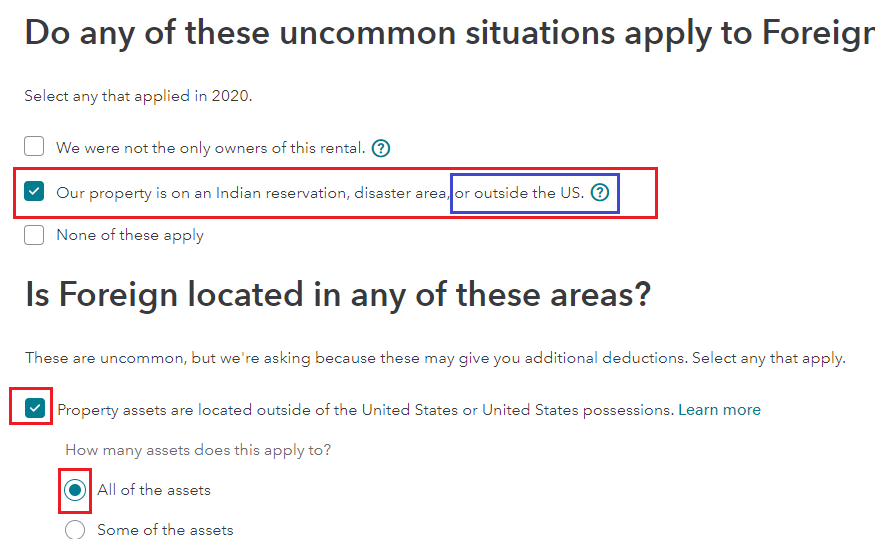

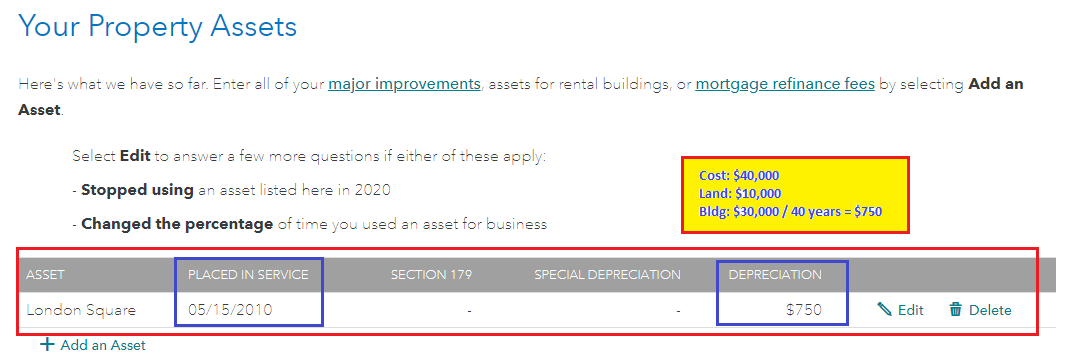

This can be fixed by using the following steps making sure to mark the appropriate selections as you go through the entry of the building and/or improvement on this foreign rental property. Date placed in service and the right selections will provide the correct 40 year depreciation.

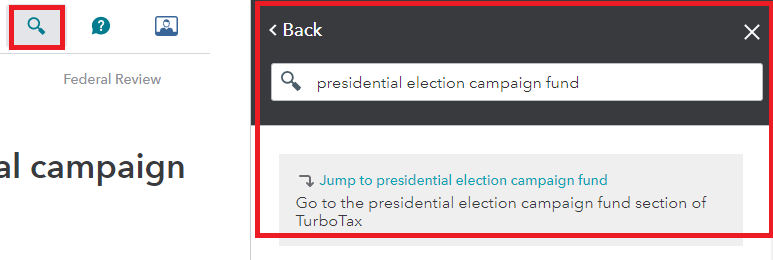

- Sign into your TurboTax account > Search for Schedule E (upper right) > press enter > select the Jump to link

- Select the Edit beside the foreign property > Scroll to the Asset(s) and select Edit > Select Yes to go to the asset summary

- Select Edit beside the rental unit asset > Continue to Tell us about your rental asset and check the date purchased

- Next Continue, then check the date placed in service, correct if necessary

- Continue to check the prior and current depreciation amounts - TurboTax will be correct using the 40 years if the date placed in service is before 2017.

- See the images below for assistance.

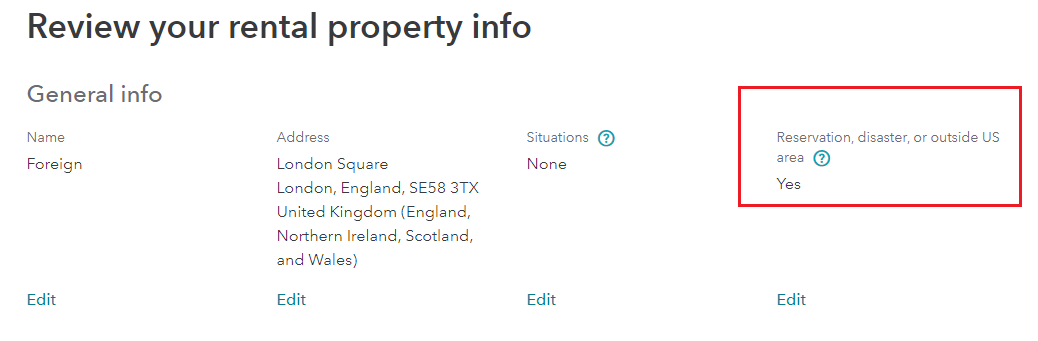

The first time through this asset questions are asked about the location (see images below), after the first time of entry, one of the screens has a statement that you told us this was used outside the US. (see image below)

- If you don't see the correct depreciation, follow steps 1-2 above, the select Edit beside the Rental property info to answer the questions about location by selecting Edit under Reservation, disaster, or outside US area.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sonia-yu

New Member

dougiedd

Returning Member

user17539892623

Returning Member

wcrisler

New Member

jjon12346

New Member