- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: TT calc cap gains as LT for land I inherited and sold < 1 yr., no place to enter acq date, only date sold. How do I change the calc method for capital gains to ST?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT calc cap gains as LT for land I inherited and sold < 1 yr., no place to enter acq date, only date sold. How do I change the calc method for capital gains to ST?

Need to force TT TO use ST rather than LT Capital Gains method, how do I do that on Sch D?

Topics:

posted

May 16, 2021

1:26 PM

last updated

May 16, 2021

1:26 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

2 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT calc cap gains as LT for land I inherited and sold < 1 yr., no place to enter acq date, only date sold. How do I change the calc method for capital gains to ST?

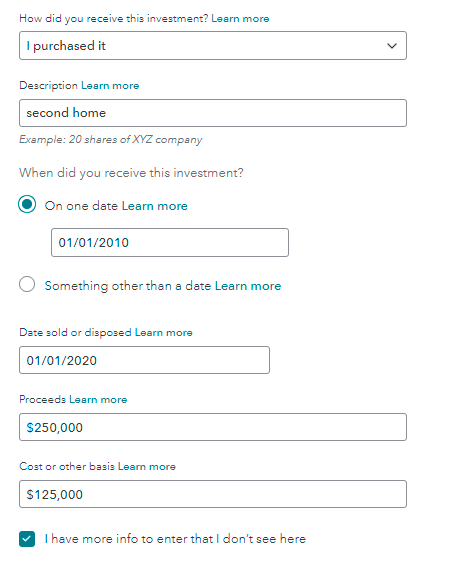

When you enter the sale of land, you will have similar screens to selling a second home. Please see the screenshot with the purchase date shown.

May 16, 2021

1:41 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT calc cap gains as LT for land I inherited and sold < 1 yr., no place to enter acq date, only date sold. How do I change the calc method for capital gains to ST?

After doing a lot of searching I discovered Inherited Property is always taxed at LT rate. Thank you for your response

May 16, 2021

2:28 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17538342114

Returning Member

brian94709

Returning Member

Pablo287

Level 2

kerilovesou

New Member

Blue Storm

Returning Member