- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

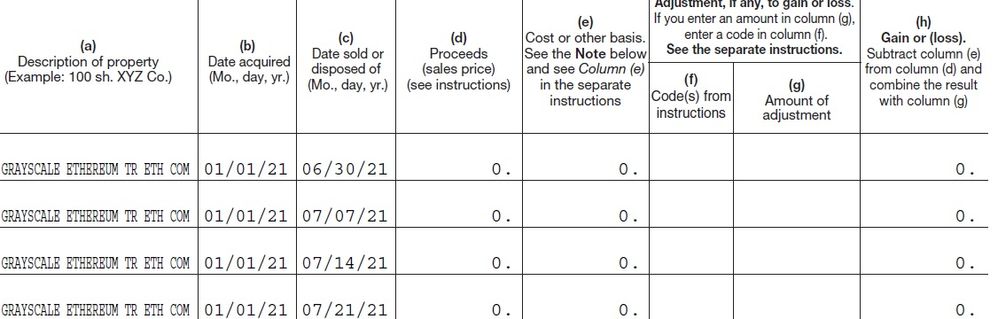

I have many pages of brokerage imported 8949 transactions with sub-50 cent proceeds from ETFs with no reported basis (each ETF with one sale per week). I manually entered 0 as the basis when requested by TT to fix the transactions so they have a basis (I am not interested in manually entering and looking up all of the basis values and scaling them for so many transactions for so little amount of money, so I used a cost basis of 0).

The TT Form 8949 rounded every transaction proceed to 0. e.g., it now shows pages of asset sale rows as "0 proceeds, 0 basis, 0 gain/loss", page after page, for all transactions. So, TT is rounding the proceeds to 0 and the net result is that nothing gets bubbled up into Schedule D Part 2.

With larger proceeds the round off errors could be in the noise and could theoretically wash each other out if the distribution behind the decimal was not limited to sub-50 cent values. While my situation is limited, I could have easily have had 10,000 imported sub-50 cent short term gains from one brokerage firm amounting to $4900 (and other big blocks of the same type of transactions from other brokerage firms with ETFs). In this case TT would indicate that there would be no need to pay tax on it because it would round all of the proceeds down. That simply cannot be correct and TT seems to be playing fast and loose with the interpretation of how and when rounding can occur. (To be flippant I would say that I have found a great way to avoid short term capital gains that should be exploited.)

Regardless, of whether there is a bug or not in TT, what is the process to correct the situation that will make TT happy, my Schedule D Part 2 match my 1099-B, and will allow my Federal and State taxes to be able to be filed electronically with a TT guarantee of accuracy?

Thanks in advance for any help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

if there are many transactions with tiny amounts under 50 cents or under one dollar,

the only solution is to use aggregation.

that means you list the security, the total cost basis and the total proceeds for all, on one line.

---

the detail reporting rule (explained in IRS instructions) is :

a) covered transactions without adjustments do not require Form 8949.

b) covered transactions with adjustments (i.e. wash sales) must be detailed on some 8949 or your other forms in the manner of 8949.

--

If you aggregate a) no mailing is necessary. the totals appear on Schedule D line 1a or 8a.

If you aggregate b) or aggregate other categories (BC, EF) either attach (*) or mail in the details. the b) totals appear on Schedule D line 1b or 8b.

(*) some users have reported TurboTax Online may prompt you to attach a PDF file of details.

Box A and Box D are your covered transactions.

a) is the only Exception to the IRS requirement to list in detail every closing transaction you make during the year.

----

You may aggregate some but not all transactions in a category.

In that case, those transactions already detailed on the e-Filed 8949 would not require any additional mailing.

Sectioning your consolidated 1099-R for this would require the Adobe PDF editor. or, literally, cut- and -paste.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

Any overrides will prevent e-File.

You never access Schedule D directly and you never access Form 8949 directly.

You use the 1099-B entry screen.

That screen will let you select the box category or categories to be summarized or detailed.

If you want to aggregate everything then yes you have to delete imports and other manual entries and start fresh.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

"(To be flippant I would say that I have found a great way to avoid short term capital gains that should be exploited.)"

If you think you can make $4,900 with 10,000 transactions of pennies each, have at it.

Otherwise, these miniscule transactions should not be listed on your tax return.

delete them or delete them from the csv or txf file you are using.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

Well it is just a weird situation peculiar to the amounts of a couple of holdings; I have a bit more than $100 with several hundred .20-.40 cent transactions (all rounded to zero on the 8949).

So my 8949 bubbles up 0 for most transactions and the Schedule D Part 2 is out of bed with my 1099-B just north of $100. That seemed a bit excessive to ignore.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

if there are many transactions with tiny amounts under 50 cents or under one dollar,

the only solution is to use aggregation.

that means you list the security, the total cost basis and the total proceeds for all, on one line.

---

the detail reporting rule (explained in IRS instructions) is :

a) covered transactions without adjustments do not require Form 8949.

b) covered transactions with adjustments (i.e. wash sales) must be detailed on some 8949 or your other forms in the manner of 8949.

--

If you aggregate a) no mailing is necessary. the totals appear on Schedule D line 1a or 8a.

If you aggregate b) or aggregate other categories (BC, EF) either attach (*) or mail in the details. the b) totals appear on Schedule D line 1b or 8b.

(*) some users have reported TurboTax Online may prompt you to attach a PDF file of details.

Box A and Box D are your covered transactions.

a) is the only Exception to the IRS requirement to list in detail every closing transaction you make during the year.

----

You may aggregate some but not all transactions in a category.

In that case, those transactions already detailed on the e-Filed 8949 would not require any additional mailing.

Sectioning your consolidated 1099-R for this would require the Adobe PDF editor. or, literally, cut- and -paste.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

Thank you. I will give this a go.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

I haven't been successful in getting this to work. I guess I am not fully understanding what to do.

My proceeds are uncovered.

@fanfare "If you aggregate b) or aggregate other categories (BC, EF) either attach (*) or mail in the details. the b) totals appear on Schedule D line 1b or 8b. "

Questions:

1. In my uncovered case, any aggregation would roll into Schedule D line 2?

2. If so, how to I actually aggregate? Manually override Schedule D line 2 amounts in TT to include the actual summation of the uncovered transactions to a single proceeds/cost basis/gain? (right click, select override, etc)

3. If so, What do I do with the 8949 with all of the 0 entries. Just include it?

4. I assume I need to mail in a Form 8453 with my 1099-B info?

Thanks in advance. Sorry to be a pain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

you don't do any overrides.

Please look at schedule D lines 2, 3, 9, 10.

You tell TurboTax what Box you want to assign and TurboTax uses the corresponding subtotal line.

There is no detail reporting exception for those Box Categories.

When you e-File Form 8949 will be submitted but it won't have any details.

If you use TurboTax Online, the program will ask you for PDF file of your 1099-B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

Sorry, I am a still lost.

"you don't do any overrides.

Please look at schedule D lines 2, 3, 9, 10."

I cannot seem to edit any values in Schedule D unless I right click and say override.

After fussing around with it, I believe you are suggesting that I remove the imported brokerage data in this area, and then enter summary data. That situation seems to work and my 8949 says "see attached statement"

Yes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

Any overrides will prevent e-File.

You never access Schedule D directly and you never access Form 8949 directly.

You use the 1099-B entry screen.

That screen will let you select the box category or categories to be summarized or detailed.

If you want to aggregate everything then yes you have to delete imports and other manual entries and start fresh.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

Thank you very much.

I needed to delete the imports for non-covered transactions, then I could add a new summary sale to get everything to where it needed to be. The deluxe CD version provided the form to be mailed with the brokerage 1099.

Thanks again!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bbrooksfamily

New Member

pinguino

Level 2

statusquo

Level 3

Juliaxyw

Level 2

Juliaxyw

Level 2