- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Bug - Multiple transactions imported into Form 8949 are not tallying up to transfer to Schedule D Part 2

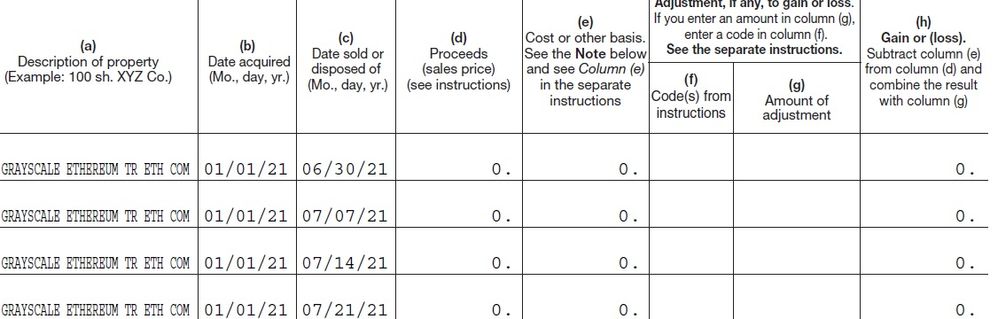

I have many pages of brokerage imported 8949 transactions with sub-50 cent proceeds from ETFs with no reported basis (each ETF with one sale per week). I manually entered 0 as the basis when requested by TT to fix the transactions so they have a basis (I am not interested in manually entering and looking up all of the basis values and scaling them for so many transactions for so little amount of money, so I used a cost basis of 0).

The TT Form 8949 rounded every transaction proceed to 0. e.g., it now shows pages of asset sale rows as "0 proceeds, 0 basis, 0 gain/loss", page after page, for all transactions. So, TT is rounding the proceeds to 0 and the net result is that nothing gets bubbled up into Schedule D Part 2.

With larger proceeds the round off errors could be in the noise and could theoretically wash each other out if the distribution behind the decimal was not limited to sub-50 cent values. While my situation is limited, I could have easily have had 10,000 imported sub-50 cent short term gains from one brokerage firm amounting to $4900 (and other big blocks of the same type of transactions from other brokerage firms with ETFs). In this case TT would indicate that there would be no need to pay tax on it because it would round all of the proceeds down. That simply cannot be correct and TT seems to be playing fast and loose with the interpretation of how and when rounding can occur. (To be flippant I would say that I have found a great way to avoid short term capital gains that should be exploited.)

Regardless, of whether there is a bug or not in TT, what is the process to correct the situation that will make TT happy, my Schedule D Part 2 match my 1099-B, and will allow my Federal and State taxes to be able to be filed electronically with a TT guarantee of accuracy?

Thanks in advance for any help.