- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

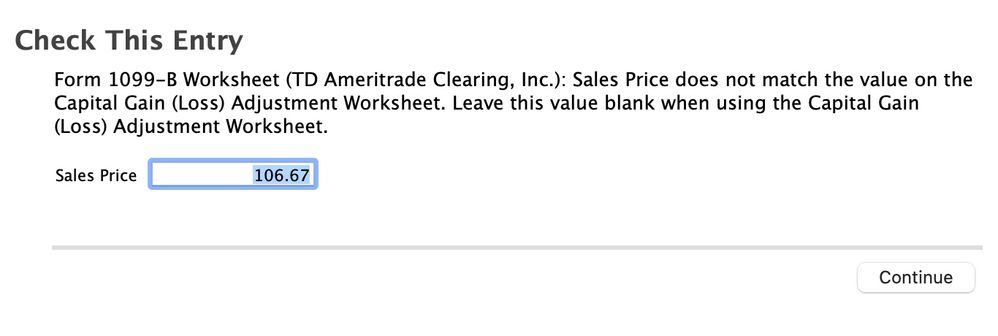

Sold a number of puts in 2020, each a small amount, between $50 and $150, that expired out of the money. At the "Review section of Turbotax, getting multiple, 'check this entry' flags. There are dozens of these transactions and flags, never had them before from a TDA 1099 and have sold puts in multiple previous years. Screenshot attached.

Appreciate any input on how to rectify, short of changing many, many entries.

Thanks,

Adam

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

Other users have reported a similar issue which, in turn, has been reported to the Moderators of this board (to pass along to the developers for further review).

Thank you for reporting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

Other users have reported a similar issue which, in turn, has been reported to the Moderators of this board (to pass along to the developers for further review).

Thank you for reporting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

some brokers report expired options in a way that TurboTax does not like.

This is a problem with the broker report, or with TurboTax, depending on your point of view.

If the broker hands you a negative number for proceeds or cost, I'd say it is the broker.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

@fanfare wrote:This is a problem with the broker report, or with TurboTax, depending on your point of view.

This is a confirmed TurboTax issue; when cents are entered, an adjustment form is generated.

The developers are working on a fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

Doubt the problem is with TDA, as I imagine my broker of ten plus years is reporting same way they have in past. Although I could be wrong in this and can check with them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

@psyadam wrote:

Doubt the problem is with TDA, as I imagine my broker of ten plus years is reporting same way they have in past. Although I could be wrong in this and can check with them.

You are not wrong; the problem is with TurboTax and not your broker.

If you want to test the foregoing assertion, all you have to do is round the numbers you are entering (i.e., do not enter cents). Some sort of programming error with rounding causes the adjustment worksheet to be generated and that is why the entries are being flagged.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

Aside from rounding issue, there seems to be issues with negative numbers as well. The field is stating the minimum value is zero. So we should round to the nearest dollar to correct the problem and enter zero when it is negative?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

@Hapa wrote:

....So we should round to the nearest dollar to correct the problem and enter zero when it is negative?

I would suggest not doing anything until the developers resolve the primary issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

"The developers are working on a fix".

How can we know when the fix is implemented? Is there a problem number that support can inquire on? Or a signup list so that I can be notified when it is fixed?

What do we do if it is not fixed by April 15?

[BTW, the screen this error appears on is unusable. It has a very small scroll window for a very large number of lines on form 8949, and no clue as to the line on which the problem was detected.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a number of puts in 2020, getting multiple, 'check this entry' flags under 'Review'

The nature of the bug is obvious: Turbo tax sees a zero for cost basis and thinks it is a blank. Zero is correct for a short put that expired worthless.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Sandyjb555

Level 3

megolaniac

New Member

user17629261984

New Member

fastboymazen

New Member

SeaLady321

Level 3