- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Should I list Property tax as an expense or is it accounted for in the 1098 from Mortgage?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I list Property tax as an expense or is it accounted for in the 1098 from Mortgage?

Should I be listing the property taxes paid for my rental property as an expense or is it already accounted for in the 1098 that my bank sends me? Because my Mortgage company pays for the Property taxes at the end of the year.

I do not want to count it twice if it is already accounted for, thank you for your expert advise!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I list Property tax as an expense or is it accounted for in the 1098 from Mortgage?

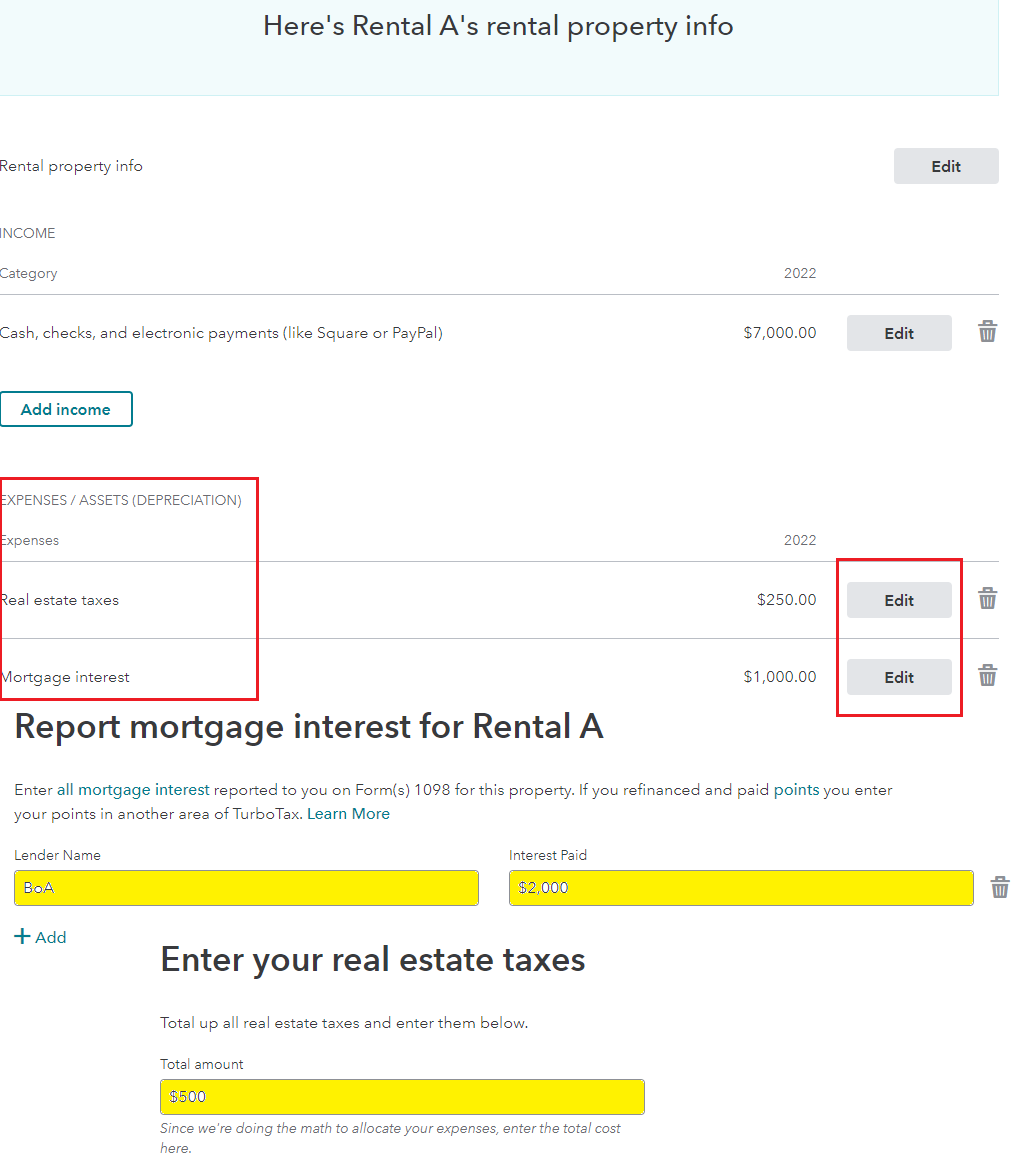

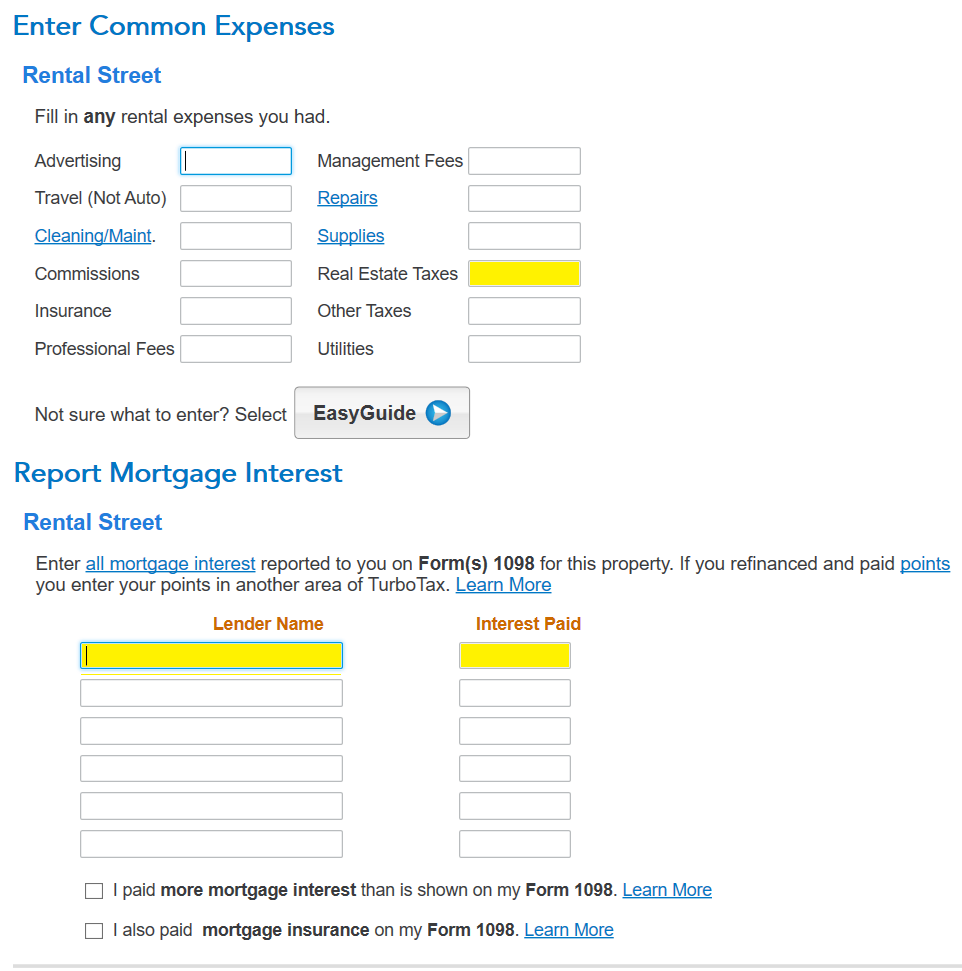

When you enter the mortgage interest for rental activity you must also enter your property taxes. There is not a separate entry for your property taxes when you enter your mortgage interest in the rental activity. See the images below.

- Search (upper right) > Type rentals > Click the Jump to... Line > Select the expenses to edit

TurboTax Desktop:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 2

djpmarconi

Level 1

realestatedude

Returning Member

ramseym

New Member

eric6688

Level 2