- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Possible error with depreciation calculation for rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

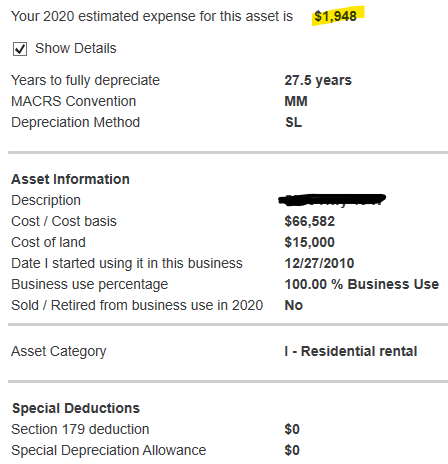

Plugging your figures and date into a test return, TurboTax is calculating $1876.

Check your entries and also your prior depreciation figure.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

What are you showing for the total of all prior depreciation taken? Should be $16,982.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

Ah ok I think we're getting somewhere. The prior depreciation not including 2020 is $15,616.

Looking at 2014's form 4562, the prior depr not including 2014 was $3,922.

I don't have access to returns prior to 2014 which was the 1st year we used TT.

Looks like the former CPA goofed somehow and didnt depreciate an entire year. How did he get $3,922? Correct me if I'm wrong, but the total depreciation as of the end of 2013 should have been $5,706=(1876*3)+78

We've been using $1,949 since 2014 as that's what TT calculated when I entered $3,922 prior depreciation.

Unfortunately, the CPA has since passed away, and we don't have any of the returns that he did for us.

What should we do??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

@aws316 wrote:

Looking at 2014's form 4562, the prior depr not including 2014 was $3,922.

but the total depreciation as of the end of 2013 should have been $5,706=(1876*3)+78

We've been using $1,949 since 2014

we don't have any of the returns that he did for us.

If the prior tax preparer did not do ALL of the tax returns starting from 2010, you can't necessarily rely on what it says for "prior depreciation".

Almost. It should be MINUS $78, not "plus", so it should be $5550.

I think I would change your "prior depreciation" to $5550 plus $1946 however many years.

Always keep ALL tax returns for the rest of your life, ESPECIALLY when you are still operating a business or rental.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

Thank you. All prior returns were done by the same preparer.

Why would it be minus 78? It was placed in service 12/27/2010, so total depr as of end of 2013 would be 1876+1876+1876+78=5706

78 is for 1 month of depreciation in 2010 (51,582*0.152%)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

Oops, sorry, I misread it and thought it showed January, rather than December. You are right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

@AmeliesUncle @Carl @Anonymous_

We were able to find the old returns.

The 2010 form 4562 shows:

Placed in service: 12/27/2010

Basis: $51,582

Recovery period: 27.5

Convention: MM

Method: S/L

Depreciation deduction: $54

...and in 2011 - $1289; 2012 - $1290; 2013 - $1290

He had all these amounts listed on the line for "residential rental property" with 27.5 yr recovery, but looks like he actually spread it out over 40 years for some reason???? Can anyone make sense of this or did he do it wrong?

Thank you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

In your post, you show the 4562 indicates a recovery period of 27.5 years. Yet you say "it looks like" he actually spread it out over 40 years. Why do you say that, if the 4562 shows a recovery period of 27.5 years?

For rental property located in the U.S. the recovery period is 27.5 years.

Located in a foreign country and placed is service *before* 2018, the recovery period is 40 years.

Located in a foreign country and place in service *after* 2017, the recover period is 30 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

The 1st year depr that he put down was $54, which is what it would be for the half month of December over 40 years. (51,582 / 40) * (.5/12)=54

Then, the following full 3 years that he prepared the taxes, he showed depr of $1,289, $1290 and $1289 for 2011, 12, and 13 respectively. 51,582 / 40 = 1,289.55

This was a US residential rental property

So when I started using TT in 2014, I showed $3,922 prior depreciation, the program calculated $1,949 current depreciation, and that's what I've been using ever since.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

The 1st year depr that he put down was $54, which is what it would be for the half month of December over 40 years. (51,582 / 40) * (.5/12)=54

Holy cow! He really messed that up big time. The math is all wrong. Take a look at IRS pub 946 at https://www.irs.gov/pub/irs-prior/p946--2020.pdf. YOu'll see that foreign residential rental property (of which I am aware your property is not foreign) is depreciated over 39years. Not 40.

Now I'm assuming your costs basis of $51,582 is the value of the structure only, and does not include the value of the land. You use the worksheet that starts at the bottom of page 38 and continues on page 39, the correct math to figure that first year depreciation for 40 year property (which is not what you have) is your cost basis of $51,582 multiplied by the correct multiplier shown in table A13a on page 85, which is 0.104. That gives a first year depreciation amount of $5364. So I'm clueless as to why the CPA would have figured it the way you say they figured it. Doesn't make any sense. Can you access the 4562 for the last return done by the CPA, and the first return you completed and filed with TurboTax? So far, this seems to be an absolute cluster of a mess.

It's also possible I"m not understanding things correctly as it pertains to your timeline of events.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

For some reason, it seems like your prior tax preparer used the "Alternative Depreciation System" (ADS) which is 40 years. Because that was how it was set up, you were NOT supposed to change it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

The last year he did the return was 2013, where he used $1289 for current depreciation for a total of (as of 2013) $3,922 since it was placed in service. The forms 4562 in 2010-2013 all showed the same thing: S/L, MM, 27

The depreciable basis is 51,582 for the improvement. The land value is 15,000.

In 2014, I entered $3,922 prior depreciation and the same info from the prior forms 4562 (S/L, MM, 27.5), then the program calculated $1949 current depreciation which is what I've used each year since. Including 2020, the total depreciation taken is $17,565 = 1949 * 7 + 3922.

What should I do now? The property was sold in April 2021, so when I file next year, should I enter the prior depreciation that SHOULD have been taken, $18,838, or the actual amount taken, $17,565??

Or should I file the form that requests the change in accounting method and catch up the depreciation not taken? Or do something else?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

I agree with @AmeliesUncle; it appears as if your tax preparer calculated the deprecation deduction using the wrong period.

You can try filing Form 3115. However, it certainly seems as if your tax preparer entered the correct recovery period (27.5 years) on Form 4562 but then calculated the deduction over 40 years which, essentially, amounts to a math error for which Form 3315 cannot be used to ameliorate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible error with depreciation calculation for rental

Using 40 years isn't necessarily "wrong". §168(g)(7) give a person the option to elect to use ADS (in this case, 40 years). It seems like the prior preparer made that election, and therefore you were not allowed to switch to 27.5 years..

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chopstickabigail

New Member

Jsteven408

Level 1

tizzy2335

New Member

Stringerjj

Returning Member

megolaniac

New Member