- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I have rental income from a farm property. I didnt sell property but federal return asks me to fill in entries under "Schedule E - Disposition Worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have rental income from a farm property. I didnt sell property but federal return asks me to fill in entries under "Schedule E - Disposition Worksheet.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have rental income from a farm property. I didnt sell property but federal return asks me to fill in entries under "Schedule E - Disposition Worksheet.

If you're in the Rental & Royalty Income section of the program, the only place you're asked for sales information, is in the Assets/Depreciation section.

As you work through each asset, you are presented a screen asking "Did you stop using this asset in 2022?". If you answered that question YES, you need to go back and answer it NO.

Now, if you stopped renting out the property, that's the only way you would answer that question YES. If this is your case, then the next screen would ask "Special Handling Required?" If you answered that screen NO, then you're telling the program you sold that asset, and you will be forced to enter sales information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have rental income from a farm property. I didnt sell property but federal return asks me to fill in entries under "Schedule E - Disposition Worksheet.

Thanks Carl. I will give that a try.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have rental income from a farm property. I didnt sell property but federal return asks me to fill in entries under "Schedule E - Disposition Worksheet.

i have the same situation--when I completed my rental inputs - I own a rental but did not sell in 2022; during the fed review, it started to ask my for acquisiton and sales dates and prices...why? I had used TT for the past 5 years and this NEVER happened

is the software broken??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have rental income from a farm property. I didnt sell property but federal return asks me to fill in entries under "Schedule E - Disposition Worksheet.

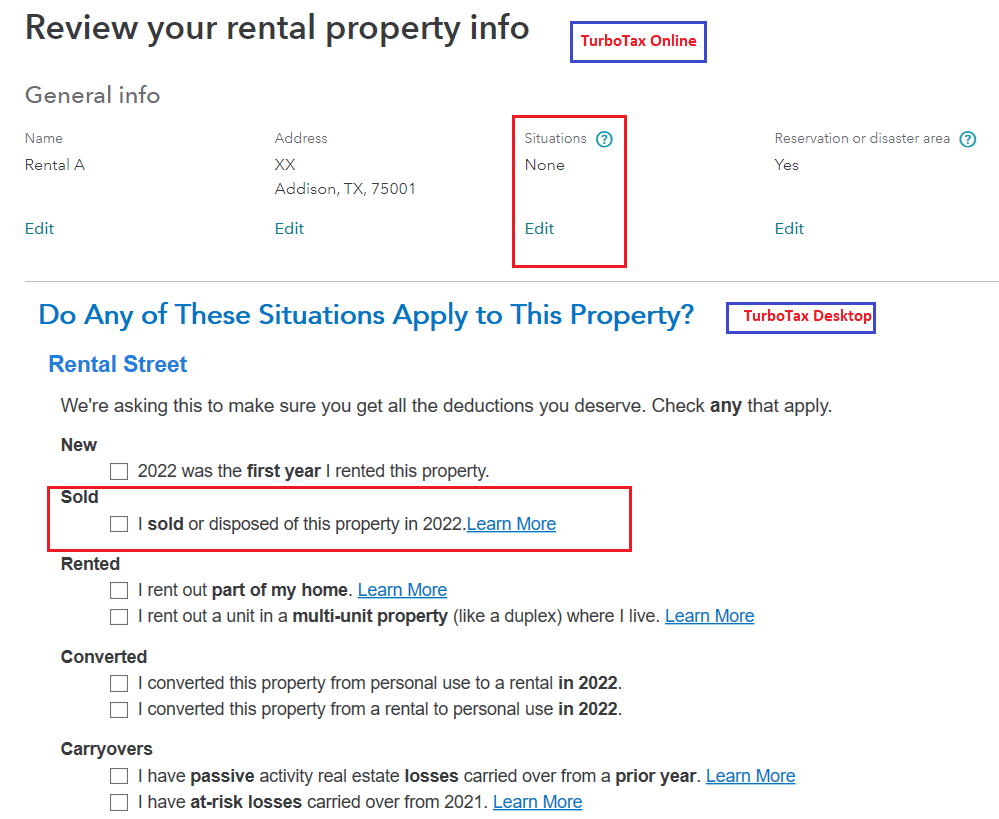

it's important to make sure the information in your return is correct. To review the question about a sale of your property you should use the following steps:

- Sign into your TurboTax account

- Select Wages & Income (or Business Income for TurboTax Desktop)

- Scroll to Rental Properties and Royalties (Sch E) > Click on Edit/Add

- Edit beside your rental activity > Edit beside Rental Property Info (Rental Property Profile in TurboTax Desktop)

- Edit under Situations deselect 'Sold, etc.' > Continue

- Review your assets to make sure the sales questions no longer appear.

- See the image below for both TurboTax Online and TurboTax Desktop.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

organdan

Level 1

jshuep

Level 2

user17539892623

Returning Member

Kenn

Level 3

ilenearg

Level 2