- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I had a rental property that was for sale during 2020 that I did not rent and I took a loss o...

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a rental property that was for sale during 2020 that I did not rent and I took a loss on it. Where on Turbotax can i report the business loss?

I purchased home in 2016 as primary residence, converted it to a rental in 2017, rented it through 2019 and tried to sell it in 2019 when the renters left and finally sold in 2020 for less than I bought it for. i keep entering the sale in turbotax in "sale of business property" but it is not accepting the entries and says since i had a loss. Where else do I enter this transaction.

Topics:

posted

February 22, 2021

1:37 PM

last updated

February 22, 2021

1:37 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a rental property that was for sale during 2020 that I did not rent and I took a loss on it. Where on Turbotax can i report the business loss?

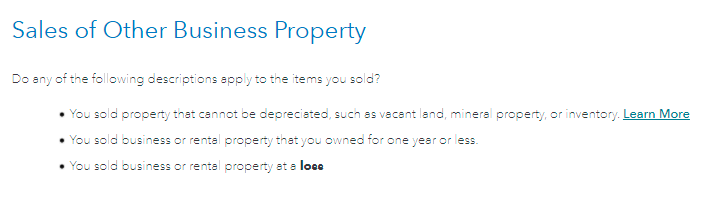

You need to continue on in that section. Even though at the beginning it states that if you have a loss, you will arrive at this screen which will let you enter the information.

Sales of Business or Rental Property

Enter the following information about your sale.

Description

Date Acquired

Date Sold

Gross Sales Price

Cost Basis

Depreciation Taken

February 22, 2021

3:04 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

janetcbryant

New Member

noodles8843

New Member

josephmarcieadam

Level 2

abarmot

Level 1

chiroman11

New Member