- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Final Sale of Publicly Traded Partnership (PTP) Results in a Negative Basis--Turbotax Won't Allow E-File

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final Sale of Publicly Traded Partnership (PTP) Results in a Negative Basis--Turbotax Won't Allow E-File

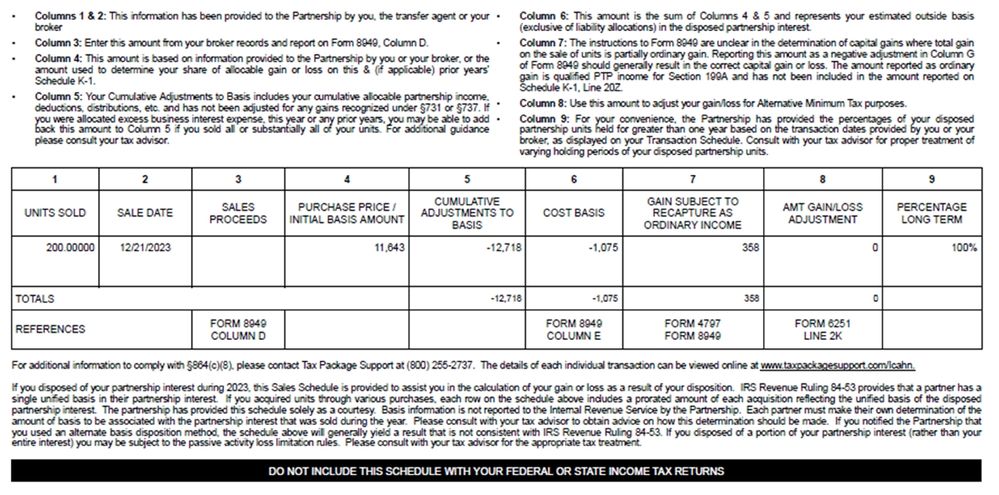

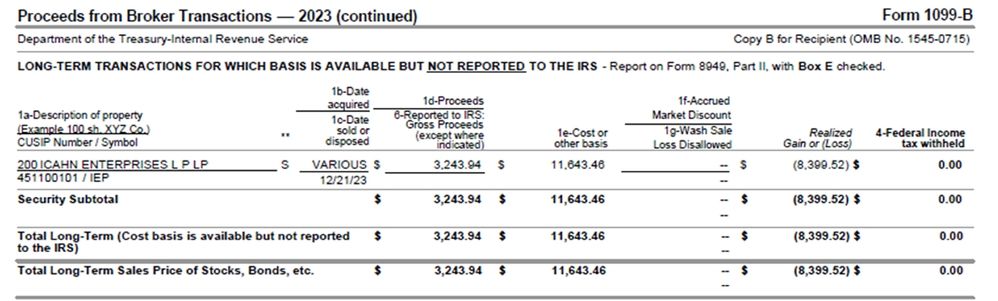

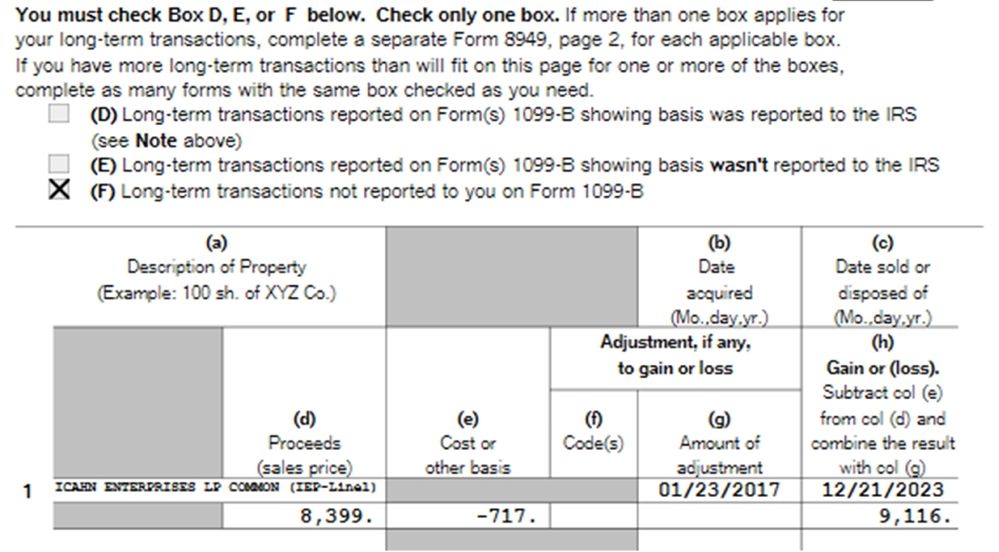

I have owned 200 units of a PTP (IEP) which I purchased in 2017 for $11,643. I sold the entire position in Dec. 2023 for $3,244. The K-1 I received shows that I have a negative basis (the K-1,1099B and Form 8949 are below). I have run the Final Review in Turbotax Desktop and receive this lone error: "You have negative cost or other basis on Form 8949, Sales and Dispositions of Capital Assets" and proclaiming this makes my return "ineligible for E-Filing."

I will never, ever buy another PTP again, but first, I need to get this last step along my trail of agony completed. What have I done wrong here?

K-1

1099B

FORM 8949

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final Sale of Publicly Traded Partnership (PTP) Results in a Negative Basis--Turbotax Won't Allow E-File

There's a question in the interview that reads "All of my investment in this activity is at risk". When you first buy the PTP, your investment is the purchase price and its all at risk -- if the PTP disappeared, you'd lose all that money -- so that box is checked. But as the year's go by, and the PTP pays distributions and hands out tax losses, your 'basis' steadily reduces until one day it hits 0 and you no longer have anything at risk: you've had your entire investment returned to you. At that point, you uncheck the box and:

- the losses that are reported on the K-1 don't automatically go to sched E or get carried over

- any distributions have to be reported as capital gains (and you pay tax)

- the sales schedule that shows you with a negative basis is wrong -- you're basis will never go below 0.

To fix, you'll need to start with the return where basis first dropped below 0, uncheck the "at risk" box, and TT will bring form 6198 into your return. If that was in a prior year, you'll need to amend your return to handle the reporting of distributions. You'll also see the carry-over losses being adjusted, since those are limited.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final Sale of Publicly Traded Partnership (PTP) Results in a Negative Basis--Turbotax Won't Allow E-File

Thank you very much for the information. I wish Turbotax would have a notification regarding this info…it really seems that handling K-1s is an afterthought, but for someone like me that doesn’t really understand the process, a lot more hand-holding by the software would be appreciated. I really appreciate your guidance!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ripepi

New Member

mmcdono7612

New Member

dave-j-norcross

New Member

nirbhee

Level 3

johnsmccary

New Member