- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final Sale of Publicly Traded Partnership (PTP) Results in a Negative Basis--Turbotax Won't Allow E-File

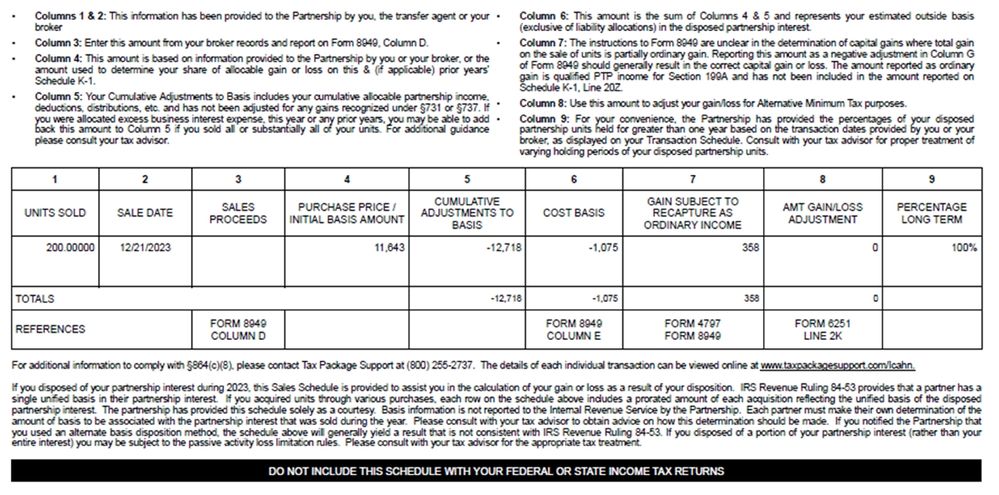

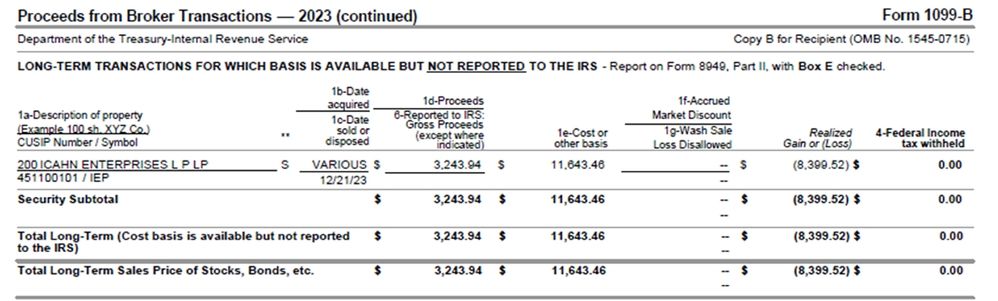

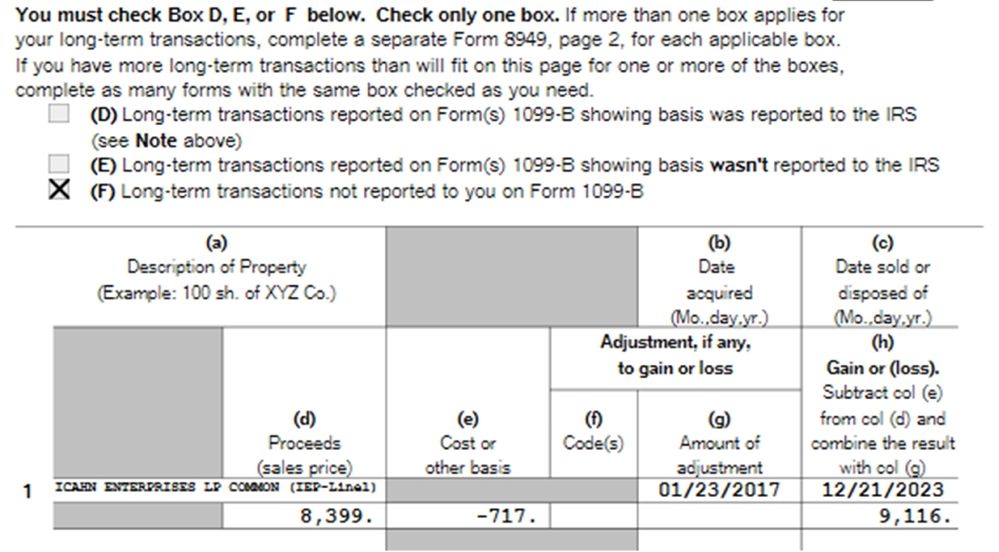

I have owned 200 units of a PTP (IEP) which I purchased in 2017 for $11,643. I sold the entire position in Dec. 2023 for $3,244. The K-1 I received shows that I have a negative basis (the K-1,1099B and Form 8949 are below). I have run the Final Review in Turbotax Desktop and receive this lone error: "You have negative cost or other basis on Form 8949, Sales and Dispositions of Capital Assets" and proclaiming this makes my return "ineligible for E-Filing."

I will never, ever buy another PTP again, but first, I need to get this last step along my trail of agony completed. What have I done wrong here?

K-1

1099B

FORM 8949

April 1, 2024

6:15 PM