- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Converting property from rental to residential

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting property from rental to residential

1. Never set up the property as an asset for depreciation.

2. Never removed the property as an asset.

3. Rent was fair market value at time of first renting (2010) but never changed since then.

TIA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting property from rental to residential

It seems you need to go back to square one and enter your Rental Property.

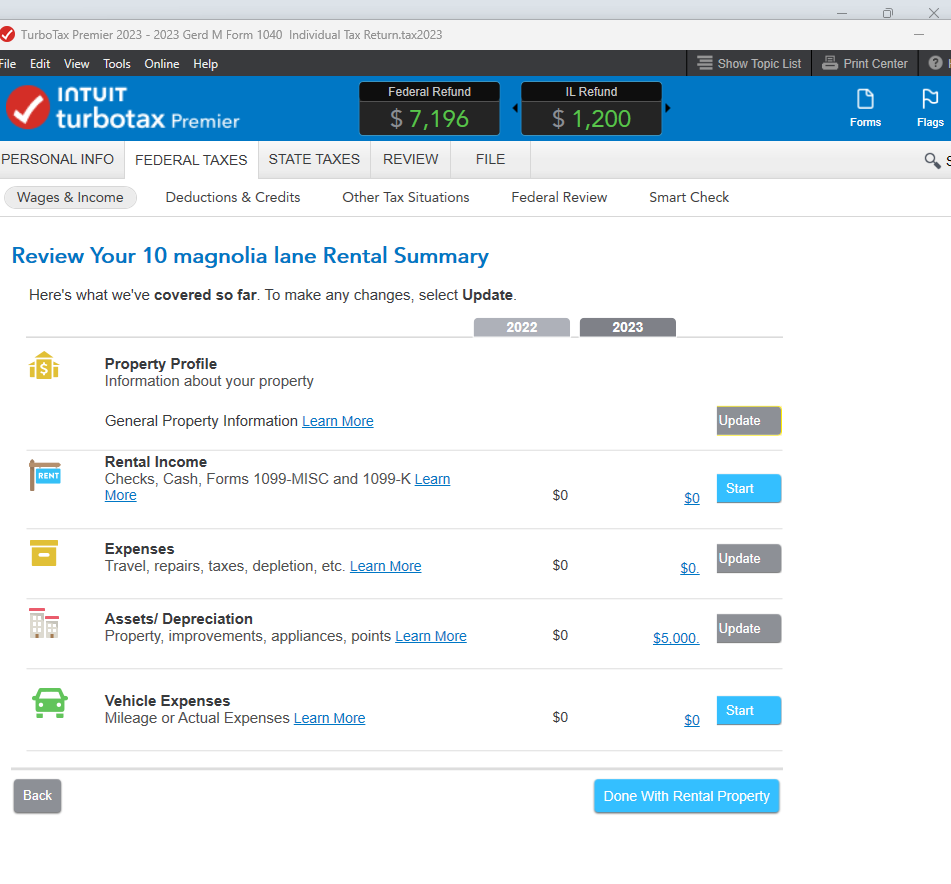

-First section is 'Property Profile', where you can indicate when you started renting it, that you converted it to personal use in 2023, and that you rented below market value (number of days rented in 2023 is number of days of personal use), ownership, etc. There are several screens in this section.

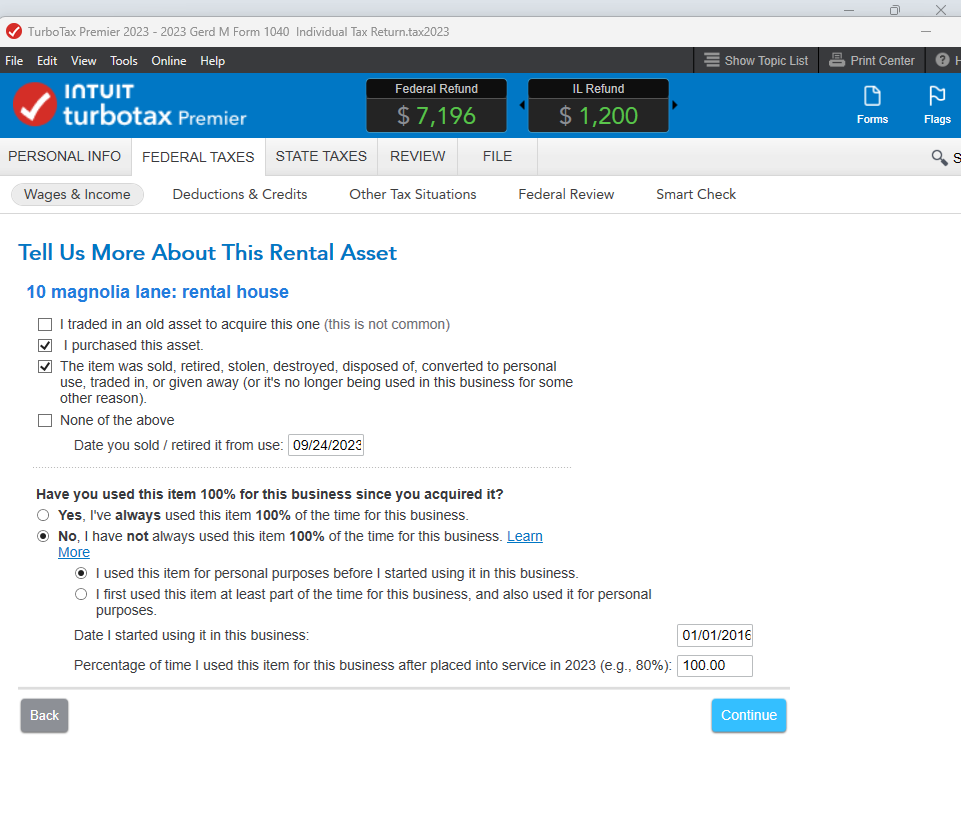

-Back at the Rental Topics page, go down to 'Assets/Depreciation', where you need to enter how much you paid for the house and land, when you purchased it, when you started renting it, and if you used it for personal use before renting. Again, you will indicate you 'converted to personal use' and the date. TurboTax will display an amount on a page for 'prior depreciation' based on the date you started renting, and cost.

-Back at the Rental Topics page, you can enter Rental Income and Expenses for 2023. Your expenses will be limited as you are renting at below market value.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting property from rental to residential

To all the good people who are trying to help me:

To all the people trying to help me,

Using TT Desktop H&B 2023. The problem I seem to be having is that what I am seeing in my TT differs from what folks are telling me I should see.

From the top,

1. Start a new return.

2. Import return data from 2022 TT.

3. Review and confirm imported data from 2022.

4.Next Screen I see is "Let's find some business deductions". Select continue.

5. Next screen select "I'll choose what I work on".

6.Next screen "Rental Real Estate and Royalties". has "Yes" and "No" buttons. Do I leave the "Yes" button checked or do I choose "No"?

7. If I select "No" I eventually get to a screen with a choice to select "I converted this property from rental to personal use in 2023". If I select that any info about the property disappears from TT and I don't know how to proceed from there.

I have never claimed the property as an asset and was never asked by TT if I wanted or needed to. I have never been able to find the "Assets" sections refereed to by the respondents here That's why I'm stuck where I am and cannot see where to go from here. Any help appreciated. TIA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting property from rental to residential

What you describe gets to to the main rental property entry where you have to select the EDIT button to actually "do" anything. Then you have choices:

- Property Profile

- Rental Income

- Expenses

- Assets/Depreciation

- Vehicle Expenses

Select Assets/Depreciation. If you are presented the option to "Go directly to your asset summary", select YES then continue. Otherwise, read the next line below.

If asked if you bought anything less than $2,500, select NO then continue. Otherwise, read the next line below.

If asked if you made improvements in 2023, select NO and continue. Otherwise, read the next line below.

At this point, you "SHOULD" see at an absolute minimum, the property itself listed. If you have more than that, let me know. Is this what you experience? If it's not what you experience, then what "do" you experience? I will also need to know in what tax year you started reporting this property on SCH E. I know you may have mentioned it above. But this thread is so long now, I would rather not have to read through it all for a third time. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting property from rental to residential

To all the good people here trying to help me,

Using TT Desktop H&B 2023. The problem I seem to be having is that what I am seeing in my TT differs from what folks are telling me I should see.

From the top,

1. Start a new return.

2. Import return data from 2022 TT.

3. Review and confirm imported data from 2022.

4.Next Screen I see is "Let's find some business deductions". Select continue.

5. Next screen select "I'll choose what I work on".

6.Next screen "Rental Real Estate and Royalties". has "Yes" and "No" buttons. Do I leave the "Yes" button checked or do I choose "No"?

7. If I select "No" I eventually get to a screen with a choice to select "I converted this property from rental to personal use in 2023". If I select that any info about the property disappears from TT and I don't know how to proceed from there.

I have never claimed the property as an asset and was never asked by TT if I wanted or needed to. I have never been able to find the "Assets" sections refereed to by the respondents here That's why I'm stuck where I am and cannot see where to go from here. Any help appreciated. TIA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting property from rental to residential

The program interview does indeed bring forth the asset entry section when setting up the rental in the system so if you did not notice it and/or cannot find that section now then I highly recommend you upgrade to one of the LIVE options this year to get one on one directions where they can help you screen by screen. OR us a local tax pro who can educate you in this situation.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

eric6688

Level 2

timeflies

Level 1

VJR-M

Level 1

tim191919

New Member