- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

It seems you need to go back to square one and enter your Rental Property.

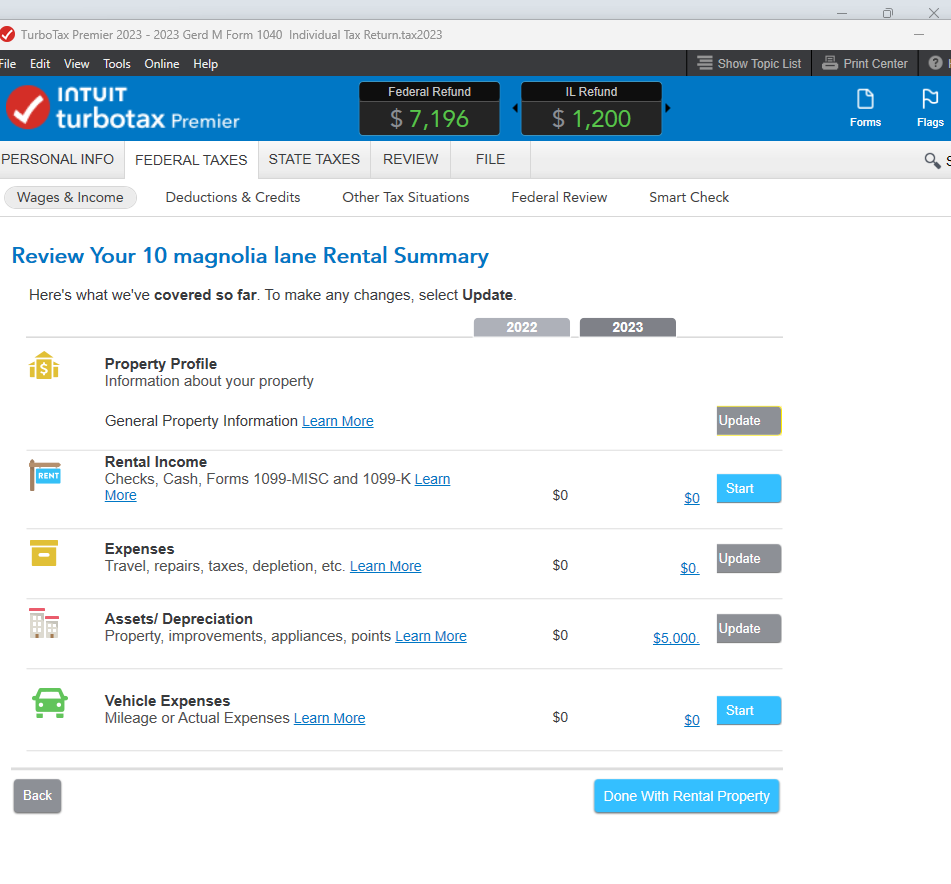

-First section is 'Property Profile', where you can indicate when you started renting it, that you converted it to personal use in 2023, and that you rented below market value (number of days rented in 2023 is number of days of personal use), ownership, etc. There are several screens in this section.

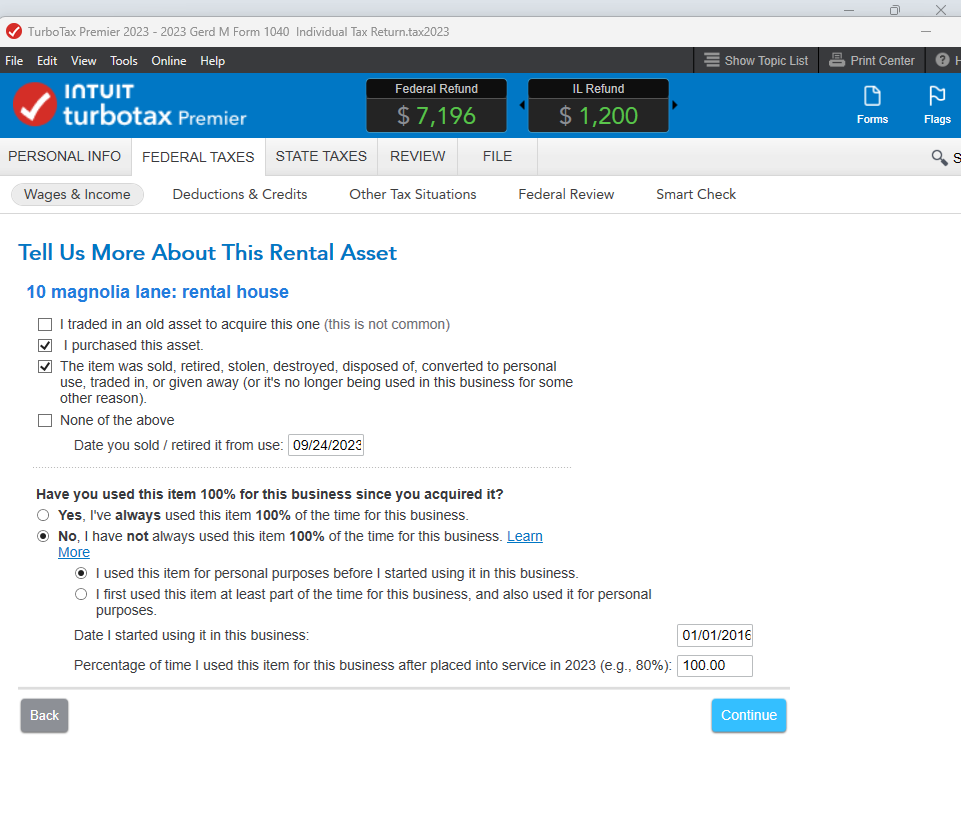

-Back at the Rental Topics page, go down to 'Assets/Depreciation', where you need to enter how much you paid for the house and land, when you purchased it, when you started renting it, and if you used it for personal use before renting. Again, you will indicate you 'converted to personal use' and the date. TurboTax will display an amount on a page for 'prior depreciation' based on the date you started renting, and cost.

-Back at the Rental Topics page, you can enter Rental Income and Expenses for 2023. Your expenses will be limited as you are renting at below market value.

**Mark the post that answers your question by clicking on "Mark as Best Answer"