- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Carryovers for 199A rental property - QBI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Carryovers for 199A rental property - QBI

We use the step-by-step dialogs and don't normally deal with the underlying schedule forms. This year TT is asking us to enter a value directly into schedule E.

We have a single rental property. It had losses in 2018 and 2019, but the allowed losses were zero. TT has prepared the "Carryovers to 2020 Additional Info for Section 199A Deduction" as part of Schedule E. It has entered the disallowed passive operating losses for 2018 and 2019 in the Regular tax column and a value for 2018 in the QBI column which equals their sum. TT is asking us to fill in the value in the QBI column for 2019.

We understand the values in the regular tax column come from the disallowed losses for those years, but do not understand why TT used the 2018 QBI value it entered nor how we should determine the QBI value for 2019. Is this QBI column asking for values from our previous tax returns or something we determine for 2020? If the former, where do we find these values? If the latter how do we determine the values?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Carryovers for 199A rental property - QBI

QBI means Qualified Business Income. As it pertains to rental income, your net income or loss is typically QBI if you materially participated in the rental activity. You can use this link to see if your rental activity qualifies as QBI:

The box in TurboTax that you list here that is highlighted in pink, is asking for your 2019 QBI amount. Since your loss was $2,935, that would be the entry for 2019 QBI, assuming your rental activity qualified as a QBI activity for that year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Carryovers for 199A rental property - QBI

I have the exact same circumstance happening to me. I also have a single home rental and have taken losses in prior years. This is the first time turbo tax has given me an "error" to fill in this exact box. It appears the answer given was to put in the same amount that is showing in the "regular tax" column into the "QBI" column, if it was indeed considered QBI (which is it). Why is TT doing this now?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Carryovers for 199A rental property - QBI

If you know you are not eligible for the qualified business income deduction (QBID), and for a single home rental it would seem ineligible, then make sure the answers to the questions are answered accordingly.

You should be able to put a zero in both columns by overriding the entry. First go through the questions to answer based on your situation.

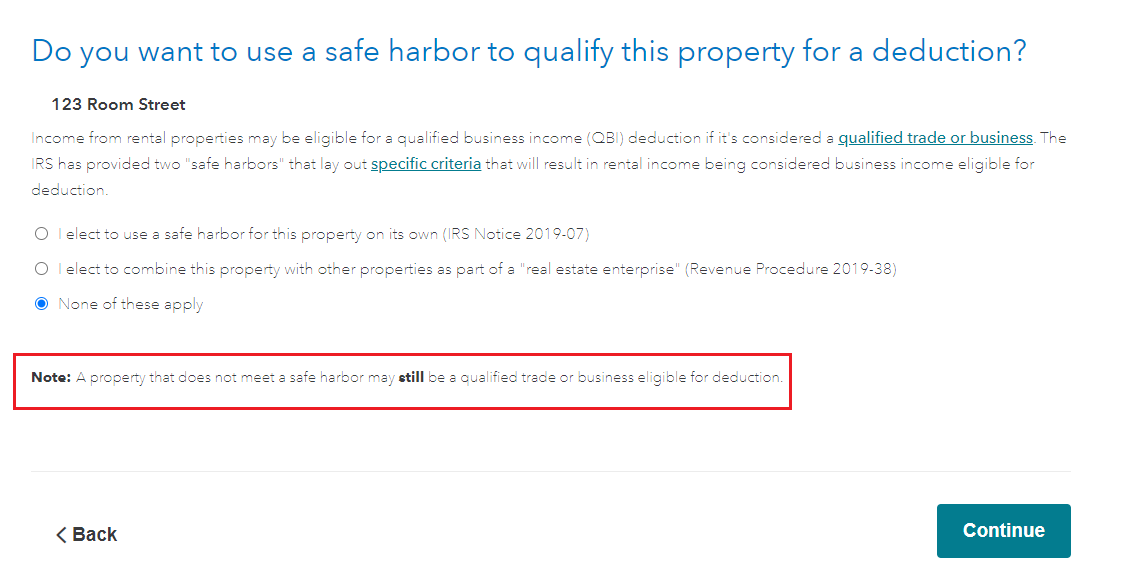

Rental real estate does not always rise to the level necessary for the qualified business income deduction (QBID). The second notice, produced by the IRS, defines more clearly about the safe harbor on page 5 of Revenue Procedure 2019-38 and helps you to understand the required record keeping to qualify for QBID.

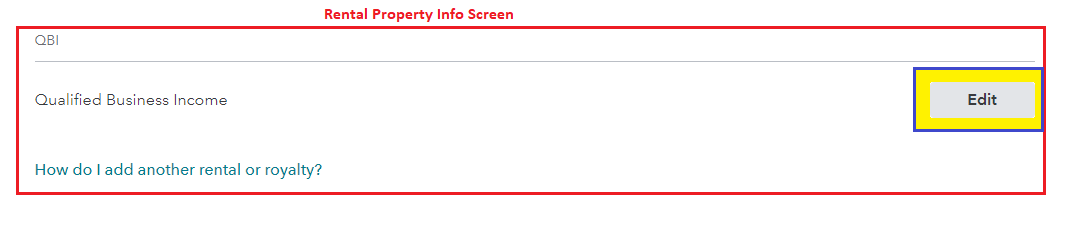

- Select to Edit or Review beside each rental property > Scroll to LESS COMMON SITUATIONS > Select QBI

- You see the aggregation screen if you indicated that your taxable income might exceed certain levels. Otherwise, the "aggregation" screen does not appear. (It's not necessary to aggregate)

- If you do not select either safe harbor methods the next screen will ask you if this is qualified business income. If you select 'No' then TurboTax will do the calculations.

- Be sure to select and read the link "More Info about what's considered a qualified business" before you answer.

- See the images below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

alvin4

New Member