- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

If you know you are not eligible for the qualified business income deduction (QBID), and for a single home rental it would seem ineligible, then make sure the answers to the questions are answered accordingly.

You should be able to put a zero in both columns by overriding the entry. First go through the questions to answer based on your situation.

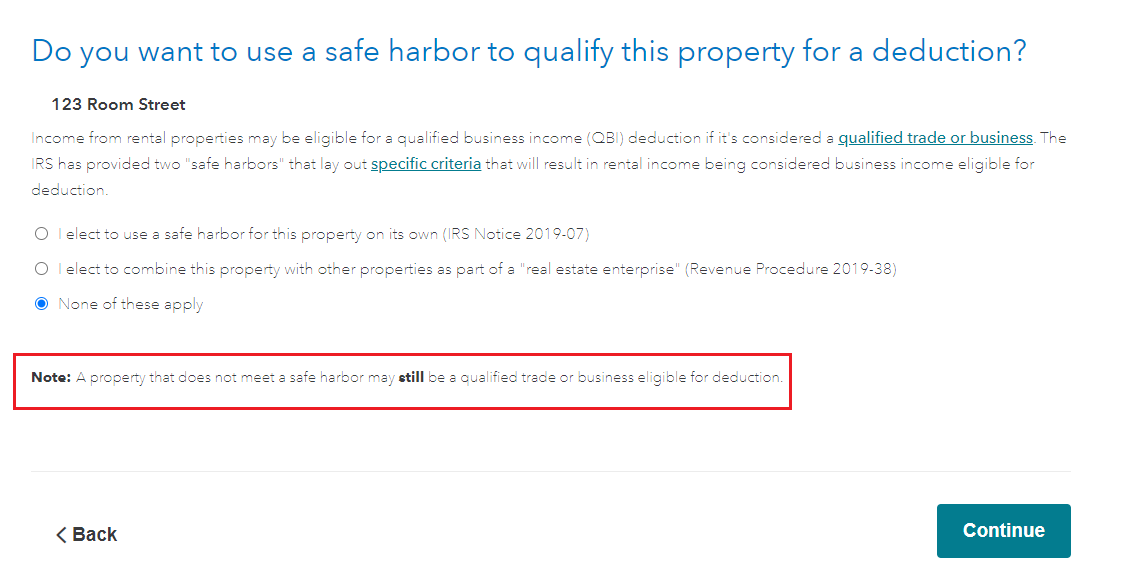

Rental real estate does not always rise to the level necessary for the qualified business income deduction (QBID). The second notice, produced by the IRS, defines more clearly about the safe harbor on page 5 of Revenue Procedure 2019-38 and helps you to understand the required record keeping to qualify for QBID.

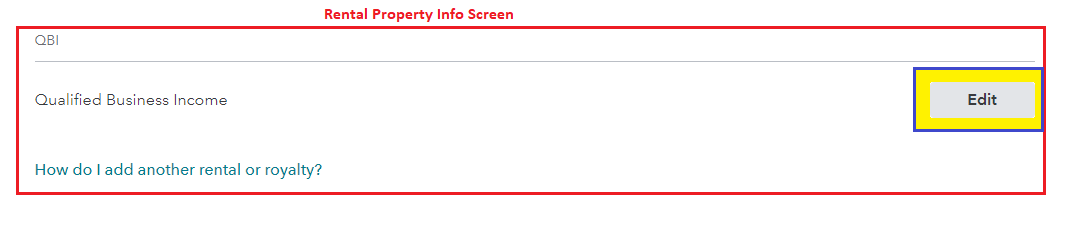

- Select to Edit or Review beside each rental property > Scroll to LESS COMMON SITUATIONS > Select QBI

- You see the aggregation screen if you indicated that your taxable income might exceed certain levels. Otherwise, the "aggregation" screen does not appear. (It's not necessary to aggregate)

- If you do not select either safe harbor methods the next screen will ask you if this is qualified business income. If you select 'No' then TurboTax will do the calculations.

- Be sure to select and read the link "More Info about what's considered a qualified business" before you answer.

- See the images below

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 10, 2021

7:22 AM