in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: As of 1/26/23 on 1099-B, if I have a stock sale with both Cost Basis and an adjusted cost bas...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As of 1/26/23 on 1099-B, if I have a stock sale with both Cost Basis and an adjusted cost basis, the Review page shows $0 Cost Basis. Has anyone else seen this mistake?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As of 1/26/23 on 1099-B, if I have a stock sale with both Cost Basis and an adjusted cost basis, the Review page shows $0 Cost Basis. Has anyone else seen this mistake?

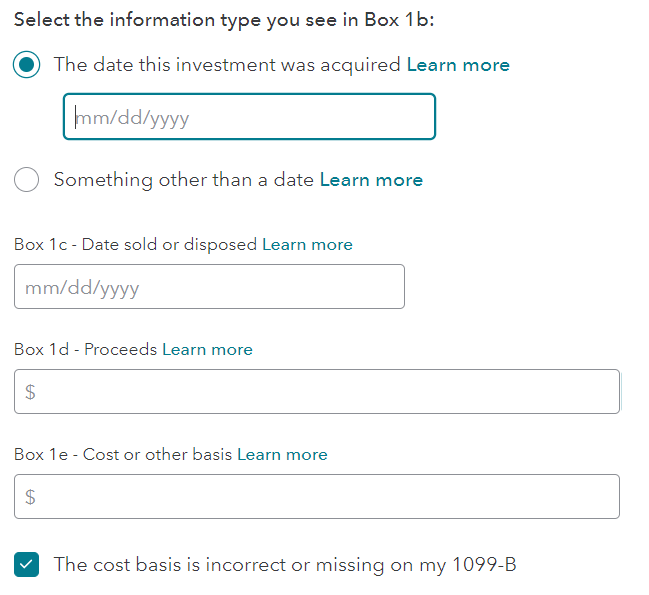

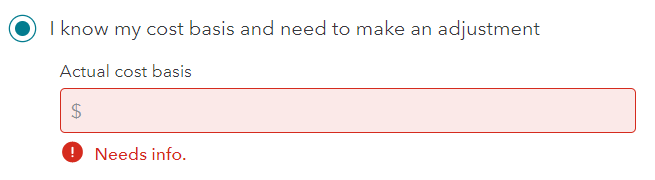

Provided both cost basis and adjusted cost basis are not zero, check first if this is what is shown as a covered transaction, it is being reported to the IRS as such. So if this is a covered transaction you must initially enter the reported basis as shown so as not to contradict the issuer and have the IRS send you a letter requesting information. You can then adjust to what the actual basis is in the follow-up question "I need to adjust the cost basis".

If this is not a covered transaction, simply enter the actual cost basis where called for and fill in the rest of the screen where applicable.

The next page will show the following:

After all entries and corrections are made, be sure to check the summary to make sure the gain or loss displays accurately

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524923356

Level 2

johntheretiree

Level 2

onelovelylavi

New Member

Blue Storm

Returning Member

Jeff-W

Level 1