- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- non income producing property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

I have a rental property which has been rented out since 2015, at the end of September 2019, the last tenant moved out, the property is terribly damaged, so I decided to do a total remodeling and then sell it. I hired a contractor start the remodeling in the middle of Nov 2019, and the remodeling is completed in early December, was put on market for sale before Christmas 2019, and finally sold in February 2020. I spent $18000 in the remodeling cost, now my question is how to report this $18000 on my tax return? Should I add it into 2019 tax return as depreciation, but choose "deduct the whole cost at once" with the section 179? Or can I just put this $18000 into my 2019 rental property expense? My confusion is the cost happens in 2019, but the house is sold in 2020, if I wait until i report 2020 tax return, can I still include this cost as cost basis for selling the property? Please help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

Your remodel is actually property improvements that add to your cost basis of the property. Normally rental property improvements are depreciated over time starting on the date those improvements are placed "in service" as a rental asset. However if your case your property improvements were never placed in service. Therefor they are not depreciated. Yet they still add to your cost basis of the property regardless.

There are a number of ways to report this. But regardless of the way you report it, there is absolutely no need to include these property improvements on your 2019 tax return if you don't want to. However, if you can if you want, and it might be a good idea to do so. Therefore I am recommending that you do. Before I get into how to do that correctly, some explanation concerning depreciation is called for here.

As you know, you are required by federal law to depreciate rental assets. However, by that same law land is not depreciated when utilized in the production of rental real estate income (commercial or residential.) Then in the tax year you sell that property you are required to recapture all depreciation taken on the property and pay taxes on it. Recaptured depreciation is added to your AGI and has the potential to put you in a higher tax bracket. Therefore, if you are not required to depreciate the property, then you definitely don't want to do that.

Residential rental real estate property depreciation starts on the first day that property or property improvement is placed "in service" and becomes available for rent. SInce you made no attempt to rent the property after the last renter moved out in 2019, I highly recommend you convert the entire property and any depreciable assets that existed prior to the last renter moving out, back to personal use. This will stop depreciation on that day. Your date of conversion back to personal use needs to be no sooner than one day *after* the last renter moved out.

First, I will discuss how to convert the property back to personal use. Then I will discuss how to add your property improvements as assets in a way that will increase your cost basis in the property, without depreciating those property improvement assets that were completed after the last renter moved out.

Converting the property to personal use:

Start working through the rental "as if" nothing changed. About the third screen in (the property profile section) is titled "Do any of these situations apply to this property?"

On that screen select "I converted this property from a rental to personal use in 2019"

If you have passive carry over losses from IRS form 8582 on your 2018 (twenty eighteen) tax return, you'll also select the option for "I have passive activity real estate losses carried over from a prior year."

Then continue working it through, and enter your carry over losses if applicable and if you have any. Continue working it through "as if" nothing changed, reporting all rental income and rental expenses. Keep in mind that you can only claim those rental expenses incurred up to the date of conversion to personal use. (no, you're not going to "lose out" on expenses incurred after the renter moved out in Nov 2019. Those are dealt with differently. )

On the screen, "Was this property rented for all of 2019?" select NO.

For "days rented" the day count starts on Jan 1st and ends on the day the last renter moved out.

For "Personal use during the year" the number you enter here is ****ZERO****. The program is asking you for days of personal use *WHILE* *THE* *PROPERTY* *WAS* *CLASSIFIED* *AS* *A* *RENTAL*. What you used it for *after* you converted it to personal use *DOES* *NOT* *COUNT*. Period. End of story.

When you get done with rental income and rental expenses, the next section is "Assets/Depreciation". Start working through that section. Elect to edit/update the assets/depreciation section. If asked if you want to go straight to your asset summary, select YES. Now you have to work through each individual asset one at a time, and do the below for each individual asset listed here. At an absolute minimum, the property itself will be shown in the "Your Property Assets" list.

Elect to edit/update the first asset and begin working it through.

On the screen, "Did you stop using this asset in 2019?" select YES.

For the "date of sale or disposition" the date entered here must be at least one day after the last renter moved out. The date you enter here will be the date depreciation stops on this specific asset. So you want to enter the same date for all assets to keep things consistent. Leave the "date acquired" alone.

On the "Special Handling Required?" screen, select YES. If you select NO then you will be "forced" to enter sales information. Since you did not sell the property in 2019, you can't enter sales information on your 2019 return. So you must select YES on this screen.

The next screen shows you the depreciation on this asset for 2019, and the amount is based on the date you converted it to rental. Click Continue and repeat the above for the next asset, if you have other assets listed.

Once you have completed all the above for all assets listed, click the DONE button.

Now if at any time in any year you claimed any vehicle use for this property, even if less than 100% business use, you "must" work through the vehicle section and show your disposition of this vehicle. More than likely, you will just indicate that it was removed for personal use and be done with it.

This completes converting the property from rental business use, to personal use. Now lets add the property improvements you did after the last renter moved out.

Now back on the "Review.....Summary" screen elect to start/update the Assets/Depreciation section again. If prompted to go straight to your asset summary, select YES and continue. Now you're back on the "Your Property Assets" screen, and everything listed there has already been converted to personal use. Let's add those property improvements now.

Keep in mind that we really aren't "that" concerned with the MACRS asset classification for your property improvements, since they are not being placed in service, and will not be depreciated.

Click the "Add an Asset" button.

Select "Rental Real Estate Property " and continue.

Select "Residential Rental Real Estate" and continue.

Now enter a description for your property improvement. For all improvements that were completed after the last renter moved out, you can just group them all together. It makes your life easier in the long run, and since we're not going to depreciate them anyway, it's not going to matter.

For the cost of these property improvements, this will include not only what you paid for the asset, but also the cost of shipping, delivery, labor for installation, the electric and water bill used by the workmen in their labor process, etc.

Now enter in the "Cost of Land" box the same exact amount you entered in the COST box. What this does is allocate the entire amount entered in the cost box, to the land. Since land is not a depreciable asset, that means that no matter what "in service" date you enter, this asset will not be depreciated. I suggest you enter an in service date of Dec 31, 2019 in the box for "date purchased or acquired". Then continue.

Select "I purchased this asset new" and then for the sole sake of simplicity, select that you used the asset 100% of the time for this business. Then give it a start date of 12/31/2019 and continue.

If offered the "Special Depreciation Allowance" you will note the amount allowed is $0. Select NO and continue.

On the Asset Summary screen you'll see the depreciation amount is $0. If you select show details, you'll see the amount added to your cost basis, and no type of depreciation is taken or allowed. That's exactly what you want. Finish working this through and you're done.

If offered the "safe harbor" option, select "None of these apply" and continue.

Finish working things through to the "Rental and Royalty Summary" screen. Then to save everything and completely exit the SCH E section of the program click the DONE button.

Now you can continue with the rest of your tax return as needed or required. If you have done everything completely and correctly, then this particular property should "NOT" be imported into your 2020 tax return when you start it next year. THerefore, there a three documents that you will need to print a hard copy of, *AFTER* you have completed your return, filed it with the irs *AND* it has been accepted by the IRS.

Once your return has been accepted by the IRS, elect to save a copy of *EVERYTHING* as a PDF file. Not just the forms needed for filing, and not just the forms needed "for your records". You want to save "EVERYTHING" in PDF format so that you can open and print the pages you will need, using either the Edge browser, or the free Adobe Acrobat Reader program.

The documents I'm instructing you to print here will be *REQUIRED* when you report your sale of this property on your 2020 tax return. Without the information provided on these 2019 tax forms, it will be impossible for you to correctly and completely report the sale.

First, you need to print the two IRS Form 4562's for this specific rental property. Both of these 4562's print in landscape format. One is titled "Depreciation and Amortization Report" and the other is titled "Alternative Minimum Tax Depreciation".

The other form you will need is the IRS FOrm 8582. This form will only exist in your 2019 tax return if you have carry over losses that could not be used in 2019. So if the form 8582 does not exist in your PDF copy, that means either you have no carry over losses, or if you had carry over losses from 2018 they were all used up in 2019. This can and does happen. But it's not all that common.

File both 4562's and the 8582 (if applicable) with your 2020 tax data. You will need information off those forms when you report your 2020 sale of the property on your 2020 tax return that you will complete next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

@Carl thanks so much for such a detailed answer, i have followed the steps to put the remodel cost into my 2019 tax return, and it does show as cost basis as you mentioned. I have some additional questions:

1. Thanks for pointing out specifically what form is important to keep and file. I always purchase the Turbotax software each year, and start with importing last year's return. And I always use e-file for both Federal and State return. Is my understanding correct that if I use e-file option, Turbotax will take care of including all needed forms to submit to IRS for my 2020 return? I will definitely save a PDF copy of all the forms for my return as well.

2. As the $18000 remodeling cost has been added in my 2019 return as cost-basis, so in 2020 return, this cost basis will be offset the capital gains I have when I sell the property, correct? Also is the closing cost I paid when selling the property can also be used to offset the capital gain as well? Well, I am trying to offset the gains as much as I can so I don't have to pay too much capital gain tax in 2020.

3. You mentioned that the depreciation recapture will be added to my AGI, I have followed your advice to convert the property back to personal use on 10/1/2019, and I do see the property's its own depreciation reduced around 1K. So is there any other ways I can do to make less recaptured depreciation being added to my 2020 AGI?

Thanks again for your time and it's really helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

1. Turbotax will take care of including all needed forms to submit to IRS for my 2020 return?

Yes. But the only forms actually submitted to the IRS (in electronic format of course) are those forms required for filing. The 4562's I informed you that you need to print, are not forms required for filing. But *you* *personally* will need to refer to them later when you report this sale on your 2020 tax return next year.

2. As the $18000 remodeling cost has been added in my 2019 return as cost-basis, so in 2020 return, this cost basis will be offset the capital gains I have when I sell the property, correct?

Yes, if you report it correctly of course. There are two possible ways to report this sale in TurboTax next year, and we'll use whatever you deem easiest/simplest for you. Regardless of which reporting process is used, the end result will be exactly the same.

Also is the closing cost I paid when selling the property can also be used to offset the capital gain as well?

You're referring to closing costs. The program deals with those just fine. But it's up to you to keep a detailed list of your closing costs. Thats because some of those costs add to the basis, while other costs are just a straight up deduction.

Basically, costs associated with acquisition/deacquisition of the property are added to the cost basis. As the seller, you probably won't have any of these costs since it's the buyer that gets to claim them (regardless of who pays them). Costs associated with the loan (for you as the seller) will be a flat out deduction. You may have a few of those associated with the final payoff of the mortgage you had on the property prior to the sale.

Well, I am trying to offset the gains as much as I can so I don't have to pay too much capital gain tax in 2020.

For you as the seller, you're just not gonna have that much. One thing I would recommend you do "right now at this very instant in time" is that if you sold at a gain, go ahead and send the IRS a flat 20% of what you estimate that taxable gain is. You can do that at www.irs.gov/payments. Remember to print your receipt so you can include it as "taxes already paid" on your 2020 tax return.

If your state also taxes personal income, then send your state a percentage of whatever your "normal" tax rate is for your state. I would expect that to be anywhere from 5% to no more than 8%.

Now don't worry yourself to much about those payments. It's highly likely that when you file your 2020 federal and state taxes next year you will have over paid and will get a refund. But that's more preferable than being assessed and underpayment penalty and interest for under paying.

3. You mentioned that the depreciation recapture will be added to my AGI, I have followed your advice to convert the property back to personal use on 10/1/2019, and I do see the property's its own depreciation reduced around 1K. So is there any other ways I can do to make less recaptured depreciation being added to my 2020 AGI?

Nope. The IRS will get their money one way or another, sooner or later. For us rental property owners it's set up to make sure they get it later, so that they get more by hopefully bumping us into a higher tax bracket with the recaptured depreciation. It sucks, but it is what it is.

One thing is for that property improvement you entered for $18K, I assume you gave it an in service date of 12/31/2019. This ensures all the SCH E data will be imported into the 2020 return. So on your 2020 return you "sorta" don't need to concern yourself with converting it back to personal use. Remember, you entered the cost of your property improvement in both the "cost" and "cost of land" box so that it won't be depreciated.

On the 2020 return you'll have the choice to covert that asset to personal use on 1/1/2020. But then you'll have to report the sale in the "Sale of Business Property" section. As it stands now, it looks like that's going to be the best way to report it, unless there are any major programming changes to the program. So this is the primary reason why you will need those forms I recommended you print out.

By the way, does your 2019 return have the IRS Form 8582 showing your passive carry over losses? Just curious at this point because it's more common than not for rental property to have carry overs every year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

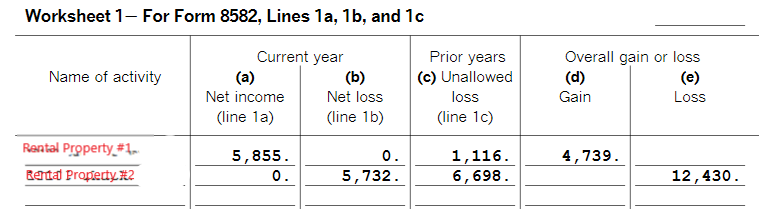

@Carl thx again for all the detailed answer. While you brought up the question of carry-over loss, I do have questions on that part. I will try to see whether I can describe clearly :). I have 2 rental properties, one is normally at profit, the other one is always at loss in the recent 3 years (thanks to my HOC tenant). So in the last 3 years, I always have carry-over loss (my joint income is too high to deduct the loss, TurboTax always shows I can deduct 0 every year), then in the next year, I put in the non-deducted loss in the carry-over part. This is the 8582 form in my 2019 tax return:

So my understanding is I will have a carry-over loss of (12430-4739) =7691 to carry to my 2020 tax return, and this amount can offset my capital gains from selling the #2 property above, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

Understand the 8582 shows you the aggregate loss. In other words, the fact you had a gain on one rental and a loss on the other doesn't matter. What matters if if you show a gain or loss on all rentals combined (aggregated.)

Now I myself am in a rather unique situation, having paid off one rental property, completed depreciated another and converted a 3rd one back to personal use. I "used up" all my losses years ago and the aggregate of my remaining two rentals shows a taxable gain every year now. So I've not had an 8582 generated for I don't know how many years now.

Based on this, I'm not sure that what I'm saying below is 100% correct.

You can't realize your losses against other non-passive income until the tax year you sell the last rental property. I *think* your AGI plays into this too. Additionally, after selling that last rental you may be limited to a maximum of $3000 of losses a year against other ordinary income, until all of those losses are used up.

Hopefully someone with more knowledge and details on this can jump in to educate you better, and refresh my memory on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

@Carl , Hi Carl, I do come up with another question on the same rental property which I have been mentioning in this thread early (the one got sold in 2020). So since the year I have purchased it, I have been paying $450 each year as the "Front Foot Benefit Charge" to the water company, I did not include this cost into my annual expense (i simply just forgot it), so my question is: 1. can this FFBC charge to be included in my annual rental property expense? 2. If not, now I have sold my property, can I add the total amounts I have been paying all these years into the cost basis just like how I add the remodeling fee so it could lower my capital gain?

Looking forward to your help! TIA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

I have been paying $450 each year as the "Front Foot Benefit Charge" to the water company,

That's a simple rental expense that would be reported as a "utilities" cost. You can only claim it in the tax year you actually paid it. You can't add it to your cost basis in any way, shape, form or fashion because weather you paid it or not makes absolutely no difference in the value of the property. You also can't claim prior years paid all in one single tax year.

You'd have to amend your prior year's returns to claim what you paid each year. But you can only amend the current tax fileing year (2019 as of now) and three years back. Amending more than 3 years back for this will make no difference to your tax liability in your favor.

If amending more than three years back results in you owing the IRS more taxes, then you are required to pay it. But if amending more than 3 years back will result in additional refund for you, then you will *NOT* receive it. The IRS has a 3 year statute of limitations on refunds.

If you paid the 2019 bill in 2019, then you can claim that as a rental expense on your 2019 return. But you can't claim any expenses paid in any other year on your 2019 return.

Personally, since long term residential rental property most commonly operates at a loss "on paper" at tax filing time, I wouldn't bother with amending. Since you can only amend back to 2016 (and amending for the 2019 tax year expires on July 15, 2020) it's way to much of a PITA for the piddly amount of money involved.

Remember, an amended return can not be e-filed. The IRS says so. You have to print, sign and mail it to the IRS.

Additionally, after amending yor 2016 tax return, when you go to amend the 2017 tax return you flat out can not import your changes from the carry over loss that changed on the 2016 return. You'll have to correct the carry over loss manually on the 2017 return. Same would hold true for the 2018 return.

Now you could import from your amended 2018 return *IF* you haven't started your 2019 return yet. But that too can pose it's own separate PITA.

If you completed one or more of the prior year's returns using the online version, amending it is a real PITA because you have to obtain and install the CD version of the program for that specific year. Then after installing it on your computer you have to download the .tax20nn data file to your computer and then use the CD version to open and amend it. It's a real pain. For less than a $500 per year expense that's less than $1500 for 2016-2018 and it "might" make a grand total $10 difference in your final tax liability on any gains realized from the sale. Just not worth the effort that risks human error on your part resulting in back taxes, fines, penalties and late fees later down the road. You can double that cost if your state taxes personal income too.

Overall, I suggest you leave well enough alone and simple claim the amount you paid in 2019, on the 2019 tax return and just press on with life.

Things like this I like to refer to as a "stupid tax". We all pay our share of stupid tax, and usually more than once. I've paid my share, and have no doubt I will pay more stupid tax in the future. But so long as we don't pay it for the same thing twice, it's a learning experience. So for you, since the amount involved for each tax year is so minuscule in comparison to the overall bigger picture, you may just want to leave it as a lesson learned in the school of hard knocks, and press on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

thanks, Carl, will follow your advice, lessons learned, will move on without doing any amendment in previous years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

@Carl If you don't mind I bother you again with one additional questions. So as you told me previously, I convert this rental property to personal use on 10/1/2019 (my tenant moved out on 9/30/2019), so the original property depreciation stopped on 10/1/2019. I also follow your instruction to add the home renovation cost as an asset, and put in 12/31/2019 as the start using date. The house was sold on 2/21/2020(closing date), my question is next year, when I file the tax return for 2020, I am going to say this rental property has been sold, since it was vacant since 10/1/2019 until 2/21/2020, will I still be able to report all the expenses(utility, tax, mortgage interest etc) ? Or converting a rental property back to personal use will make all these impossible because it's not rental property any more? thx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

I'm going to point some things out a didn't make you aware of before, and in the process it will answer your additional questions. I failed to make you aware of my reasoning for having you do things the way I suggested. So in explaining my reasoning, it will answer your questions.

so the original property depreciation stopped on 10/1/2019.

Right. Any expenses incurred after that date are "NOT" deductible as a rental expense. Key wrods here - "AS A RENTAL EXPENSE".

So if you are keeping the utilities on after 10/1/2019 (electric, water, etc.) the bill you recieve "after" 10/1/2019 is not a rental expense and can not be claimed as such on the SCH E. However, with the property sold in 2020 it's what's called a "carrying cost". I.e.; your costs of maintaining the property in a salable condition after the last renter moved out, and it was converted to personal use. I really don't want to go into "carrying costs" right now, because these costs will not be dealt with until you file your 2020 tax return next year. Note that it *does* *not* *matter* that some of your carrying costs were incurred in a prior tax year either. You'll still claim/report them on the 2020 tax return as "a part of" your sales expenses.

I also follow your instruction to add the home renovation cost as an asset, and put in 12/31/2019 as the start using date.

Great. What that does is "guarantee" the property will be imported on SCH E when you start your 2020 tax return next year. We want this to happen because it's less work on the brain for you to report this sale in the SCH E section of the program, instead of in the "Sale of Business Property" section. When you start your 2020 taxes next year using TurboTax 2020, as far as the software is concerned, you still have an "in service" and active asset on that rental property. So that will "force" the program to import it. After you import it to the 2020 program, you'll show all remaining active "in service" assets as converted to personal use on 1/1/2020. Most likely because it was in service for basically 1-2 days, no depreciation will be taken. But if there is, it's only going to be a few bucks and it will make absolutely no difference to your 2020 tax liability. Not a penny. (Unless of course, it's a multi-million dollar asset or something like that of astronomical cost)

Then you'll go through the process of reporting this sale in the SCH E section on your 2020 taxes, in the SCH E section of the 2020 program.

when I file the tax return for 2020, I am going to say this rental property has been sold, since it was vacant since 10/1/2019 until 2/21/2020,

That's exactly what you're going to do.

will I still be able to report all the expenses(utility, tax, mortgage interest etc) ?

Expenses incurred and paid between 10/1/2019 and 2/21/2020 will not be claimed or reported as rental expenses - because they're not rental expenses. They will be claimed as carrying costs and included as a part of your sales expenses.

Now technically speaking, the mortgage interest and property taxes are going to be pro-rated on the 2019 tax return and split between the SCH E for the period 1/1/2019 to 10/1/2019 when the property was a rental, and 10/2/2019 thru 12/31/2019 on the SCH A for the period of time it was personal use. So those items on the SCH A of the 2019 return can not be claimed as any type of sales expeneses or carrying costs.

But if you'll take a look at your closing statement on the sale (Form HUD-1 by any chance?) you'll see where you paid a prorated portion of the property taxes for the period of time you owned it in 2020 before the closing date. That amount is added to your cost basis in the property, thus reducing your taxable gain. Whereas the interest you may have paid on the mortgage in 2020 is a sales expense that gets included in your total sales expenses, and gets deducted from any gain you realized on the sale. So if you get a 1098 from your old mortgage holder next year for interest paid in 2020, you will "NOT" enter it as a SCH A deduction. If you do, then you can't claim it as a deductible sales expense. That would be double-dipping.

Whew! I know the above is a lot. But after taking your time and reading it through a few times (which I'm sure is necessary to absorb it all) does it make sense now?

Overall, I would highly recommend you bookmark this thread. That way if you have questions on reporting this sale on your 2020 tax return next year, you can just reference this thread so you don't have to waste time going through the back story. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

I need to list property bought in 2019 but will not be producing income until after renovations are completed in 2020? Do I list all of these expenses into the cost basis? This consists of a house with major renovations and an adjacent lot that had to be cleared .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

I have very similar situation as @xzll, except the lease ended 6/30/2019 with tenants moved out 3rd week of June. The property was left beat and gross so we planned to take 2 months to gut it. In August, I posted the property for rent on Zillow. I got nervous to get the right people in there that would take care of the place (after I sank 40K in renovation) so we listed the property for sale in early September with a realtor. The market went really cool and so I listed it for rent simultaneously. In the end, we sold it to Zillow and chose a closing date just after the new year of 2020. Basically the property was never occupied or put in use in the second half of 2019.

My question is, can I still do what @Carl suggested to avoid the recaptured depreciation in TY2020? Or must I file away the 40K of renovation as capital improvement for 2019? If the later, would I be able to add most of that 40K investment back as cost basis to offset the capital gain realized at time of sales of the property in Jan 2020? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

I myself would not bother converting the property to personal use on the 2019 tax return. I would leave it as a rental since the "intent" was to rent it out by the end of year. I also would "NOT" add the $40K of property improvements to the 2019 return. I would instead wait and add them to the 2020 return. Here's a gist of how I would do it on the 2020 return next year.

- Convert the property and all listed assets (before adding the $40K of improvements) to personal use on Jan 1, 2020

- Add the $40K of property improvements with an "in service" date of the closing date of the sale and a business use percentage of 1% (yes, one percent business use). If any depreciation is taken, it will be negligible.

After working through the rental section for that particular rental in it's entirety and doing the above, I would then work through it a 2nd time to report the sale using my "reporting the sale of rental property" guidance.

On the 2nd work through to report the sale, that would mean in the property profile section you would at a minimum, have both "I converted to personal use" *AND* "I sold or otherwise disposed of this property" selected.

If you convert it to personal use on your 2019 return just to stop depreciation (which you can if you want) then it will complicate things for reporting the sale on the 2020 return. Don't get me wrong, as it's perfectly doable. But it will require more work and more manual math on your part.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Remodeled and sold in 2020

@Carl , thank you for your great advise! I didn't know I can hold off reporting this $40K investment to improve the property since all the expenses were paid in TY2019. Your instruction is very clear and thank you for taking the time to explain.

Since I do all the bookkeeping and taxes myself, I am definitely looking for simplest and manageable way, yet financial and tax-compliant sound tactic, to account for this $40K improvement cost.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sy1phidscribb1es

Level 1

rosasanc8

New Member

tshorty

Level 1

gdama001

Level 1

dr-huameng

New Member