- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

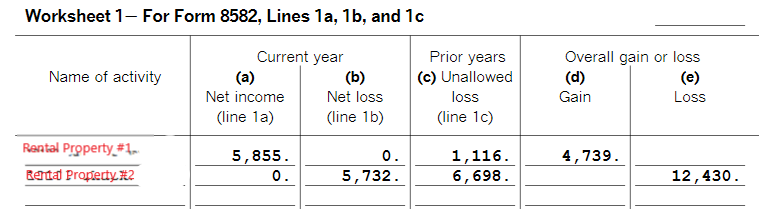

@Carl thx again for all the detailed answer. While you brought up the question of carry-over loss, I do have questions on that part. I will try to see whether I can describe clearly :). I have 2 rental properties, one is normally at profit, the other one is always at loss in the recent 3 years (thanks to my HOC tenant). So in the last 3 years, I always have carry-over loss (my joint income is too high to deduct the loss, TurboTax always shows I can deduct 0 every year), then in the next year, I put in the non-deducted loss in the carry-over part. This is the 8582 form in my 2019 tax return:

So my understanding is I will have a carry-over loss of (12430-4739) =7691 to carry to my 2020 tax return, and this amount can offset my capital gains from selling the #2 property above, correct?