- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- No Option for 39-year depreciation on Airbnb income???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No Option for 39-year depreciation on Airbnb income???

We rent a property on airbnb and average less than 7-day stays, but it's rented out about half the year.

After reading several CPA blogs on Airbnb income from transient rentals , I understand the following:

- this is still passive schedule E income, even though the rentals are "transient," because we are not providing substantial services. (Some less knowledge bloggers seem to think that transient automatically means schedule C active income.).

- however, because of the transient nature of our rentals (less than 7 day average stay), the property does not qualify for 27.5 depreciation but instead must be depreciated over 39 years.

The problem is that turbotax is not asking for the average length of stay and is not giving the option for 39 year depreciation anywhere.

Is there a place to enter the average length of stay or a way to get 39 year depreciation???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No Option for 39-year depreciation on Airbnb income???

1. No. You can have a rental property that is a commercial building, as required for transient renters.

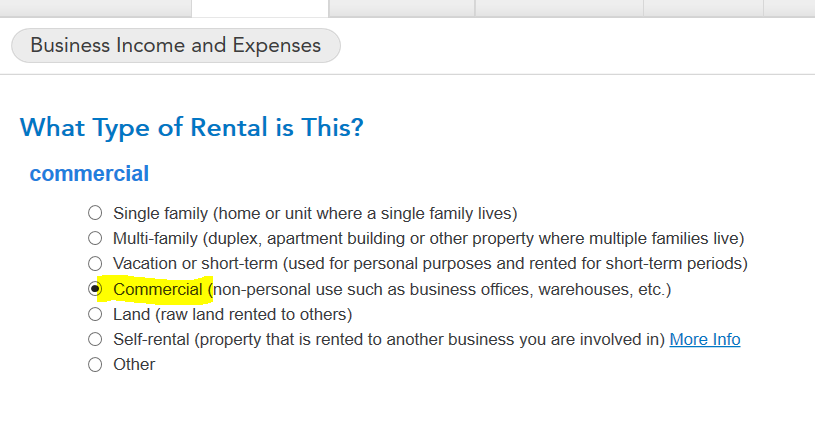

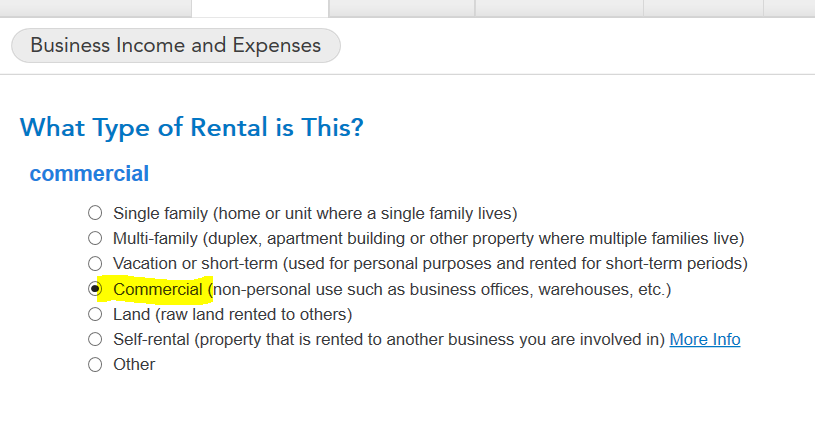

2. You need to return to your property profile and select commercial rather than rental when asked What Type of Rental is This?

3. The program does not ask about units and percentages. The transient requirement includes a unit in a hotel, motel, inn, or other establishment where more than half of the units are used on a transient basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No Option for 39-year depreciation on Airbnb income???

when you entered the type of property for depreciation purposes you probably selected residential rental. you must select commercial and then the 39-year life will be used.

Residential properties depreciate over 27.5 years, while non-residential properties depreciate over 39 years. If the short-term rental only averages 30 days or less as an average rent period, it would classify as transient. It is therefore classified as a commercial property and depreciates over 39 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No Option for 39-year depreciation on Airbnb income???

Thanks! Will selecting residential automatically put me into schedule C?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No Option for 39-year depreciation on Airbnb income???

Sorry I meant will selecting commercial automatically put me into schedule C?

And i do not believe i had a choice between residential and commercial anyways. I just answered questions concerning our amount of activity in running the rental property honestly, and I believe the system automatically slotted me in residential 27.5 years based on my answers. I am surprised there is no question about average length of stay??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No Option for 39-year depreciation on Airbnb income???

1. No. You can have a rental property that is a commercial building, as required for transient renters.

2. You need to return to your property profile and select commercial rather than rental when asked What Type of Rental is This?

3. The program does not ask about units and percentages. The transient requirement includes a unit in a hotel, motel, inn, or other establishment where more than half of the units are used on a transient basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524531726

Level 1

SB2013

Level 2

tucow

Returning Member

AndrewA87

Level 4

Vidyaprakash54

New Member