- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

You'll enter it in the "Investment Income" section of the Wages and Income under federal taxes. The first option in investment income is the 1099-B form. Click start next to that and then enter the information from your 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

well your 1099 probably lists a dozen or more individual transactions. I just set up my spreadsheet, figured out all the details and then added the basis information to the transactions that were auto-uploaded to Turbotax. If you aren’t using that automatically download feature, it would be easier to simply figure the totals, declare the basis and sales price of the underlying bitcoin sold (profit or loss) and declare that on your takes where you put individual stock/asset transactions for gains/losses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

If there were NO sales during the 2022 year - can I simply multiply the "Expenses per Share" by the number of shares held. For GBTC the total expenses per share for the year (2022) is 0.51424999. Can I multiply that number by the number of shares held. ie.. 0.51424999*100?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

If you initially purchased your GBTC more than a year before the first sale (so like prior to Jan 2021) then you can be assured that all of the BTC sales were long term. In that case, it is easy, just do that multiple as you said. My 1099 actually has TD Ameritrade listing each and every individual sale, so I need to make that wash, but if you are putting it in by hand, you could probably get away with the total for the year that was so long as all of the BTC sales were long term capital gains/losses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

I'm also struggling with a lack of "cost basis factor" on my 1099. I'm trying to use the framework of Wealthfront's calculator from last year (since they aren't putting one out this year), but the Wealthfront 1099 does not provide a "cost basis factor" and I have been unable to figure out how they got those values last year when comparing the 2021 Grayscale tax document to the 2021 Wealthfront calculator. And I have many sales to address for 2022 since I mostly got out of GBTC in 2022 due to last year's tax headache!!

Is there a formula I am missing to determine what the "cost basis factor" is for each bolded line on the Grayscale 2022 gross proceeds file?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

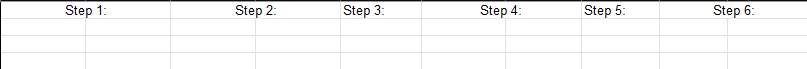

I would create a table with the six steps as outlined in the Grayscale Tax Letter (corresponding to the Asset and Year (ie. GBTC, ETHE etc) .. then follow each step carefully. It is tedious but I was able to follow along with the help of an organized spreadsheet. I used their example as a guide.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

Since the investment expenses should be added on to the basis of GBTC and ETHE when dispose the assets, I would take these them when I actually sell them. In the meantime, to simplify the accounting of it, I would input the cost basis as the proceeds and recognize no gain or loss in the year I receive the Form 1099 B for these investment expenses. Any downside of treating this way? Feedback welcome. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

This year Turbo tax is asking me to enter information on the "Your info should match your 1099‑B exactly. You can add any situations next." screen what do I do here. These are fund expenses here not me selling stock. I believe we note them on form 1040D line 13. Looking for advice on wat to do here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

If this is something like GBTC, it is a true sale. Grayscale sells the underlying asset (bitcoin) to pay expenses. The IRS expects you to track those sales, declare the gain or loss, pay long/short-term capital gains taxes if a gain, and then reduce your basis accordingly. It is WAY complicated. If you are referring to some other "stock" that does this sort of thing, I am sure it is the same. If it is GBTC, you can go to the Grayscale website and download the 2023 tax letter, which explains it and how to do it. I manage a spreadsheet, and it is worse since I bought several lots of GBTC at different times...

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sam992116

Level 4

abarmot

Level 1

Micky2025

Returning Member

zenmster

Level 3

user17558084446

New Member