- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- MM macrs depreciation on rental real estate purchased in 2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MM macrs depreciation on rental real estate purchased in 2021

I need to use mm depreciation, but this option is not available even though it is described thru the help button. The calculation will only work for mid year or mid quarter. How do I get turbotax to depreciation with the mid month convention?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MM macrs depreciation on rental real estate purchased in 2021

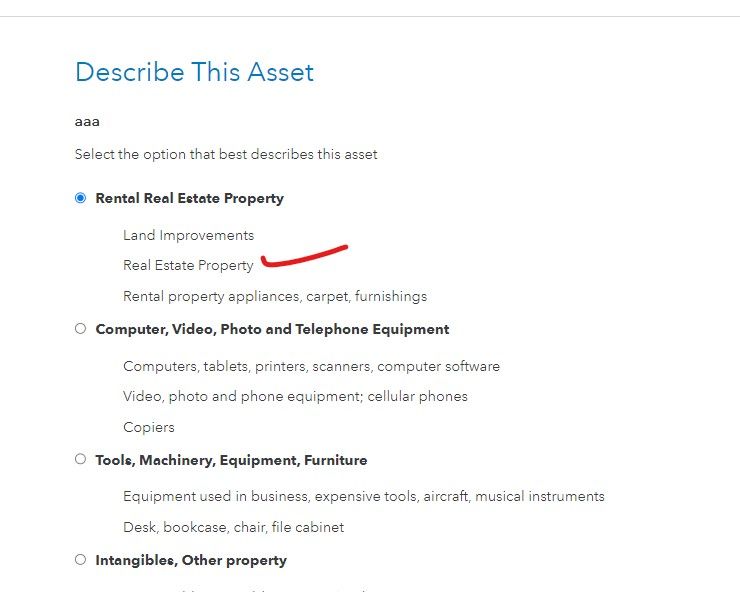

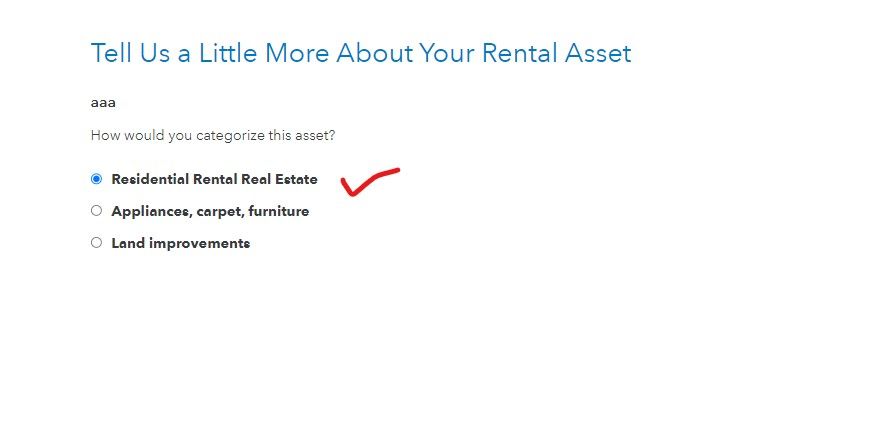

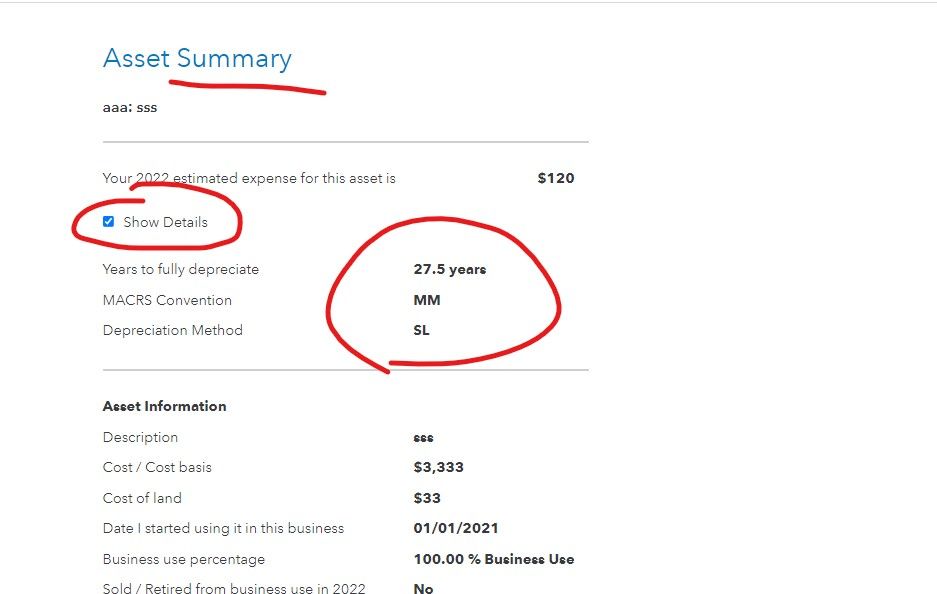

You will need to work thru the asset entry section correctly if you need to manually enter it if it was not transferred in from the year before. I highly recommend you delete that asset and start over again and make sure to choose the real estate option as this will put you into the 27.5 year MM SL option automatically ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MM macrs depreciation on rental real estate purchased in 2021

You will need to work thru the asset entry section correctly if you need to manually enter it if it was not transferred in from the year before. I highly recommend you delete that asset and start over again and make sure to choose the real estate option as this will put you into the 27.5 year MM SL option automatically ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MM macrs depreciation on rental real estate purchased in 2021

Thank you; will do this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MM macrs depreciation on rental real estate purchased in 2021

When working through the Rental & Royalty Income section for the first time, it's important to pay attention to the small print on every single screen. If entered correctly, the program (not you) will automatically set up residential rental real estate for 27.5 year depreciation.

Even after doing so, make sure you double-check in the Assets/Depreciation section that it is "in fact" entered there correctly. I've seen situations where they enter all the information, and then there's absolutely nothing in the assets/depreciation section.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

s d l

Level 2

kevin167

New Member

atn888

Level 2

taxbadlo

Level 1

justintccasey

New Member