- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Mileage deduction for one car used for multiple rentals question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

I have been confused about how I should use turbotax to handle mileage deduction for one car used for multiple rentals.

For example:

the total miles used on the car in 2023 was 1,746 miles

Among them, 61 miles were used for rental property 1, and 241 miles were used for rental property 2.

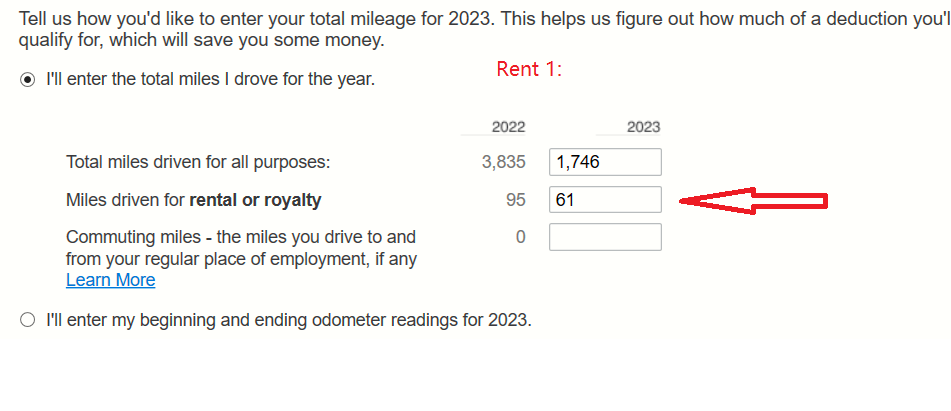

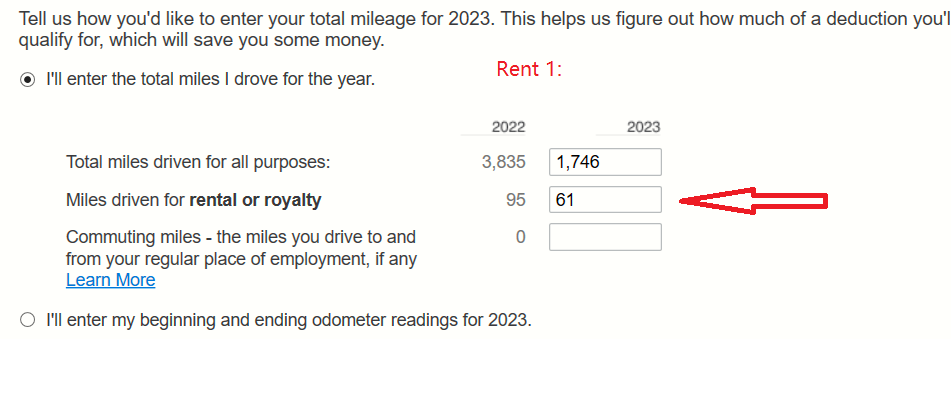

In the rental 1 interview, I entered 1,746 for 'Total miles driven for all purpose', and 61 for 'miles driven for rental or royalty'

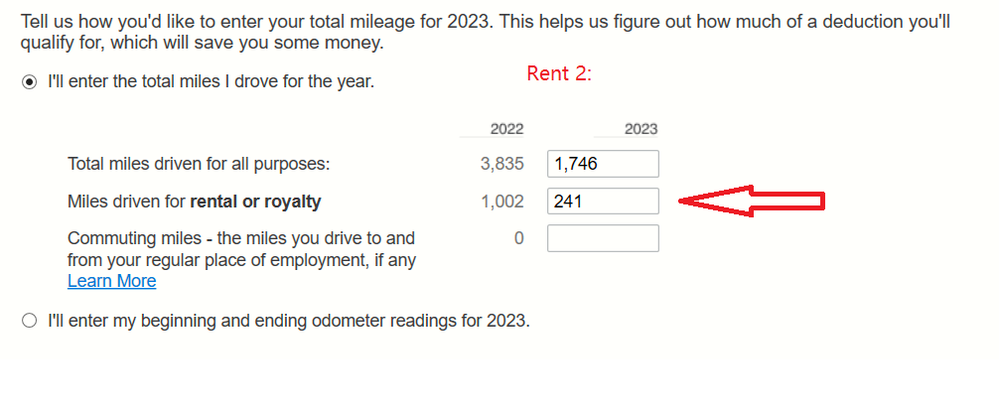

In the rental 2 interview, I entered 1,746 for 'Total miles driven for all purpose', and 241 for 'miles driven for rental and royalty'

Thus Turbotax calculated 3.49% (61/1746) business use for rent 1, and 13.8% business use for rent 2, but this is wrong, right? Because 1,746 miles include two business uses ( 61 and 241).

In this case, how should I handle it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

No, it is not wrong. The miles for Property 1 was 61/1746 which would be 3.49%. This means 96.51% of your miles driven were NOT driven for Property 1.

The miles for Property 2 would be 241/1746 which is 13.8%. This means 86.2% of your miles driven were NOT used for property 2.

It doesn't matter what the rest of the miles were driven for, it only matters that they weren't driven for that particular property. So basically, if you spent $1,000 on the vehicle for the 1,746 miles that you drove. 3.49% of that or $34.90 would be allocated to property 1 and $138.80 would be allocated to property 2. If you had no other rentals, then the other 82.7% would not be deductible. If the other 82.7% was allocated to property 3, then property 3 would get the $820.70 deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

@Vanessa AThanks for your prompt reply.

I understand basically you mean the business driven fro each rental can be separated, thus I got another question.

Basically, the miles I entered in the interview are reflected on Schedule E.

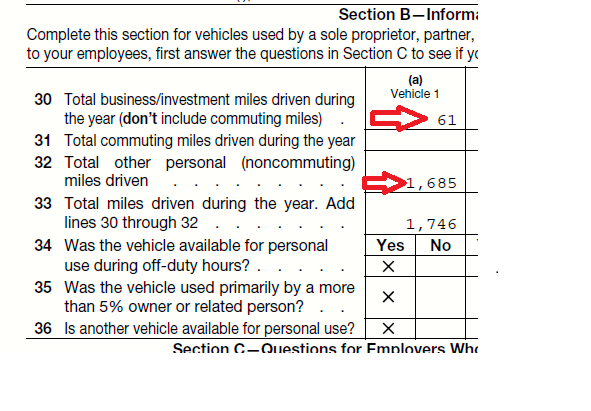

On the Schedule E for the rental property 1:

Total Business miles driven = 61

Total other personal (noncommunting) miles driven = 1,685

Total miles driven during the year = 1,746 (61 + 1,685)

But the thing is Total other personal miles driven should not be 1,685 because it also includes the business miles driven for my rental property 2.

As long as the correct miles are recorded for rental property 1 business use and total miles are recorded correctly, the 'personal' used miles really don't matter, right?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

malvinchip

New Member

ja19584

New Member

ArielA77

New Member

BRB99

New Member

Tax_Lego

Returning Member