- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

I have been confused about how I should use turbotax to handle mileage deduction for one car used for multiple rentals.

For example:

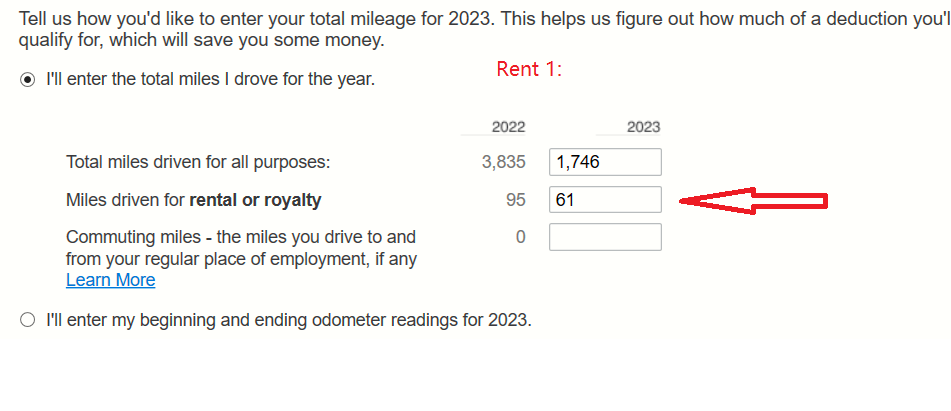

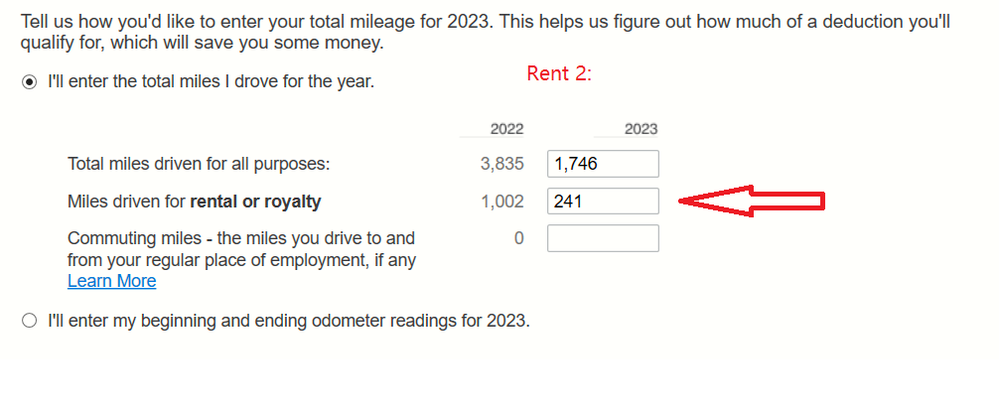

the total miles used on the car in 2023 was 1,746 miles

Among them, 61 miles were used for rental property 1, and 241 miles were used for rental property 2.

In the rental 1 interview, I entered 1,746 for 'Total miles driven for all purpose', and 61 for 'miles driven for rental or royalty'

In the rental 2 interview, I entered 1,746 for 'Total miles driven for all purpose', and 241 for 'miles driven for rental and royalty'

Thus Turbotax calculated 3.49% (61/1746) business use for rent 1, and 13.8% business use for rent 2, but this is wrong, right? Because 1,746 miles include two business uses ( 61 and 241).

In this case, how should I handle it?