- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@Vanessa AThanks for your prompt reply.

I understand basically you mean the business driven fro each rental can be separated, thus I got another question.

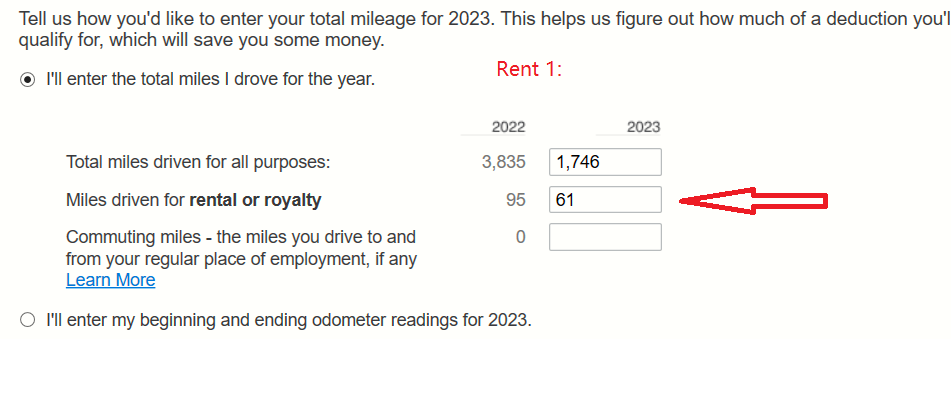

Basically, the miles I entered in the interview are reflected on Schedule E.

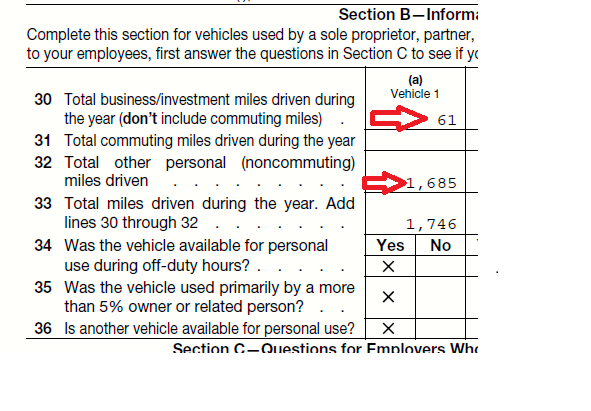

On the Schedule E for the rental property 1:

Total Business miles driven = 61

Total other personal (noncommunting) miles driven = 1,685

Total miles driven during the year = 1,746 (61 + 1,685)

But the thing is Total other personal miles driven should not be 1,685 because it also includes the business miles driven for my rental property 2.

As long as the correct miles are recorded for rental property 1 business use and total miles are recorded correctly, the 'personal' used miles really don't matter, right?

March 4, 2024

10:21 AM