- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

I have losses from a new rental property that I put into service in 2022. I also qualify for material participation. However, TurboTax is not letting me recognize the loss (i'm assuming due to the material participation).

The rental property is held and operated under my personal name and not an LLC, though that's not supposed to affect taxes, depreciation, losses, etc.

Any ideas as to why TurboTax isn't recognizing the loss?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

I should have also specified that this is a short term rental property. For STR, there's another classification in addition to the "Real Estate Professional" status and that is "Material Participation".

One of the qualifications for material participation is "at least 100 hours of participation and more than any other person at the property".

I qualify on that criteria. I'm just figuring out how to get TurboTax to recognize that so I can recognize the loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

it's the rules for passive activity losses. unless it's reportable on schedule C because significant services are provided, then by definition (tax law definition) the income/loss is passive. passive losses are subject to limitations. see form 8582.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

Hi @Rich_FL,

I am also trying to find out how to do this for my short term rental. Were you able to get any other answers?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

****EDIT**** - DO NOT DO WHAT I SUGGESTED IN THIS POST*****

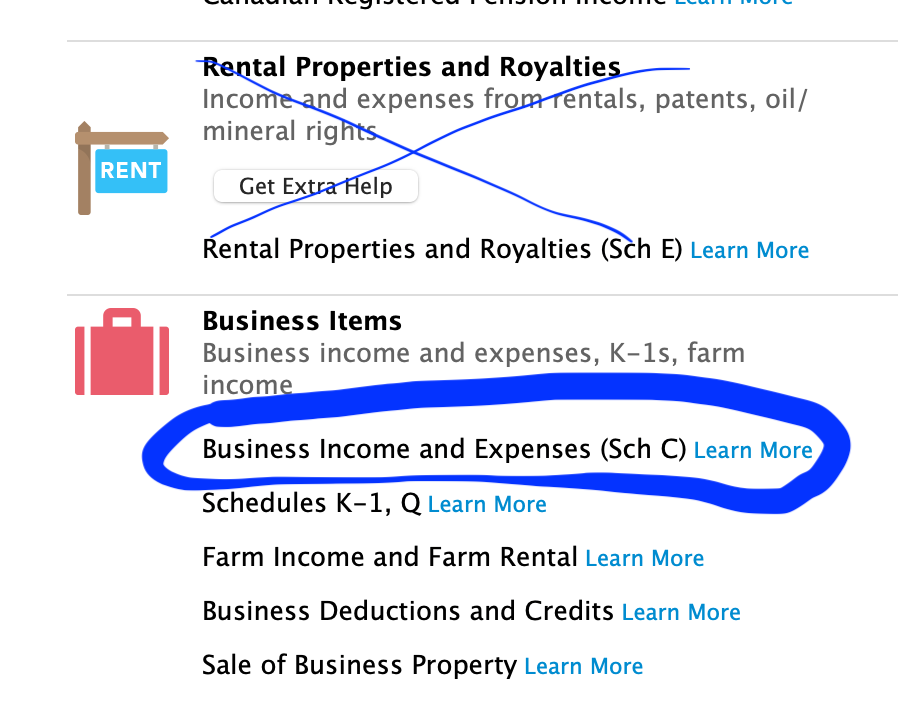

@taxtime24 What I figured out is that the depreciation needs to be recognized on Schedule C Under Business Items instead of using Rental Properties and Royalties (Schedule E).

Hope that helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

Hi @Rich_FL,

I tried H&R Block's software to compare. Near the end of the Schedule E, it asked me two questions. If the rental property was a short term rental averaging 7 days or less and if I materially participated. After answering yes to both questions it allowed me to use my losses to offset non-passive income. There are definitely benefits to sticking with the Schedule E versus the Schedule C. This is of course as long as you do not provide substantial services - if you did you would need to file a Schedule C. Just thought I would update you since I had the same issue. I will be processing my return with H&R Block because of this. It seems TurboTax did not build their system to capitalize on this important tax break for short term rentals.

For those who aren't informed about this strategy - @Anonymous_, here is an article: https://www.therealestatecpa.com/blog/short-term-rental-tax-strategy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

Thanks for that update!

I did confirm that @Anonymous_ was correct that it needs to be on Schedule E and not C.

@Anonymous_ I also acknowledge that there is disagreement over material participation of short term rentals and applying losses toward W2. I am choosing to take the direction of my CPA advisor who's entire practice is built around clients that own/operate short term rental properties.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material Participation to Recognize Rental Property Losses

That is wrong-because Short term rental is not considered real estate by the IRS, it is the Short Term Rental, STR loophole, and yes, you can materially participate and can take an active loss. So many people are uninformed on short term rentals. the question was valid and he can legitimately take a loss and take advantage of cost segregation analysis for rapid depreciation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mjtax20

Returning Member

naokoktax

Level 1

meade18

New Member

trutch89

New Member

52hopper

New Member