- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Losses on rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

We purchased a condo on a recreational lake in August, 2022, spent over $25k in repairs, painting, furniture, etc. to get it ready for rental short term rental use. We only earned $80 from the property in 2022. When populating everything on my schedule C, I see a loss of ($11,484), but didn't see any change in my overall taxable income.

Are the improvements to the condo not deductible or what am I doing wrong?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

You can expense the painting as a repair. Major Furniture and equipment purchases should be depreciated over five to seven years. Bedding, towels and things like that can be expensed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

At the screen Are you an active participant in the rental property?, did you answer No?

To check the answer, follow these steps:

- Access the rental activity.

- Click Edit to the right of Rental property info.

- Under Owner Info and Active participant does it say No?

See also here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

No, I indicated YES, I am an active participant. That's not the issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

Improvements are deductible, but have to be depreciated over 27.5 years for a residential rental, so your deduction would be minimal in the year you put them into service. It sounds like you may be deducting them as repairs, which is not appropriate for major renovations as you describe.

The main reason a loss on a schedule C would not be deductible would be that you didn't materially participate in the business or you didn't have money at risk in the business, so you would need to review your answers to those questions.

Also, unless you are providing substantial services to the rentors, such as would be the case with a bed and breakfast, you should report the activity on a schedule E for rental income, not on a schedule C which is for business income and expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

Thanks for the detailed reply. They are not just improvements... We did paint the unit at a cost of $6400, but a lot of the expenses went to furniture, bedding, towels, vanities, some minor electrical, ceiling fans, lighting, etc... Does that change anything? Thanks again for the help!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

You can expense the painting as a repair. Major Furniture and equipment purchases should be depreciated over five to seven years. Bedding, towels and things like that can be expensed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

Thanks.. Any tips on how to do this on TT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

You enter all of your rental income, expenses, and assets for depreciation in the Rental Properties section of TurboTax and then TurboTax will put all of the information on Schedule E.

Where do I enter my rental property?

What rental expenses can I deduct?

How do I handle capital improvements for my rental?

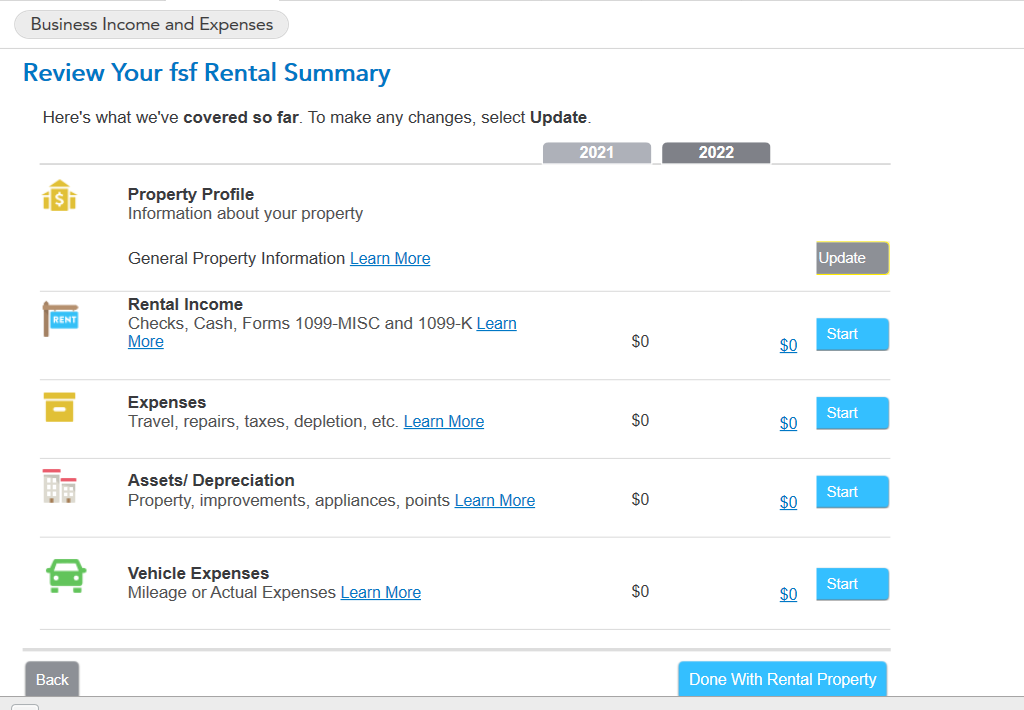

After you enter all of the set-up info, you will get to this screen where you can enter all of the assets that need to be depreciated as well as income and expenses. See the links above to see which costs go into which section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

Can you deduct rental losses from your taxable income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

@ejiongco123 wrote:

Can you deduct rental losses from your taxable income?

No. Rents not received cannot be deducted or entered on a tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Losses on rental property

It depends. While DoninGA is correct, you cannot claim a loss for income you didn't receive, IRS Pub. 925 page 4 states," you can deduct up to $25,000 of your rental loss even though it’s passive.

If you actively participate in a rental real estate activity, there is a special allowance to the general rule. IRS Pub 925 defines active participation as materially participation. "You materially participated in a trade or business activity for a year and if you satisfy any of the following:

- You participated in the activity for more than 500 hours

- Your participation was substantially all the participation in the activity of all individuals for the tax year, including the participation of individuals who didn’t own any interest in the activity.

- You participated in the activity for more than 100 hours during the tax year, and you participated at least as much as any other individual (including individuals who didn’t own any interest in the activity) for the year."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

alvin4

New Member