- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

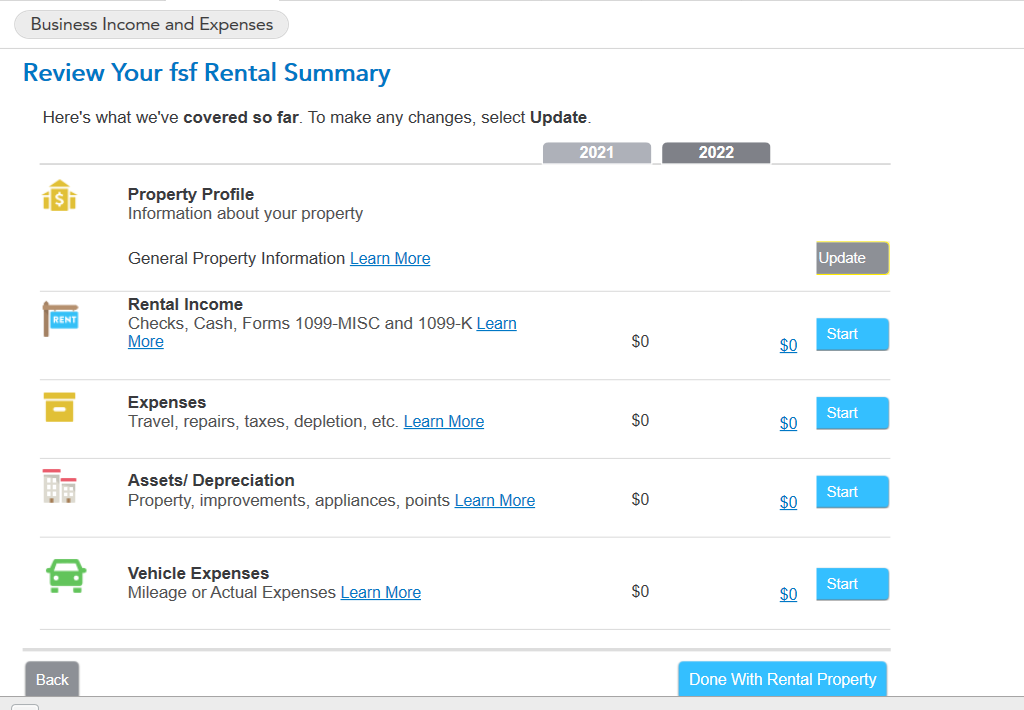

You enter all of your rental income, expenses, and assets for depreciation in the Rental Properties section of TurboTax and then TurboTax will put all of the information on Schedule E.

Where do I enter my rental property?

What rental expenses can I deduct?

How do I handle capital improvements for my rental?

After you enter all of the set-up info, you will get to this screen where you can enter all of the assets that need to be depreciated as well as income and expenses. See the links above to see which costs go into which section.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 9, 2023

9:03 PM