- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

I'm really trying but I think I've reached the ceiling of my brain on this one. I have accounted for all but the

- "CAPITAL GAIN" line

- "SECTION 1245 RECAPTURE" line.

I *think* that 1231 gain is supposed to increase my basis, so I just added them together.

If anyone can guide me what I need to do with these two other lines, and tell me if I messed up anything else.

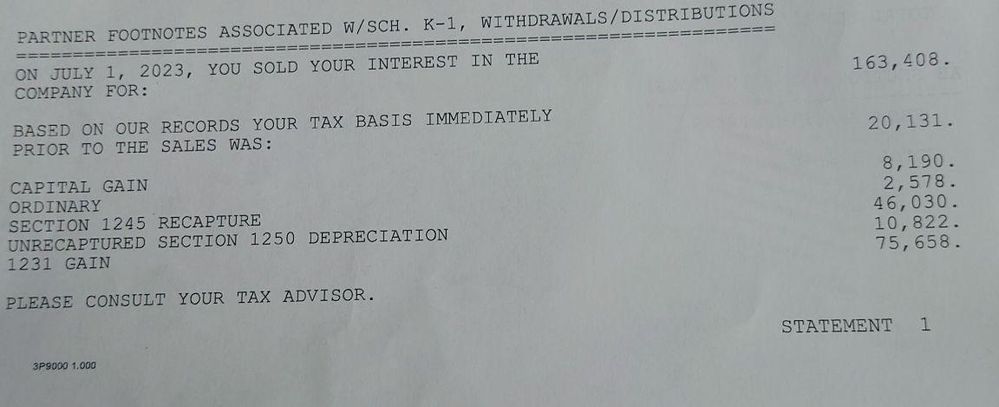

Here is what is in the K-1 Statement

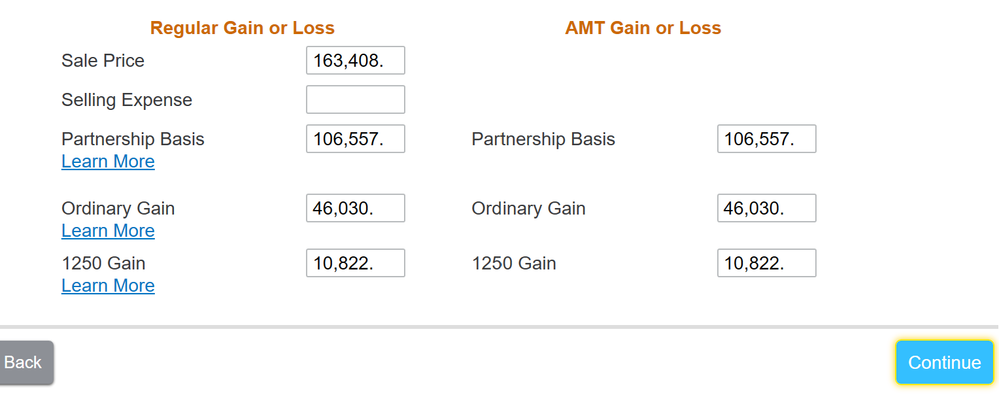

Here is what I entered in TurboTax

How far off am I? Literally any words are greatly appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

After reviewing the K-1, something just seems odd in the presentation, but attempting to analyze this in a forum such as this is difficult.

The only change after seeing the K-1, would be a few reductions to your basis:

- $106,557 - 1,083-808-1-5 = $104,660

- Overall gain is then $58,748; Ordinary $46,030 and 1250 is the 10,822

- Nothing else changes.

However, after reviewing and thinking about this, I am not sure what the ordinary amount of $2,578 and capital gain amount of $8,190 represent. I was expecting to see these amounts on the K-1 as well, but they aren't there.

So that could reduce your basis to $93,892

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

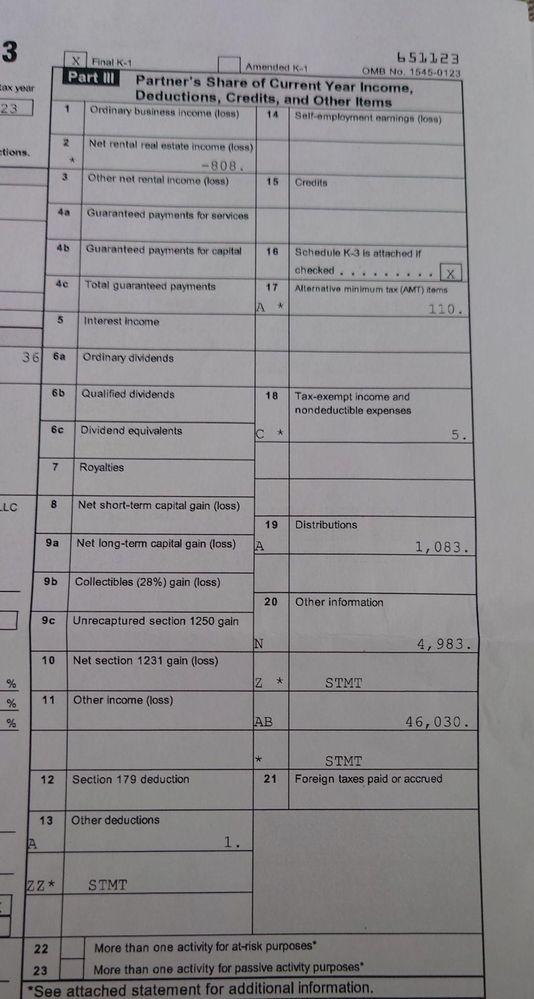

Can you also provide details on what amounts are on your final K-1 in Part III?

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

Thank you so much for your fast response! Here it is. In case it is important, this is a holdco that was spun off from the initial investment. There were 4 buildings to be built. One finished early and performed well so they spun it into a new company for itself last year and I sold my interest back to them a couple months later as I needed the cash.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

Without anything else as requested in my prior comment:

- I believe your basis is $106,557 (20,131+8,190+2,578+75,658)

- Then your selling price is the $163,408

- Your ordinary income component, the Section 1245, is the $46,030 (this is depreciation recapture)

- Then the Section 1250 is the $10,822

- The above makes sense

- Overall gain is $56,851 (163,408-106,557)

- Ordinary Section 1245 is the $46,030

- Section 1250 is the difference of $8,821 ($1 rounding)

- The Section 1245 recapture is essentially a reclassification of capital gain to ordinary income

- The Section 1250 is a limit on the capital gain rate; 25% instead of 20%

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

After reviewing the K-1, something just seems odd in the presentation, but attempting to analyze this in a forum such as this is difficult.

The only change after seeing the K-1, would be a few reductions to your basis:

- $106,557 - 1,083-808-1-5 = $104,660

- Overall gain is then $58,748; Ordinary $46,030 and 1250 is the 10,822

- Nothing else changes.

However, after reviewing and thinking about this, I am not sure what the ordinary amount of $2,578 and capital gain amount of $8,190 represent. I was expecting to see these amounts on the K-1 as well, but they aren't there.

So that could reduce your basis to $93,892

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

Sincere apologies if I misunderstood what you were asking in your previous comment. I thought you were asking to see the part III from their provided K-1 which is what my image was.

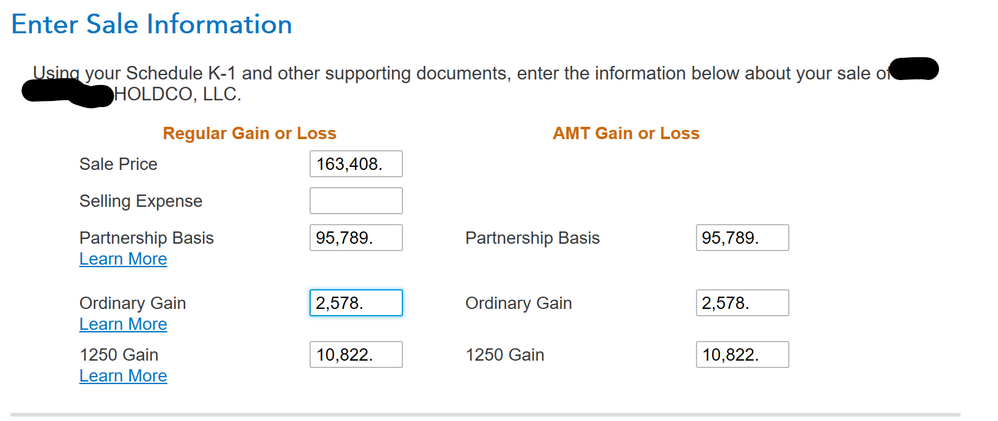

In any case, thank you so so much for what you provided. I have entered it as such here:

This seems to make sense to my primitive brain. Thank you again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

Oh I see! I would never have thought those items would impact these. Thank you. I made the suggested adjustments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

@fruehling make sure you read my response again as I added some additional comments.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

THank you Rick. I have seen them. Also, before posting here I read through a bunch of older posts similar to this subject and you were all over those as well. I just want to say that your help here is so valuable not just to me, but thousands and thousands of people who read through them over the years. People like you are what make me have faith in humanity.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

Thank you for those kind words and you are welcome.

My way of giving back and helping understand a difficult world of partnership tax.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Sold interest - 1245 recapture - capital gain - how to enter in turbotax?

your total gain is 163408 less your basis of 20131 = 143277

the ordinary portion of the gain is the 1245 recapture and the other ordinary income

so 46030 +2578 = 48608 this should appear on line part II of form 4797 line 10

143277- 48608 leaves 94669 that consists of 8190 capital gain (assumed long term)

10822 of section 1250 recapture and 75658 of 1231 gain (treated as capital gain)

sadly Tubotax can not properly handle the 1231 portion which should flow to form 4797

so to handle this increase basis from 20131 to 95789 which includes the 1231 gain

then on the actual k-1 worksheet enter the 75658 as 1231 gain so it flows to form 4797

so on the worksheet

sales price 163408

less basis of 95789 (includes 1231 gain reported on line 10 of k-1 - Turbotax has no other way of properly handling this - the 75658 then flows to form 4797 part line 2)

gain = to 67519

ordinary income 48608

capital gain 19011 (includes 1250 recapture of 10822)

if you have unrecaptured 1231 losses from prior years (form 4797 line 8), the effect is to convert up to that amount of your current year 1231 capital gain to ordinary income. that's why it's important to have the 1231 gain flow to form 4797 rather than directly to schedule D.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

4md

New Member

jjon12346

New Member

jstan78

New Member

mulleryi

Level 2

mulleryi

Level 2