- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- is no option under 1099 B where I sold company stock that was moved from401K to brokerage account in deluxe under where it ask What type of investment did you sell?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is no option under 1099 B where I sold company stock that was moved from401K to brokerage account in deluxe under where it ask What type of investment did you sell?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is no option under 1099 B where I sold company stock that was moved from401K to brokerage account in deluxe under where it ask What type of investment did you sell?

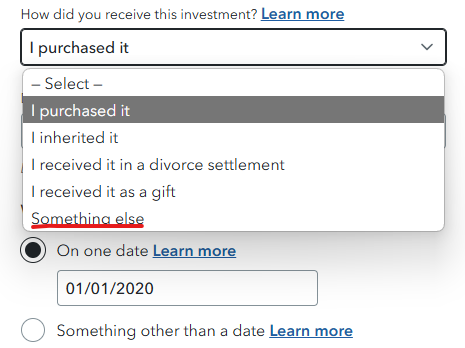

You may select Something else.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is no option under 1099 B where I sold company stock that was moved from401K to brokerage account in deluxe under where it ask What type of investment did you sell?

Thanks for the reply. That selection option (something else) is not showing for me in turbo tax deluxe under 1099B when selection is employee stock. I can select other, then something else and write in explanation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is no option under 1099 B where I sold company stock that was moved from401K to brokerage account in deluxe under where it ask What type of investment did you sell?

If you know your Cost Basis, you can report your 1099-B as a regular stock sale (not employee stock). If the Cost Basis on your 1099-B is incorrect (which it often is, since the broker does not know the amount of any discount you received), check the box 'cost basis is missing or incorrect' and enter the correct cost basis.

Here's more detailed info on Employee Stock Purchase Plans.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SCswede

Level 3

shefqet1

New Member

c_tran2000

New Member

odunham

New Member

mpapadop

Level 1