- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- In online turbo tax, Where to enter passive loss from K1 (1065) I received from partnership

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In online turbo tax, Where to enter passive loss from K1 (1065) I received from partnership

Hello -

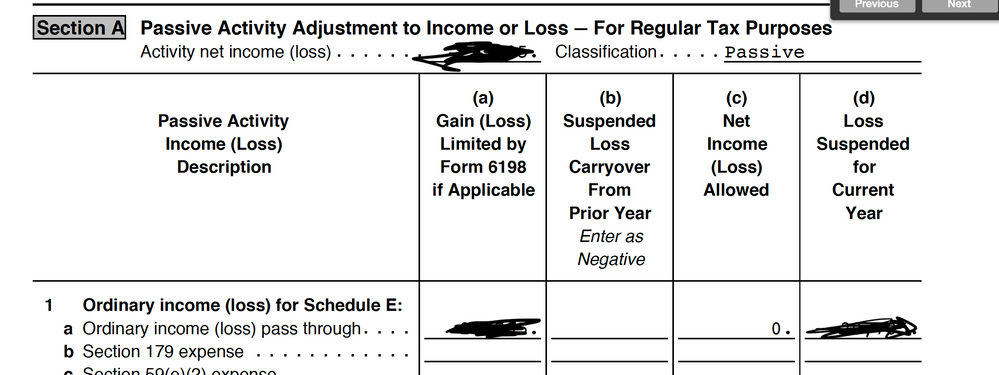

I received K1 in 2019 from my investment in REIT (Partnership). I received X amount of passive loss that i could not claim in 2019. I need to carry over that loss to this year's (2020) return using online turbo tax.

How do i do this manually? I tried "Net Operating Loss QBI Carryforward Loss " but that does not seem like a right place. There is no way to indicate passive income anywhere.

Here is a screenshot of my last year K1 where I have loses to carry forward.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In online turbo tax, Where to enter passive loss from K1 (1065) I received from partnership

When you enter your K-1 schedule, you will see a screen that says Describe the Partnership, on which there is a option that says I have passive activity losses carried over from last year, that is where you can enter your prior year passive loss carryovers:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In online turbo tax, Where to enter passive loss from K1 (1065) I received from partnership

When you enter your K-1 schedule, you will see a screen that says Describe the Partnership, on which there is a option that says I have passive activity losses carried over from last year, that is where you can enter your prior year passive loss carryovers:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In online turbo tax, Where to enter passive loss from K1 (1065) I received from partnership

Thank you very much. This was helpful. I missed this option.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CShell85

Level 1

mcs72330

Level 1

StrangerAtXRoads

Level 2

techman05

Level 2

m-clarkali11

New Member