in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I was told to claim capital loss by my agent. I bought my rental for $120,000 and sold it for $105,000. Is my depreciation $15,000?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to claim capital loss by my agent. I bought my rental for $120,000 and sold it for $105,000. Is my depreciation $15,000?

I have never claim depreciation before (my tax guy didn't do it form what I can tell).

For this sale I got Form 1099-S during closing, do I need to report that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to claim capital loss by my agent. I bought my rental for $120,000 and sold it for $105,000. Is my depreciation $15,000?

The IRS also received a copy of the 1099-S.

The information it reports needs to be entered into the proper section of the program.

The IRS states you need to recapture the depreciation taken "or could have been taken".

Whether depreciation was taken or not, it needs to be reclaimed when sold.

The basis in the rental would be the lesser of your cost or the Fair Market Value when placed into service.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to claim capital loss by my agent. I bought my rental for $120,000 and sold it for $105,000. Is my depreciation $15,000?

@toki4004 wrote:I have never claim depreciation before (my tax guy didn't do it form what I can tell).

If you have not been claiming depreciation, you need to go to a tax professional that is familiar with how to correct that on Form 3115. You really need a good tax professional this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to claim capital loss by my agent. I bought my rental for $120,000 and sold it for $105,000. Is my depreciation $15,000?

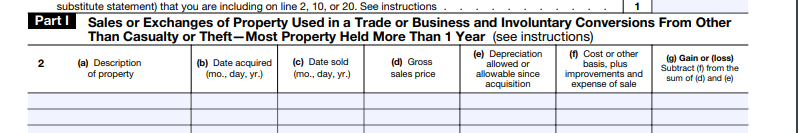

You will report the sale of your rental property on Form 4797 Sales of Business Property. You will be asked for " Depreciation allowed or allowable since acquisition" in column 2d when you are entering your sales information.

The depreciation information is required to calculate your gain or loss on the sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524367965

Level 1

user17524531726

Level 1

Vidyaprakash54

New Member

cottagecharm11

Level 4

s d l

Level 2