- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

Please follow the steps in this LINK.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

Hi ColeenD3,

Thank you for your response.

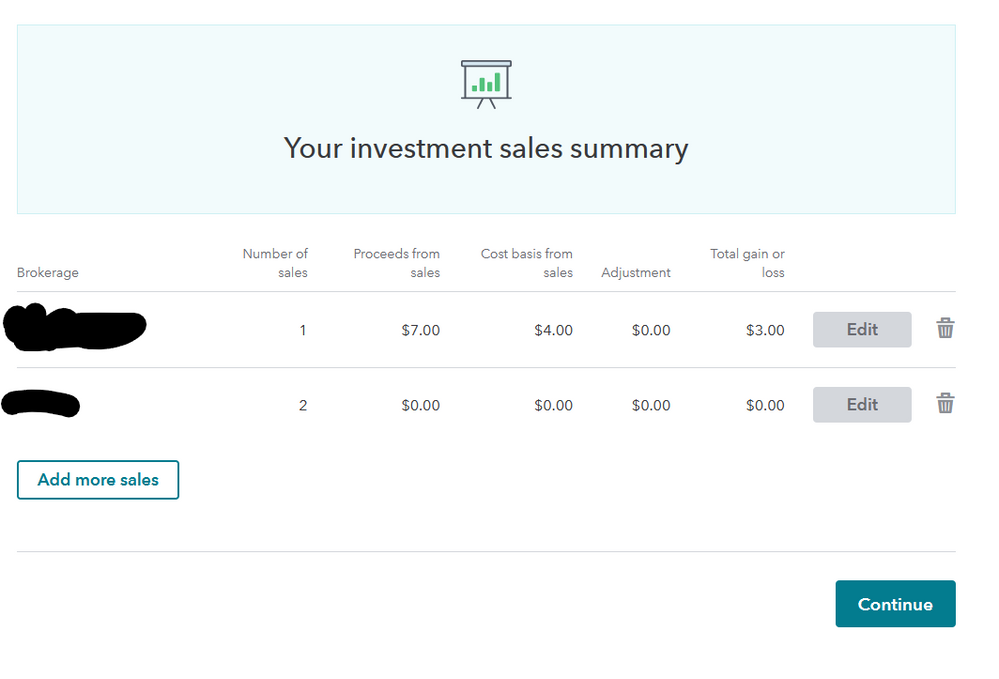

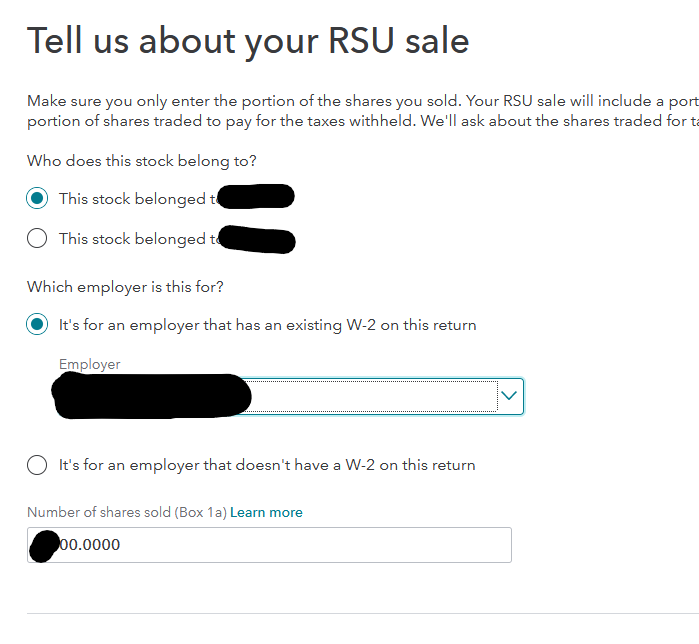

Unfortunately, the instructions at the link you referenced are no longer accurate. I am unable to reach this step:

- “If you have additional info about this sale, you can enter it on your own, or we can guide you.”, Select Guide me step-by-step (See the attached screenshot below. Click to enlarge.)

or this step...

- Click My sale involves one of these uncommon situations. (See the attached screenshot below. Click to enlarge.)

Instead I only get the screen that says...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

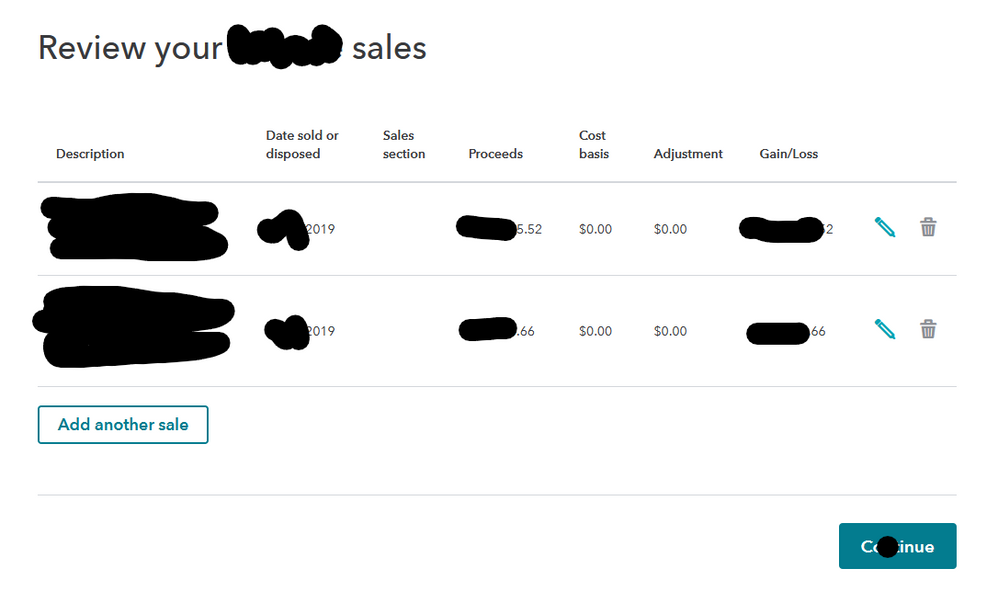

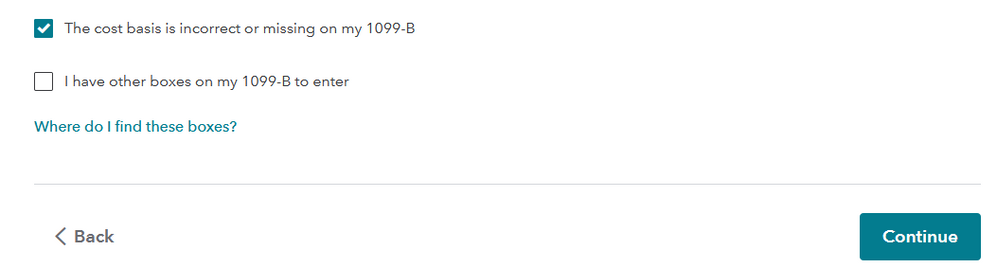

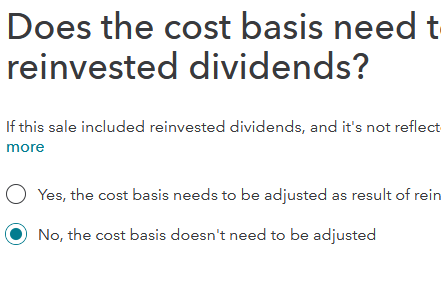

After the screen, "Now we’ll walk you through entering your sale details" and you enter all the pertinent information, you will encounter the screen below to indicate your 1202 stock.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

Hi Coleen,

checking the box you have indicated does not imply the 1202 exclusion. I click that very box and turbotax does not provide the option to indicate 1202 exlcusion. I am using TurboTax self-employed but also tried it using Premier. Same problem.

Please provide step by step instructions. As stated earlier the link you referenced above is out of date and the Turbotax prompts in the link no longer exist in the current online versions.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

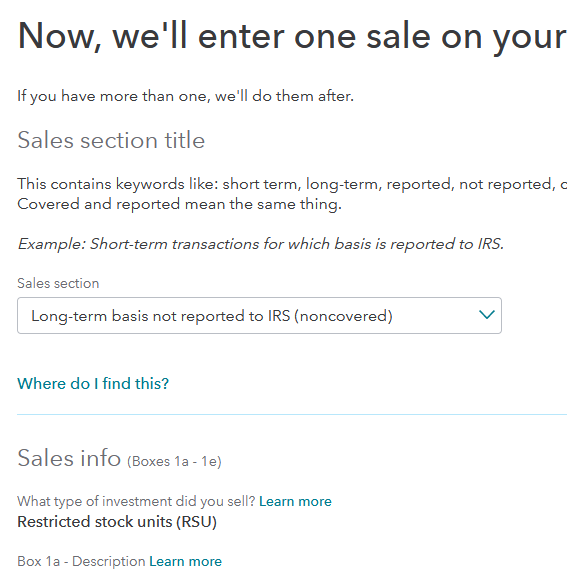

This what you have to do. I fiured it out.

Fill in 1099-B

Select "this is a small business stock"

When it asks you if you want to adjust the cost basis check the top box that says "Help me figure out my cost basis"

Then click through steps

You should see the "qualified small business 1202 exclusion" options at the end

If you do it right your summary will have a negative number under "adjustments" for this sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

OH MY! I banged my head against the wall for days! This works!!!!!! THANKYOU

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

Does the proposed method also work for the ONLINE Premier version? I had errors with my CD-version and hence had to buy the online version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

Yes, you can report the sale of qualifying small business stock in TurboTax online.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

Thanks. Can you please send me step-by-step instructions? I picked "e-trade" as the institution.

If I enter the 1099-B data that I got from e-trade, and look at the pull-down options, I don't see any option that says "Qualified Small Business Stock". Hence, if you can send me each step as I get to the Income section, that would really help me out. FYI, I am using the Premier version online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

You have to make sure allow TurboTax to “help me figure out my coat basis” during the review of the stock sale. It’s tricky to find but once you allow them to walk you through the “figure out my cost basis” you will be asked if this was qsbs stock and which % exclusion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

Thanks. Can you please provide a screen-shot or text details on your point: "“help me figure out my coat basis” during the review of the stock sale. It’s tricky to find"

You are right, it is tricky to find - and hence more guidance in the form of a screen-shot or detailed steps will really help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

Hi! I can get to "“figure out my cost basis” as you suggested.

However, Turbotax is NOT asking me if this is a QSBS stock?!!

Whereas you suggested that: "you will be asked if this was qsbs stock and which % exclusion"

I am using the online-premier version.

Can you please help me get past this really frustrating part of the flow at your earliest? How do I get TurboTax to simply factor in that this is a QSBS stock?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

After you enter the sale price, dates and cost information, TurboTax should give you an opportunity to indicate that the stock is qualified small business stock in the screen that says "Do any special situations apply to this sale?"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold Qualified Small Business Stock (QSBS) which is 100% exempt from taxes as per the Section 1202 exclusion. There was no 1099-B for this sale. Where do I report this?

I did not get that screen when trying to get QSBS or any other screen for QSBS while running through this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Cindy10

Level 1

atlg8or

New Member

hijyoon

New Member

meli932000

New Member

mikewojo

Returning Member