- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I moved into my rental property in May and it is now my primary residence. Where and how do I show this on my tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved into my rental property in May and it is now my primary residence. Where and how do I show this on my tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved into my rental property in May and it is now my primary residence. Where and how do I show this on my tax return?

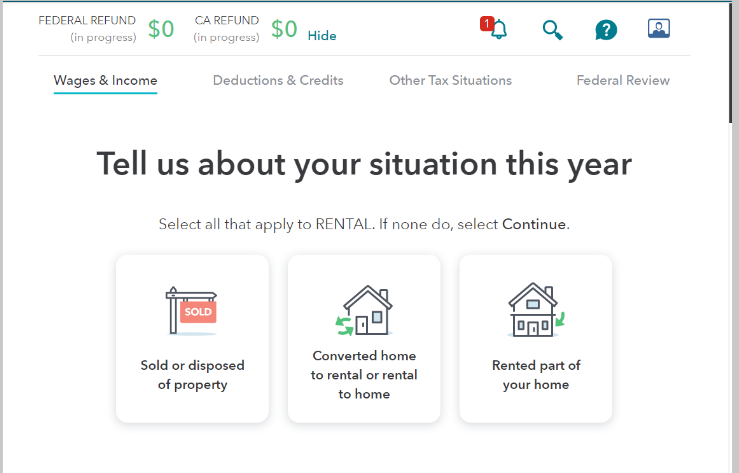

Go to the Rental Property section of TurboTax. Look for the "Tell us about your situation this year"- and indicate the you Converted home to rental or rental to home (see below).

If you moved into your rental and made it your personal residence during the year, you need to divide up your expenses. Identify the expenses you incurred while it was a rental versus the expenses you incurred while it was your home. TurboTax will ask you about expenses for the time the property was used as a rental. Later, in Deductions and Credits, you can enter expenses for the time when you lived in the home.

The other issue you need to deal with is stopping the depreciation on your rental property and rental assets. TurboTax will cover this in the assets section of the rental. Make sure you keep a copy of your depreciation report. You'll need it when you sell the rental.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved into my rental property in May and it is now my primary residence. Where and how do I show this on my tax return?

In the rental income section you will of course, enter the total of all rental income received during the tax year.

In the rental expenses section you will enter only the expenses incurred *while the property was classified as a rental*.

Then, you *must* work through the assets/depreciation section, edit each individual asset and select the option for "I stopped using this asset in 2021". Then a screen or two later you'll see the "Special Handling Required?" screen. On this screen you *MUST* select YES. If you select NO, the program will assume you sold the asset and will *force* you to enter sales information.

When asked for "date of disposition" you will enter the date that is one day after the last renter moved out, or the last day you advertised the property for rent - whichever date is later.

The program "SHOULD" pro-rate the mortgage interest and property taxes for you. So check to make sure that it does. The program will "NOT" prorate the property insurance. So you'll have to figure that manually.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jrosarius

New Member

SB2013

Level 2

VAer

Level 4

eric6688

Level 2

ttla97-gmai-com

New Member