- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

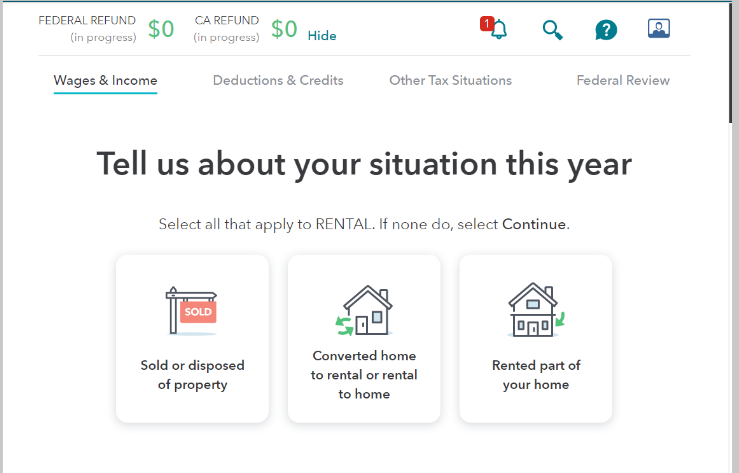

Go to the Rental Property section of TurboTax. Look for the "Tell us about your situation this year"- and indicate the you Converted home to rental or rental to home (see below).

If you moved into your rental and made it your personal residence during the year, you need to divide up your expenses. Identify the expenses you incurred while it was a rental versus the expenses you incurred while it was your home. TurboTax will ask you about expenses for the time the property was used as a rental. Later, in Deductions and Credits, you can enter expenses for the time when you lived in the home.

The other issue you need to deal with is stopping the depreciation on your rental property and rental assets. TurboTax will cover this in the assets section of the rental. Make sure you keep a copy of your depreciation report. You'll need it when you sell the rental.

**Mark the post that answers your question by clicking on "Mark as Best Answer"