- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I moved from California to another state. I had capital gains/losses, almost all in the stock market. How do I interpret the Allocating Capital Gain or Loss screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from California to another state. I had capital gains/losses, almost all in the stock market. How do I interpret the Allocating Capital Gain or Loss screen?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from California to another state. I had capital gains/losses, almost all in the stock market. How do I interpret the Allocating Capital Gain or Loss screen?

For the sale of stocks that occurred while you were living in California, allocate those gains and losses to to California. If the sale occurred after you became a resident of another state, allocate the gain/loss to that other state. If you sold California real estate or a business interest located in California, allocate it to California.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from California to another state. I had capital gains/losses, almost all in the stock market. How do I interpret the Allocating Capital Gain or Loss screen?

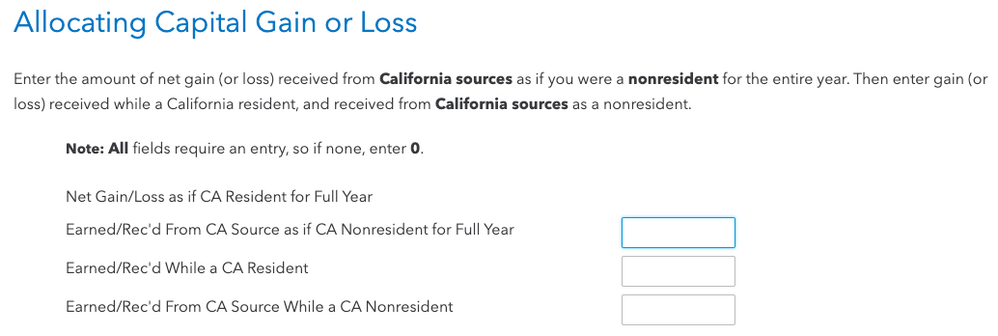

Thanks for the quick response man. That's helpful, but my mind can't really twist itself around the "treat yourself as if your somebody else" thing. Can you help me figure out how to calculate that number. And now that I have images, here's the screen I'm referring to. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from California to another state. I had capital gains/losses, almost all in the stock market. How do I interpret the Allocating Capital Gain or Loss screen?

CA should only be taxing you on what was received while living there.

Enter 0 for "Earned/rec'd from CA source as if CA nonresident for full year" and for "Earned/rec'd from CA source while a CA nonresident"

For "Earned/rec'd while a CA resident" enter the amount of stocks sold before moving out of CA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from California to another state. I had capital gains/losses, almost all in the stock market. How do I interpret the Allocating Capital Gain or Loss screen?

Very good, thanks so much. What a monumental task this will be.

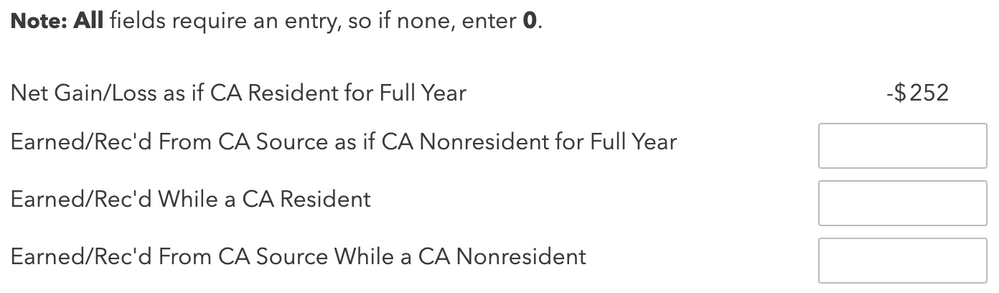

I think it would help me greatly if I understood how TurboTax comes up with the number shown -$252 (see image). I mean the actual sources, not just in theory. Can I determine what the source of that number is?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from California to another state. I had capital gains/losses, almost all in the stock market. How do I interpret the Allocating Capital Gain or Loss screen?

If TurboTax determined that you would have a net loss of $252 if all of your capital gain/ loss was from California, you could check your capital gain/loss on your Federal return to see if it matches.

You can preview your return before filing to view the forms that TurboTax has prepared from your entries and to find out how your taxes were calculated. See here for details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from California to another state. I had capital gains/losses, almost all in the stock market. How do I interpret the Allocating Capital Gain or Loss screen?

I moved from another state into California. Regarding the allocation of gains (or losses), does the date of sale override the % of time in the state? (It gives me both options, can I pick and choose which one to use, or do I need to go by the date, if a sale date is provided on the 1099-B?) Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from California to another state. I had capital gains/losses, almost all in the stock market. How do I interpret the Allocating Capital Gain or Loss screen?

Yes. You allocate sales by date - it is a specific date that is easily seen and recognized. Dividends and interest received will be allocated by time.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abicom

New Member

dpa500

Level 2

dpa500

Level 2

asdfasdf4

Returning Member

Blue Storm

Returning Member