- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to report stock sales in a foreign account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report stock sales in a foreign account

I sold stocks held in a foreign bank account. In the investment sales section, when entering the sales total for this account, what sales section should I use to report it?

Since the foreign bank doesn't send form 1099-B, I tried "Short-term did not receive 1099-B form", but it then requires a copy of the 1099-B to be uploaded, which I don't have.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report stock sales in a foreign account

You must go back and enter that You did not receive a 1099-B.

Go to the Summary Page and Add Another Sale

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report stock sales in a foreign account

Report you sales in Category C or F (no 1099-B).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report stock sales in a foreign account

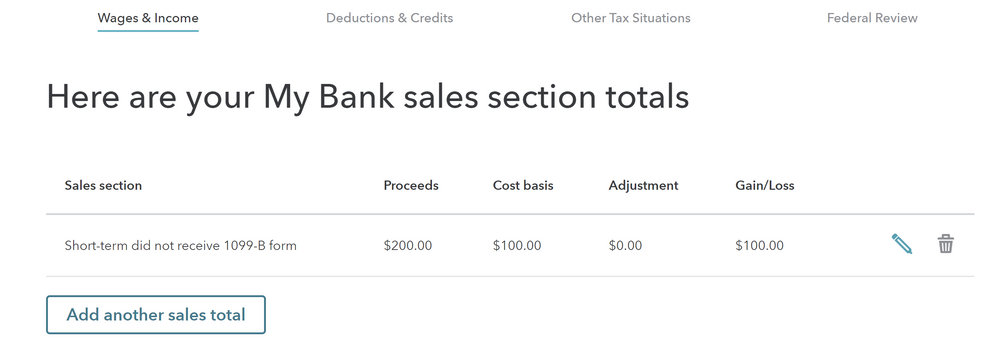

Thank you for your answer, @MaryK4 . I don't seem to have the option to enter that I did not receive a 1099-B. I am reporting sales section totals rather than one by one since there are many transactions in the account.

Here is how I report it:

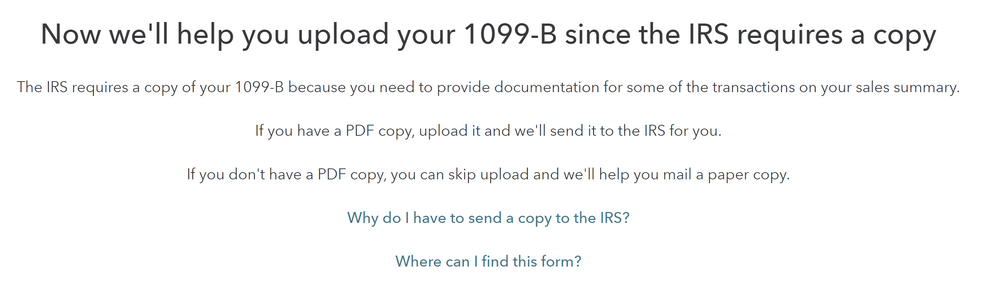

Then when I hit continue, this is what I get:

There doesn't seem to be a way to tell the program that there's no 1099-B in this case.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report stock sales in a foreign account

I have the same question..so it appears that you can enter capital gains or interest income normally as you would enter under investment or interest income section but you would add it under other income?

when I tried that ...its fine but when I submitted foreign tax credit section it showed 0$ tax credit...so I assume unless you enter your foreign income under investment and interest income section it wont show you tax credit ??

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

g456nb

Level 1

happysue19

New Member

William--Riley

New Member

user17548719818

Level 2

Newby1116

Returning Member